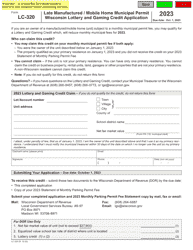

This version of the form is not currently in use and is provided for reference only. Download this version of

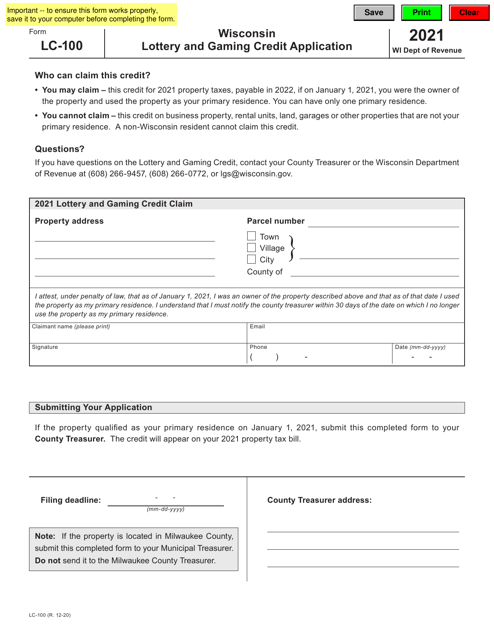

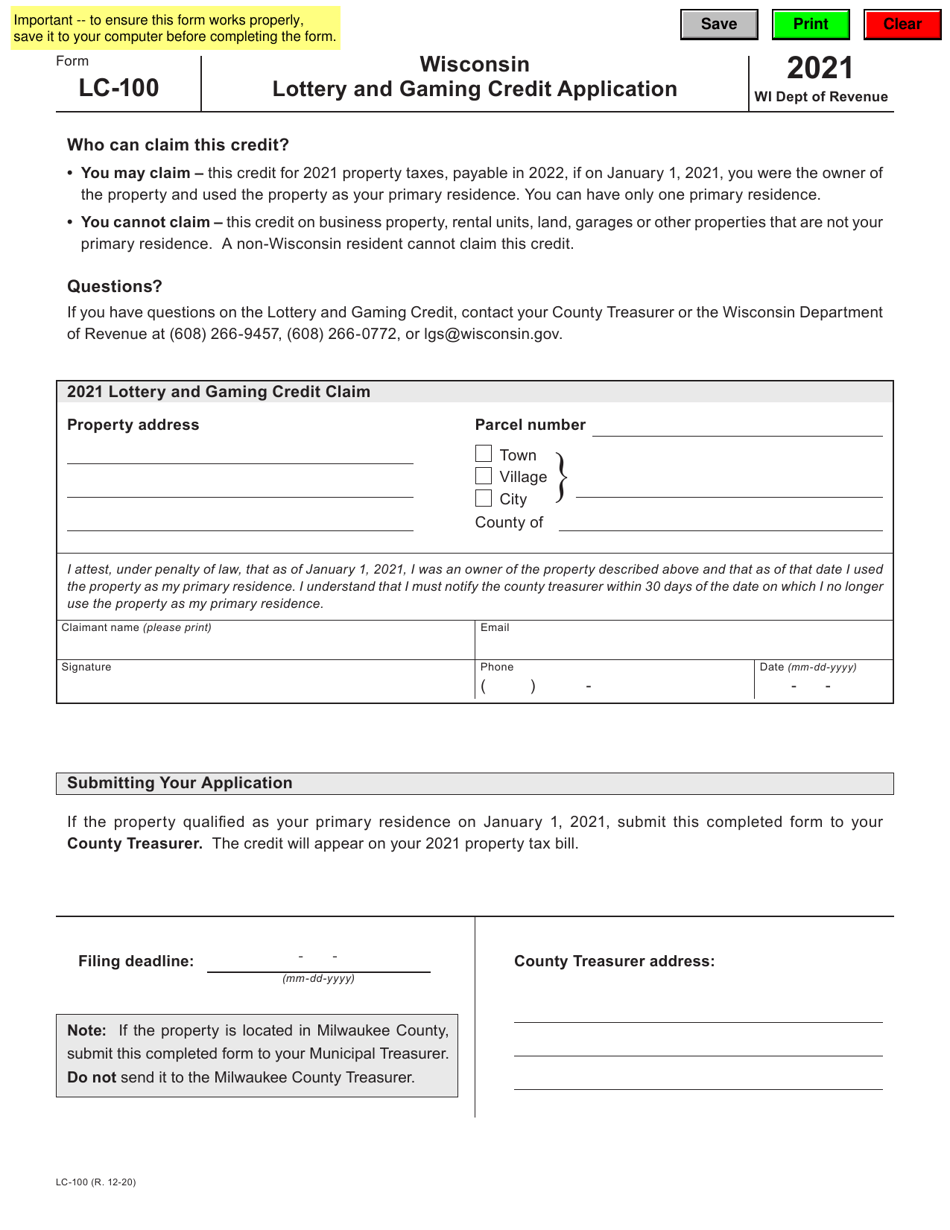

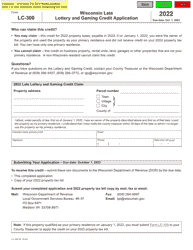

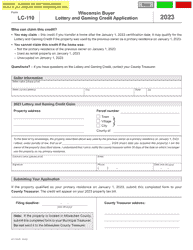

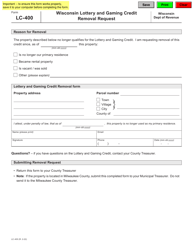

Form LC-100

for the current year.

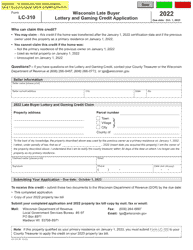

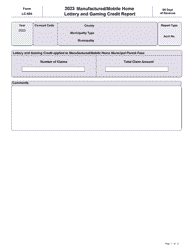

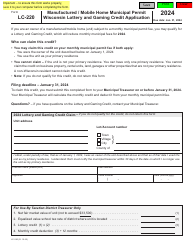

Form LC-100 Lottery and Gaming Credit Application - Wisconsin

What Is Form LC-100?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LC-100?

A: Form LC-100 is a Lottery and Gaming Credit Application.

Q: What is the purpose of Form LC-100?

A: The purpose of Form LC-100 is to apply for a lottery and gaming credit.

Q: Who should fill out Form LC-100?

A: Anyone who is eligible for a lottery and gaming credit in Wisconsin should fill out Form LC-100.

Q: What is a lottery and gaming credit?

A: A lottery and gaming credit is a tax credit provided to eligible Wisconsin residents who own property and pay property taxes.

Q: How do I qualify for a lottery and gaming credit?

A: To qualify for a lottery and gaming credit, you must be a Wisconsin resident, own or rent residential property in Wisconsin, and have paid property taxes.

Q: When is the deadline to submit Form LC-100?

A: The deadline to submit Form LC-100 is typically on or before January 31 of the year following the tax year for which you are applying for the credit.

Q: What documents do I need to submit with Form LC-100?

A: You may need to submit a copy of your property tax bill or other supporting documents along with Form LC-100. Check the instructions on the form for specific requirements.

Q: Can I apply for the lottery and gaming credit if I rent property?

A: Yes, renters may also be eligible for the lottery and gaming credit. You will need to provide your landlord's name and address on Form LC-100.

Q: What happens after I submit Form LC-100?

A: After you submit Form LC-100, the local assessor's office will review your application and determine if you are eligible for the lottery and gaming credit. You will be notified of their decision.

Q: Can I claim the lottery and gaming credit on multiple properties?

A: No, you can only claim the lottery and gaming credit on one property. If you own or rent multiple properties, you must choose which one to claim the credit on.

Q: Do I need to reapply for the lottery and gaming credit every year?

A: No, you do not need to reapply for the lottery and gaming credit every year. Once you are approved, the credit will automatically apply to your property taxes each year, as long as you continue to meet the eligibility requirements.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LC-100 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.