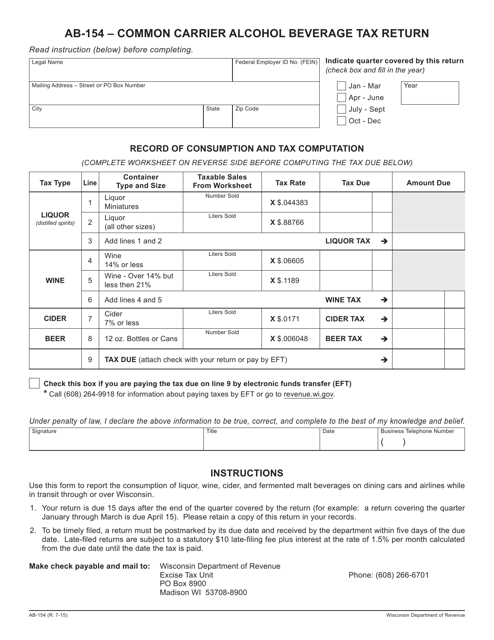

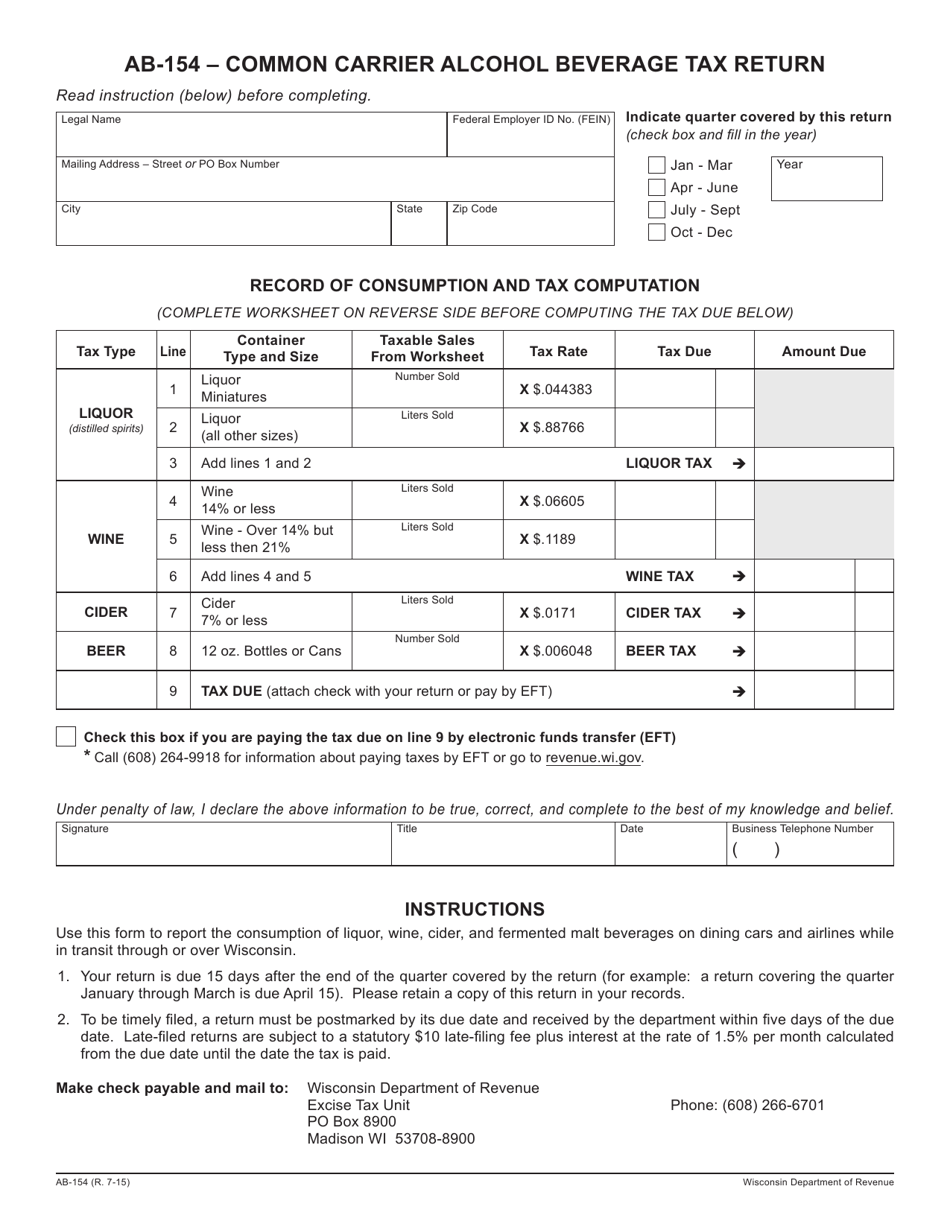

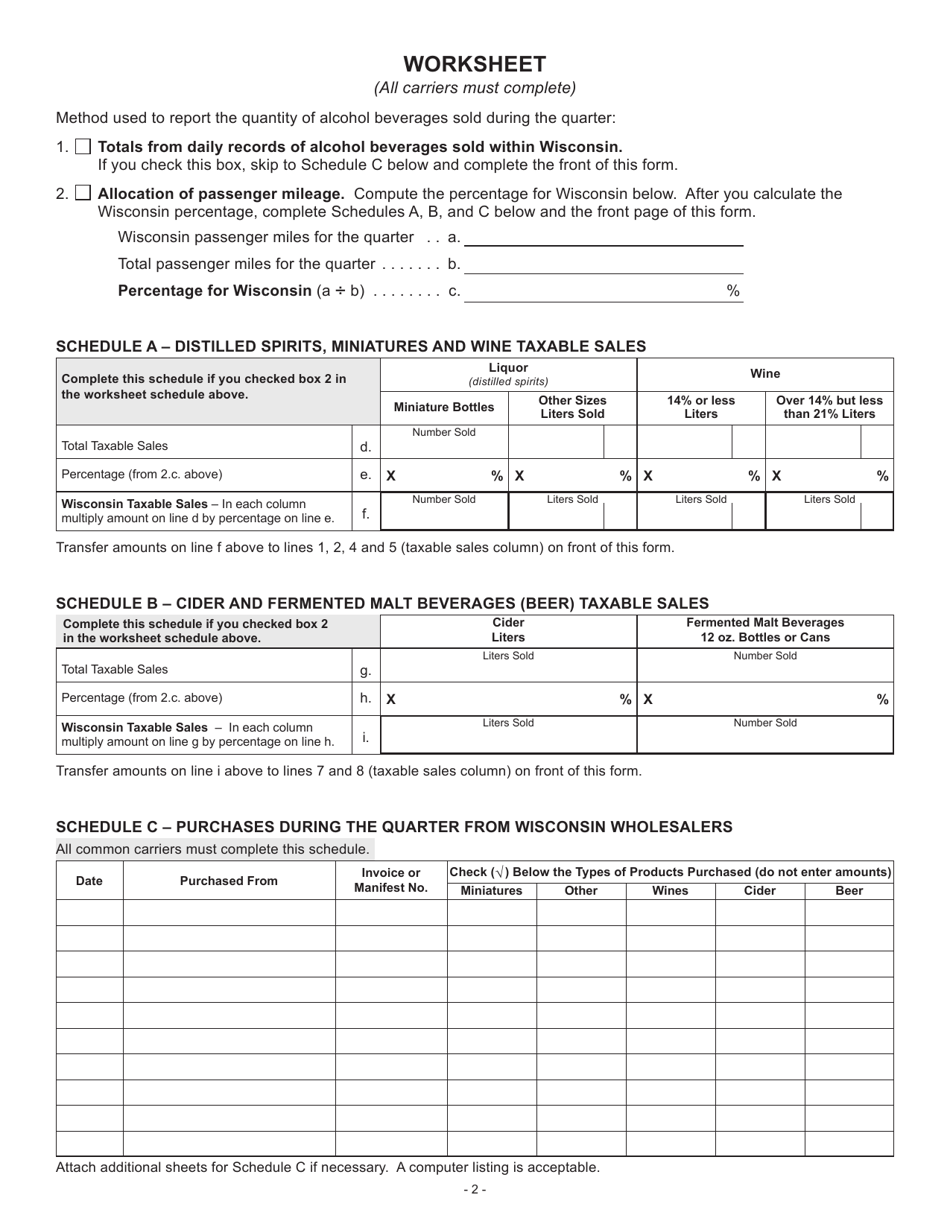

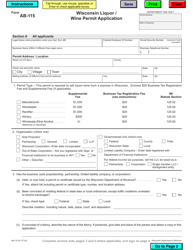

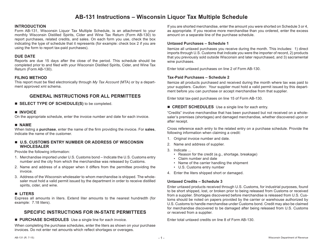

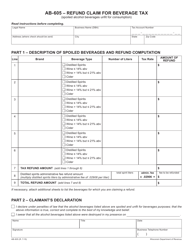

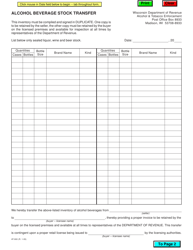

Form AB-154 Common Carrier Alcohol Beverage Tax Return - Wisconsin

What Is Form AB-154?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-154?

A: Form AB-154 is the Common Carrier Alcohol Beverage Tax Return in Wisconsin.

Q: Who needs to file Form AB-154?

A: Common carriers who transport alcohol beverages for a fee in Wisconsin need to file Form AB-154.

Q: What is the purpose of Form AB-154?

A: Form AB-154 is used to report and pay the alcohol beverage tax on alcohol beverages transported by common carriers.

Q: When is Form AB-154 due?

A: Form AB-154 is due on the 15th day of the month following the end of the reporting period.

Q: What happens if I don't file Form AB-154?

A: Failure to file Form AB-154 or pay the alcohol beverage tax can result in penalties and interest.

Q: Are there any exemptions to the alcohol beverage tax?

A: Yes, certain shipments and types of alcohol beverages are exempt from the tax. Please refer to the instructions for Form AB-154 for more information.

Q: Can I amend a filed Form AB-154?

A: Yes, you can file an amended Form AB-154 if there are changes or corrections to the original filing. Make sure to follow the instructions provided by the Wisconsin Department of Revenue.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AB-154 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.