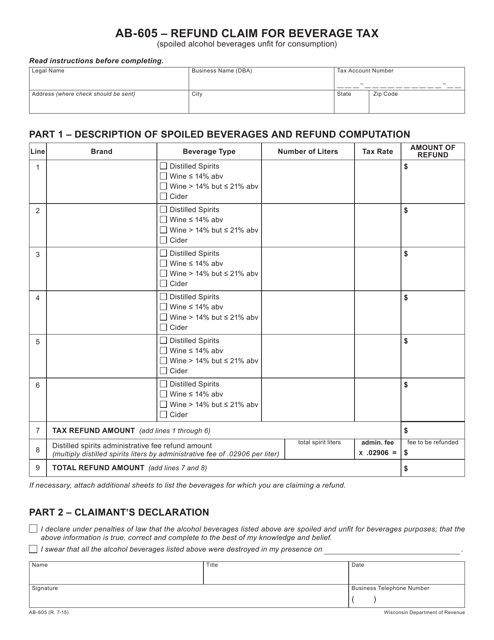

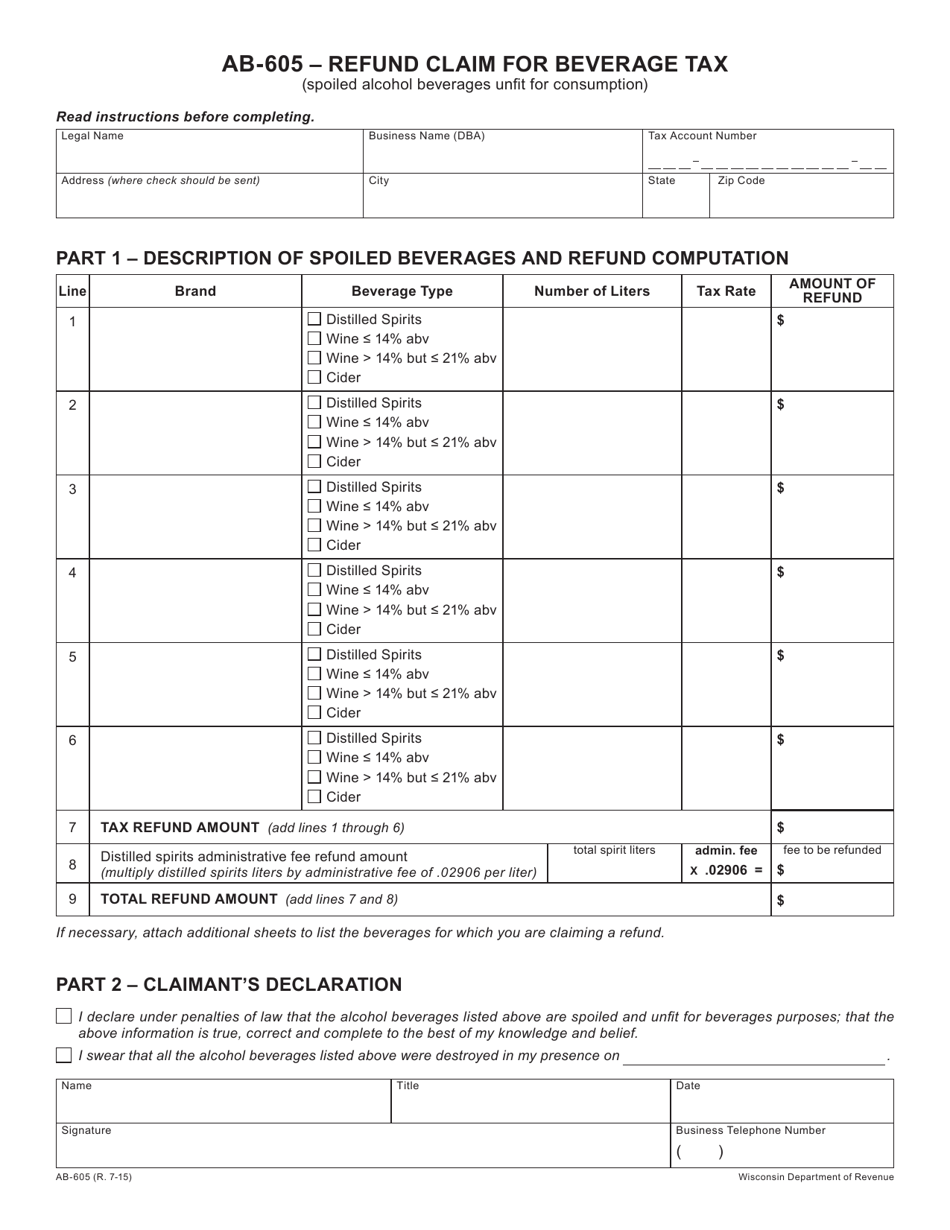

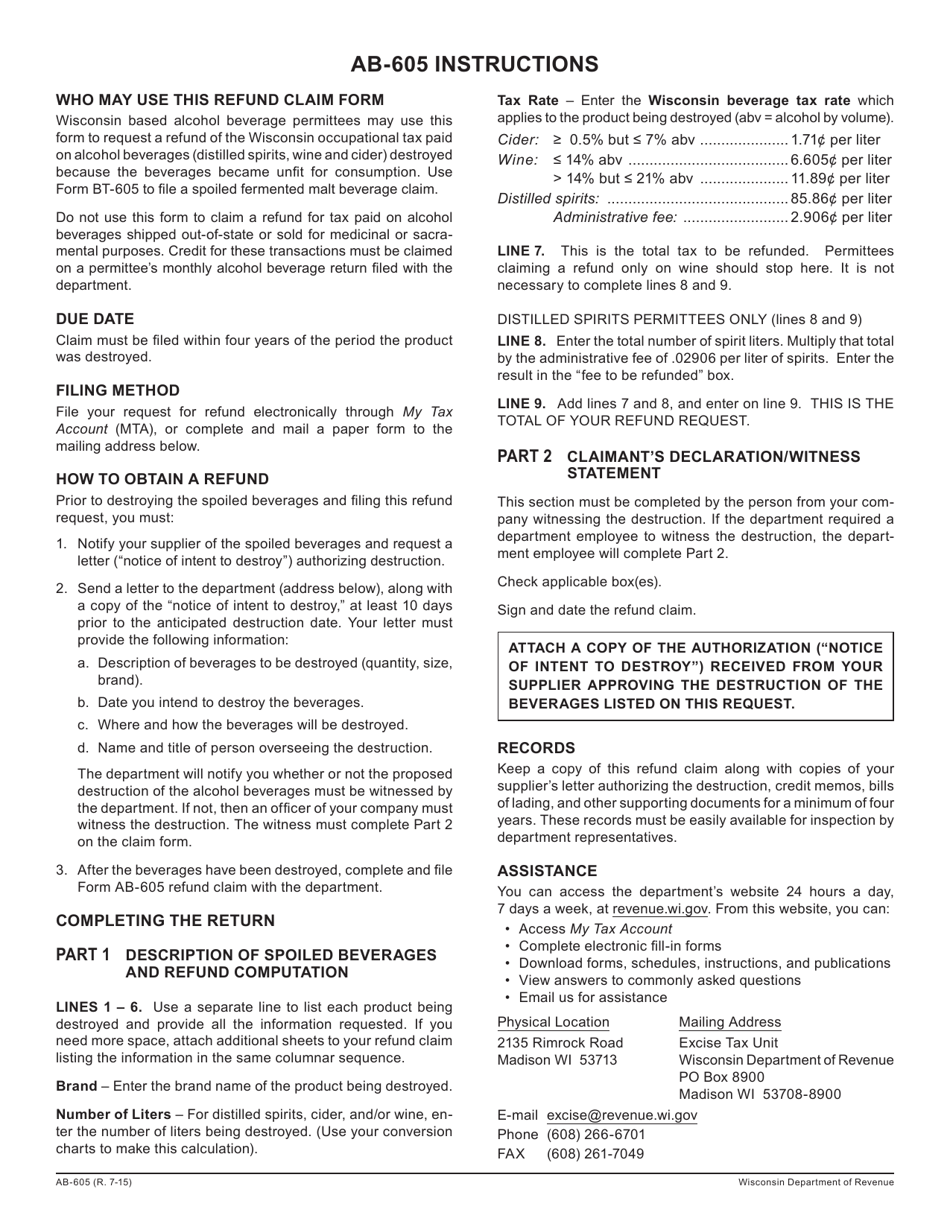

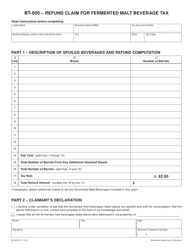

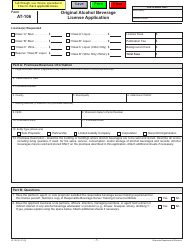

Form AB-605 Refund Claim for Beverage Tax - Wisconsin

What Is Form AB-605?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

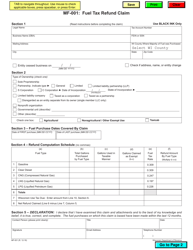

Q: What is Form AB-605?

A: Form AB-605 is a refund claim form for beverage tax in Wisconsin.

Q: What is the purpose of Form AB-605?

A: The purpose of Form AB-605 is to claim a refund for beverage tax paid in Wisconsin.

Q: Who can use Form AB-605?

A: Any taxpayer who has paid beverage tax in Wisconsin can use Form AB-605 to claim a refund.

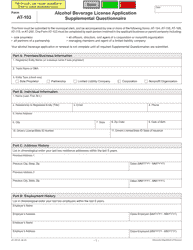

Q: How do I fill out Form AB-605?

A: You need to provide your name, address, permit number, and details of the tax paid in order to fill out Form AB-605.

Q: Is there a deadline to submit Form AB-605?

A: Yes, Form AB-605 must be submitted within one year from the date the tax was paid.

Q: What supporting documents do I need to include with Form AB-605?

A: You need to include copies of invoices, receipts, or other proof of payment with Form AB-605.

Q: How long does it take to receive a refund after submitting Form AB-605?

A: Refunds are typically processed within 90 days of receiving a complete and accurate Form AB-605.

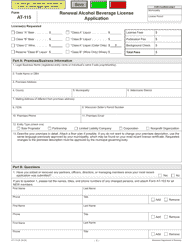

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AB-605 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.