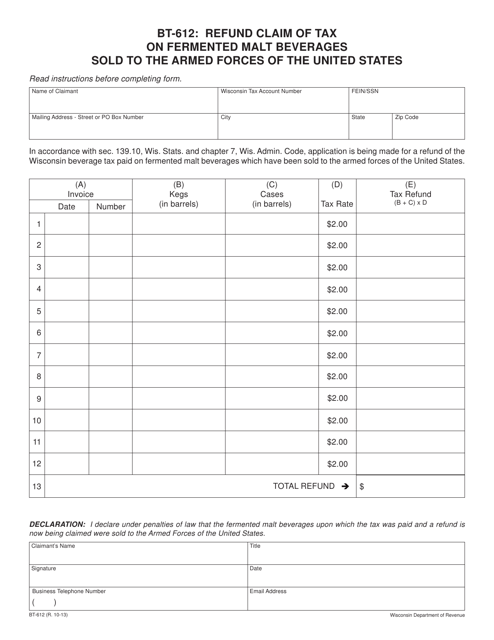

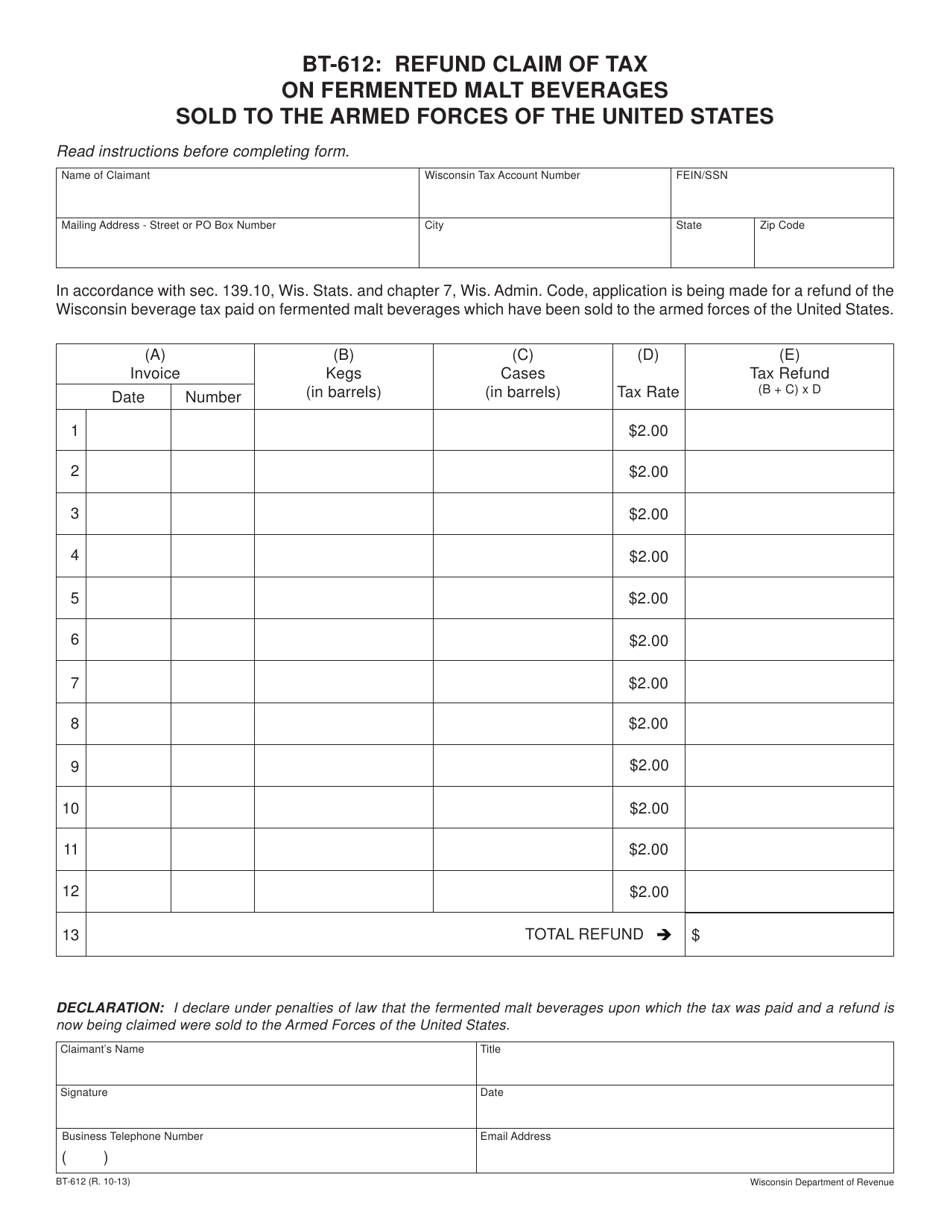

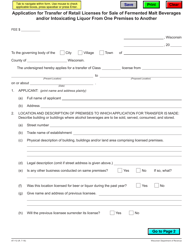

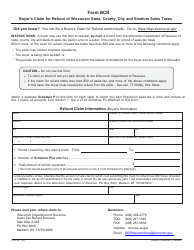

Form BT-612 Refund Claim of Tax on Fermented Malt Beverages Sold to the Armed Forces of the United States - Wisconsin

What Is Form BT-612?

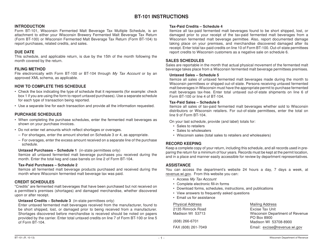

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BT-612?

A: Form BT-612 is a refund claim to request a refund of tax on fermented malt beverages sold to the Armed Forces of the United States.

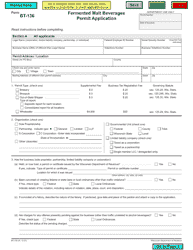

Q: Who can use Form BT-612?

A: Brewers and shippers of fermented malt beverages who have sold those beverages to the Armed Forces of the United States in Wisconsin can use Form BT-612.

Q: What is the purpose of Form BT-612?

A: The purpose of Form BT-612 is to request a refund of the tax paid on fermented malt beverages sold to the Armed Forces of the United States.

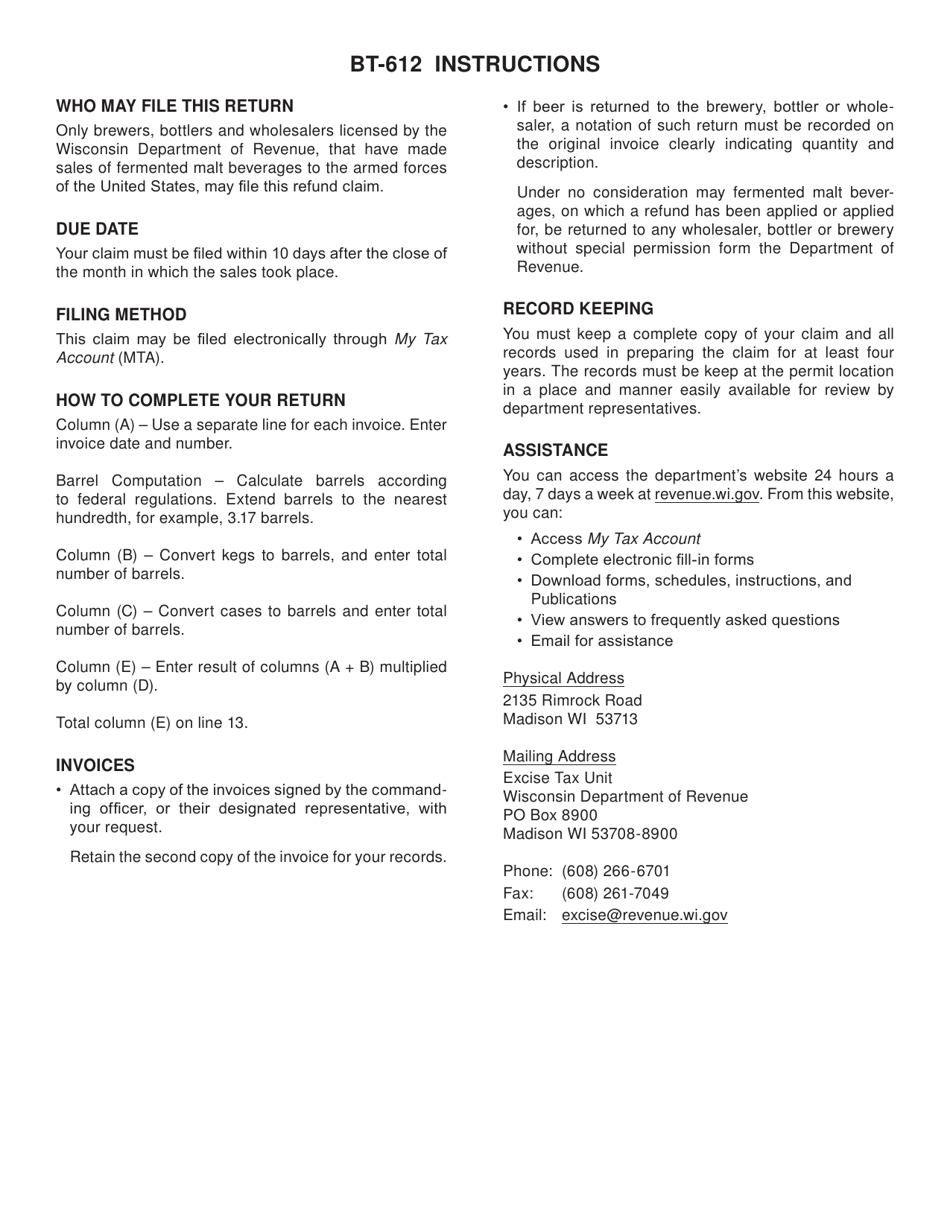

Q: How do I fill out Form BT-612?

A: The form requires information about the brewer or shipper, details of the sales to the Armed Forces, and the amount of tax paid. Follow the instructions provided with the form to properly fill it out.

Q: Is there a deadline to submit Form BT-612?

A: Yes, Form BT-612 must be submitted within 6 months of the date of sale to the Armed Forces.

Q: What happens after I submit Form BT-612?

A: Once Form BT-612 is submitted, the Wisconsin Department of Revenue will review the claim and process the refund if approved.

Q: Can I claim a refund for tax paid on fermented malt beverages sold to other customers?

A: No, Form BT-612 is specifically for claiming a refund on fermented malt beverages sold to the Armed Forces of the United States in Wisconsin.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BT-612 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.