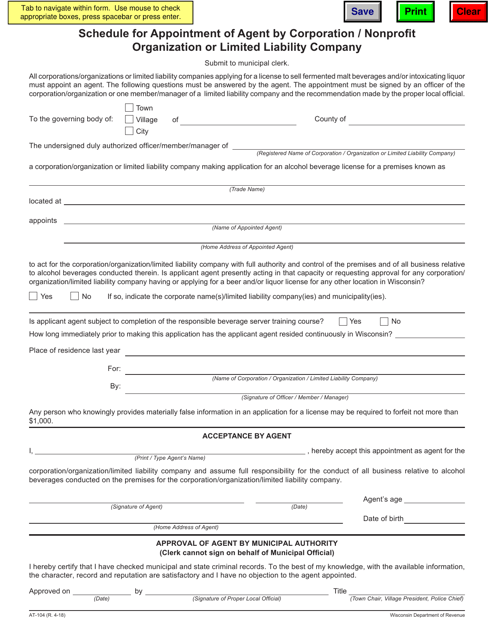

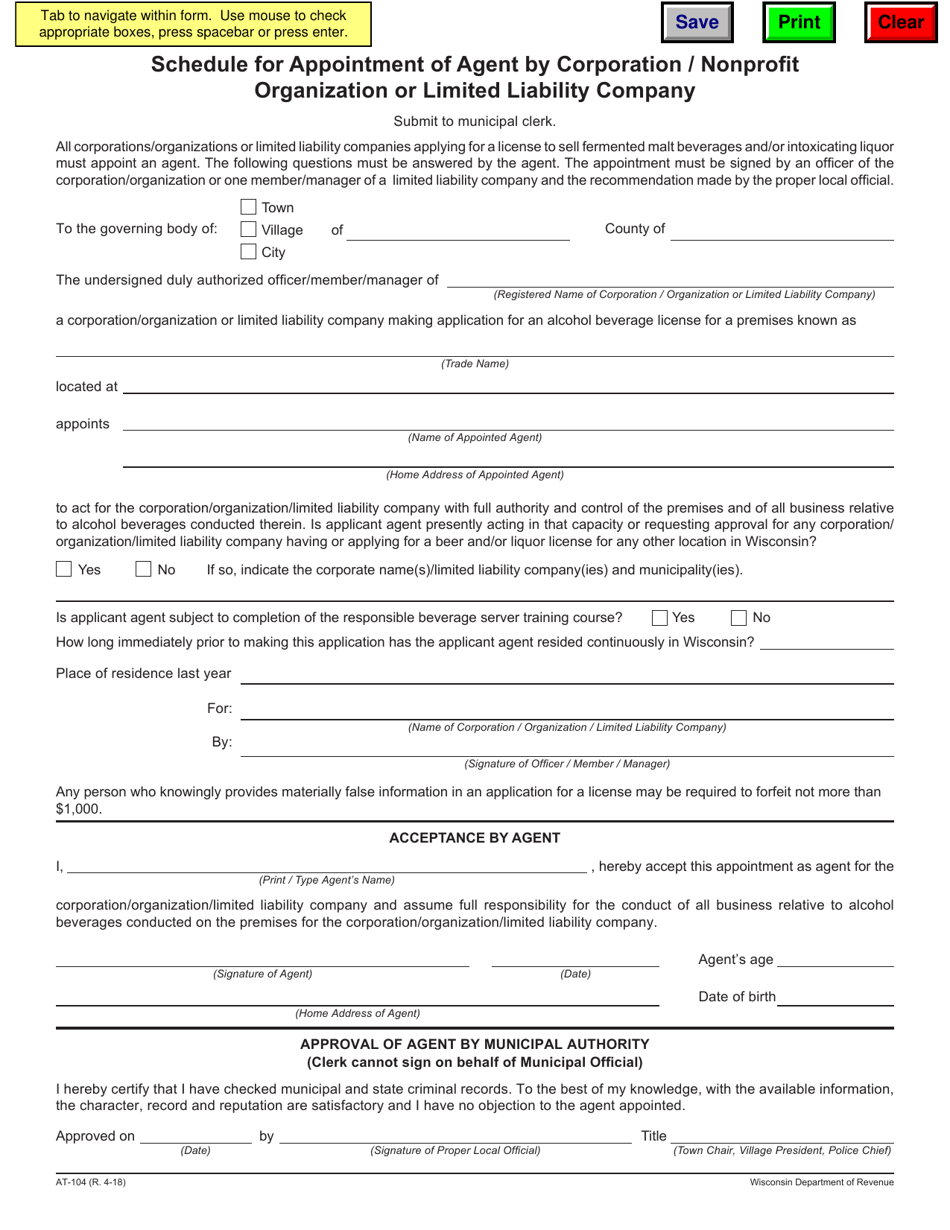

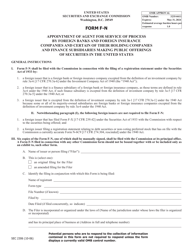

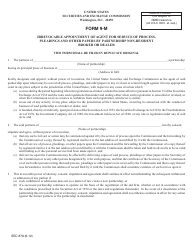

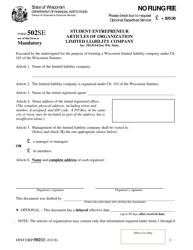

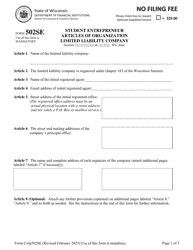

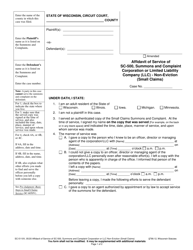

Form AT-104 Schedule for Appointment of Agent by Corporation / Nonprofit Organization or Limited Liability Company - Wisconsin

What Is Form AT-104?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AT-104 Schedule?

A: Form AT-104 Schedule is a Wisconsin tax form that is used for appointing an agent by a corporation, nonprofit organization, or limited liability company.

Q: Who needs to file Form AT-104 Schedule?

A: Corporations, nonprofit organizations, and limited liability companies in Wisconsin need to file Form AT-104 Schedule if they want to appoint an agent for tax-related purposes.

Q: Why do I need to appoint an agent using Form AT-104 Schedule?

A: Appointing an agent using Form AT-104 Schedule allows the designated agent to receive notice of any tax-related matters on behalf of the corporation, nonprofit organization, or limited liability company.

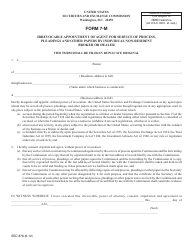

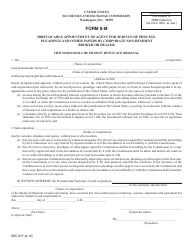

Q: How do I fill out Form AT-104 Schedule?

A: To fill out Form AT-104 Schedule, you will need to provide information about the corporation, nonprofit organization, or limited liability company, as well as the agent being appointed. The form also requires a signature from an authorized representative.

Q: When is the deadline to file Form AT-104 Schedule?

A: The deadline to file Form AT-104 Schedule is typically the same as the deadline for filing the corresponding tax return for the corporation, nonprofit organization, or limited liability company.

Q: Are there any fees associated with filing Form AT-104 Schedule?

A: There are no fees for filing Form AT-104 Schedule.

Q: Can I file Form AT-104 Schedule electronically?

A: Yes, Form AT-104 Schedule can be filed electronically through the Wisconsin Department of Revenue's e-file system.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AT-104 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.