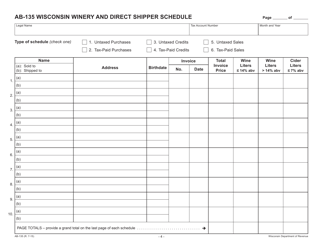

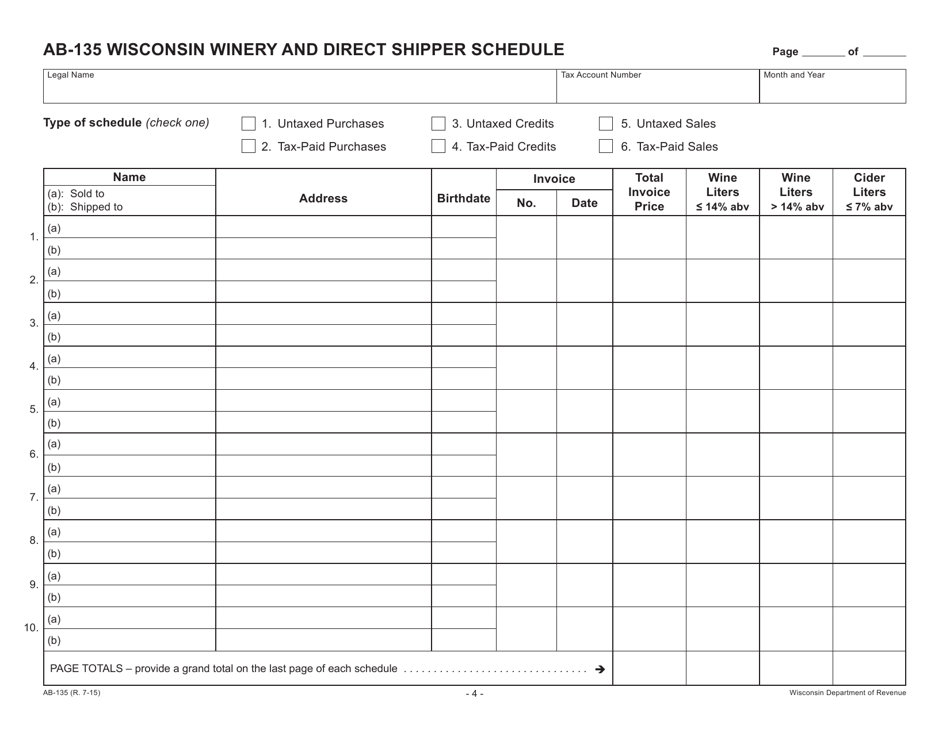

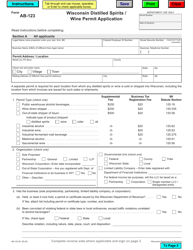

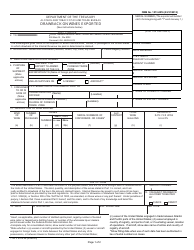

Form AB-135 Wisconsin Winery and Direct Shipper Schedule - Wisconsin

What Is Form AB-135?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-135?

A: Form AB-135 is the Wisconsin Winery and Direct Shipper Schedule.

Q: Who needs to file Form AB-135?

A: Wineries and direct shippers operating in Wisconsin need to file Form AB-135.

Q: What is the purpose of Form AB-135?

A: The purpose of Form AB-135 is to report the sales and shipments of wine by wineries and direct shippers in Wisconsin.

Q: When is Form AB-135 due?

A: Form AB-135 is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter.

Q: What information do I need to complete Form AB-135?

A: To complete Form AB-135, you will need to provide information such as your winery or direct shipper license number, total sales and shipments of wine in Wisconsin, and any applicable taxes collected.

Q: Are there any penalties for late filing of Form AB-135?

A: Yes, there are penalties for late filing of Form AB-135. It is important to file the form by the due date to avoid any penalties or interest charges.

Q: Are there any exemptions or special rules for filing Form AB-135?

A: Yes, there are certain exemptions and special rules for filing Form AB-135. It is recommended to review the instructions provided with the form or consult with the Wisconsin Department of Revenue for more information.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AB-135 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.