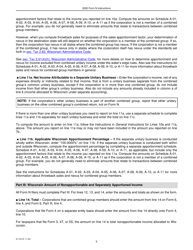

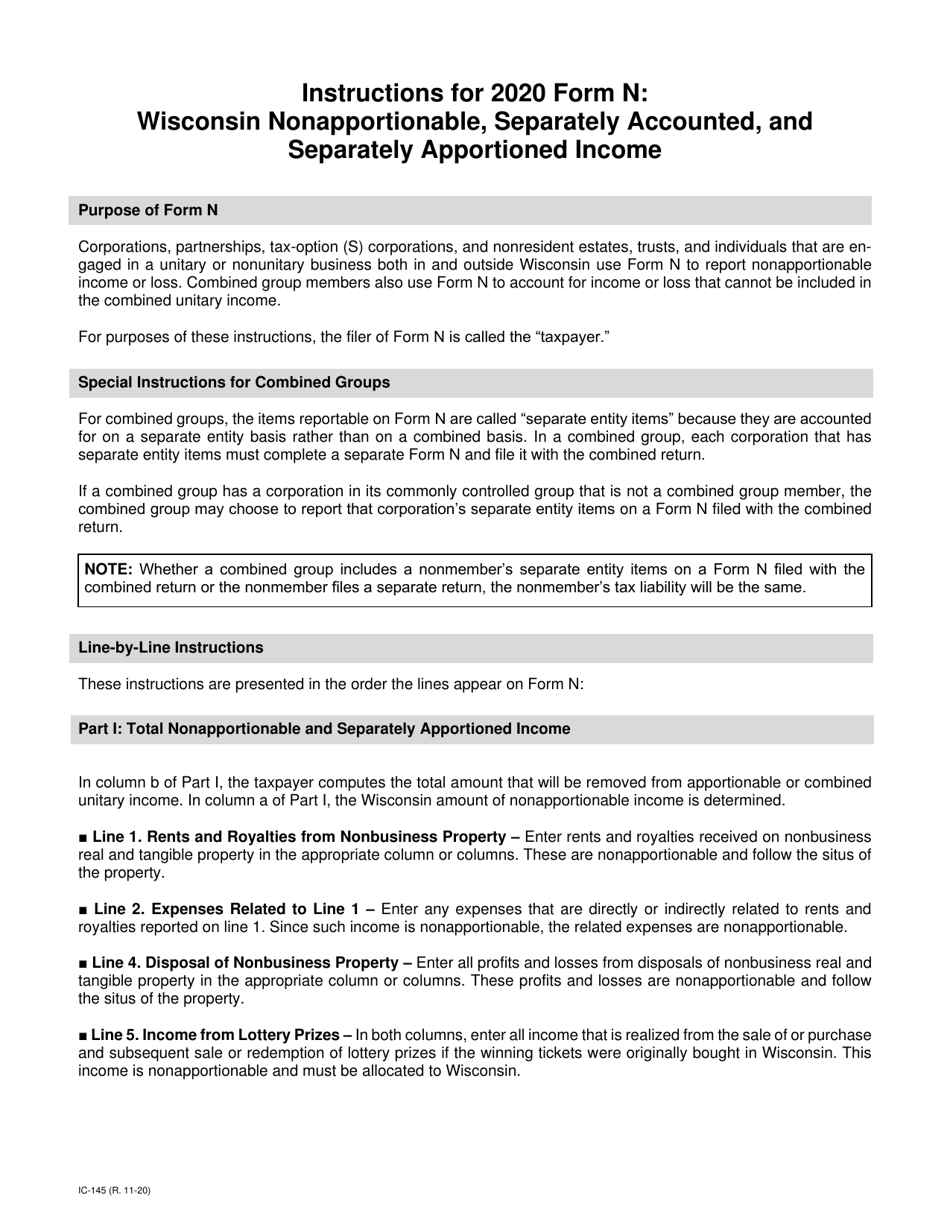

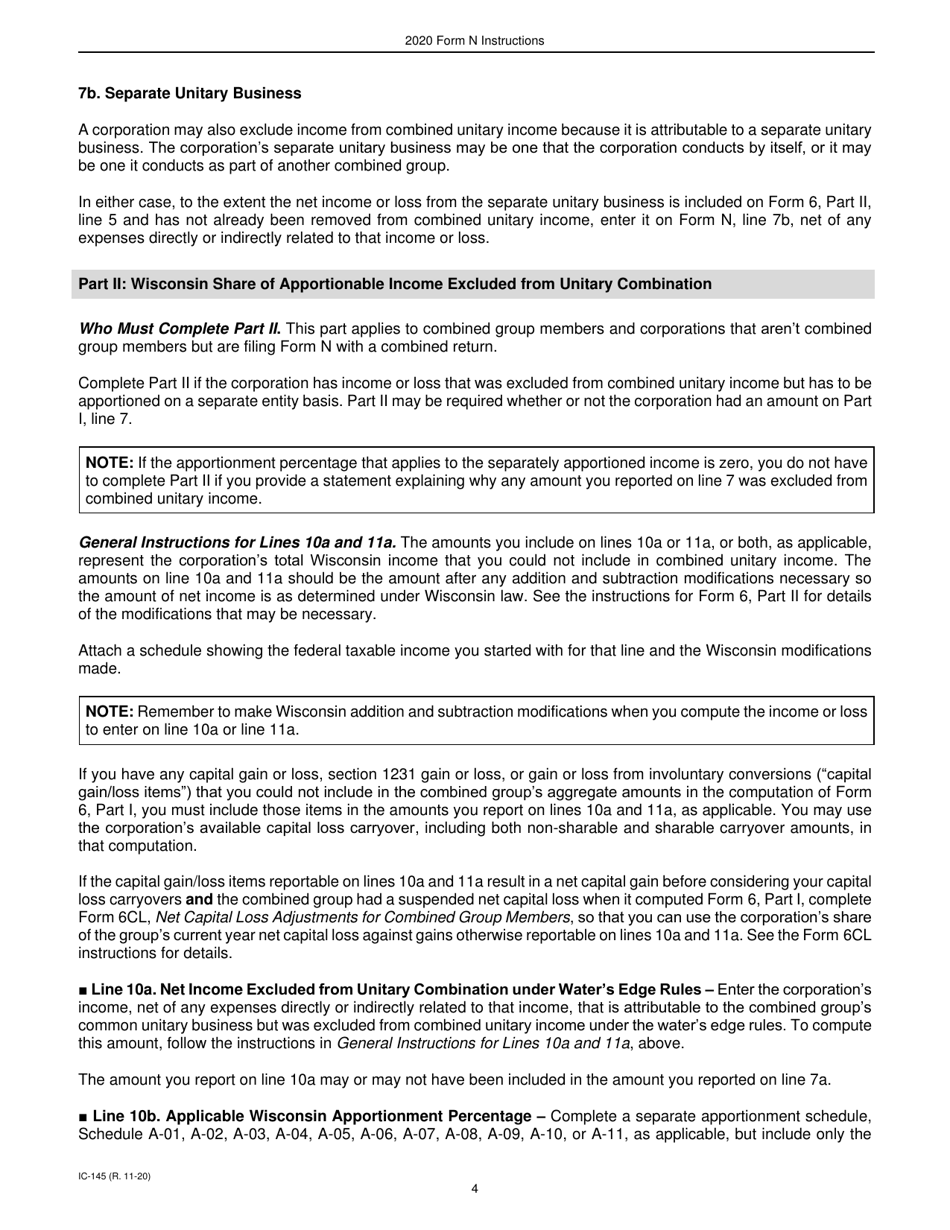

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N, IC-045

for the current year.

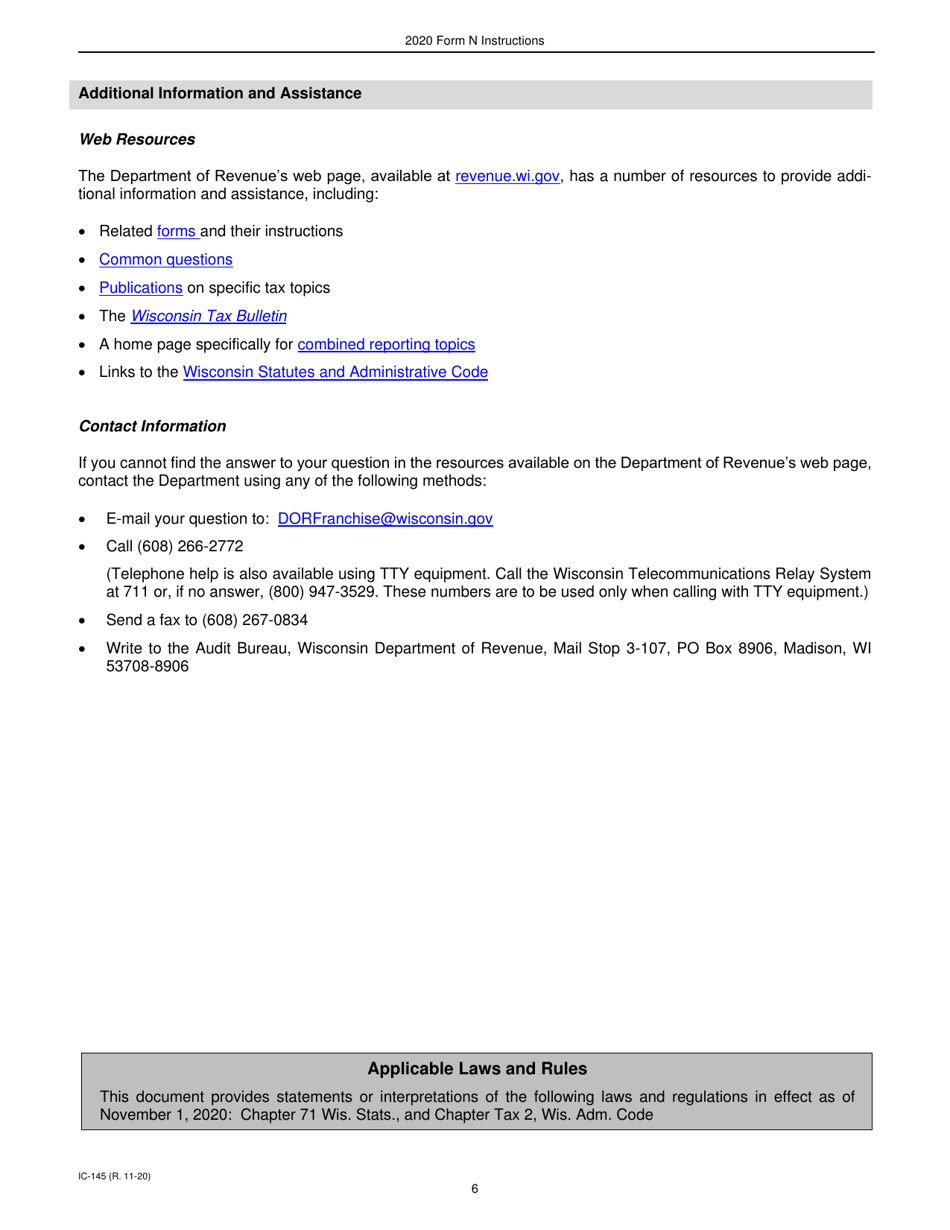

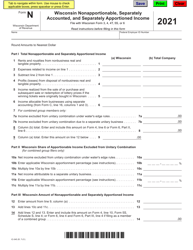

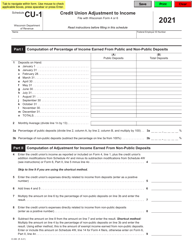

Instructions for Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income - Wisconsin

This document contains official instructions for Form N , and Form IC-045 . Both forms are released and collected by the Wisconsin Department of Revenue.

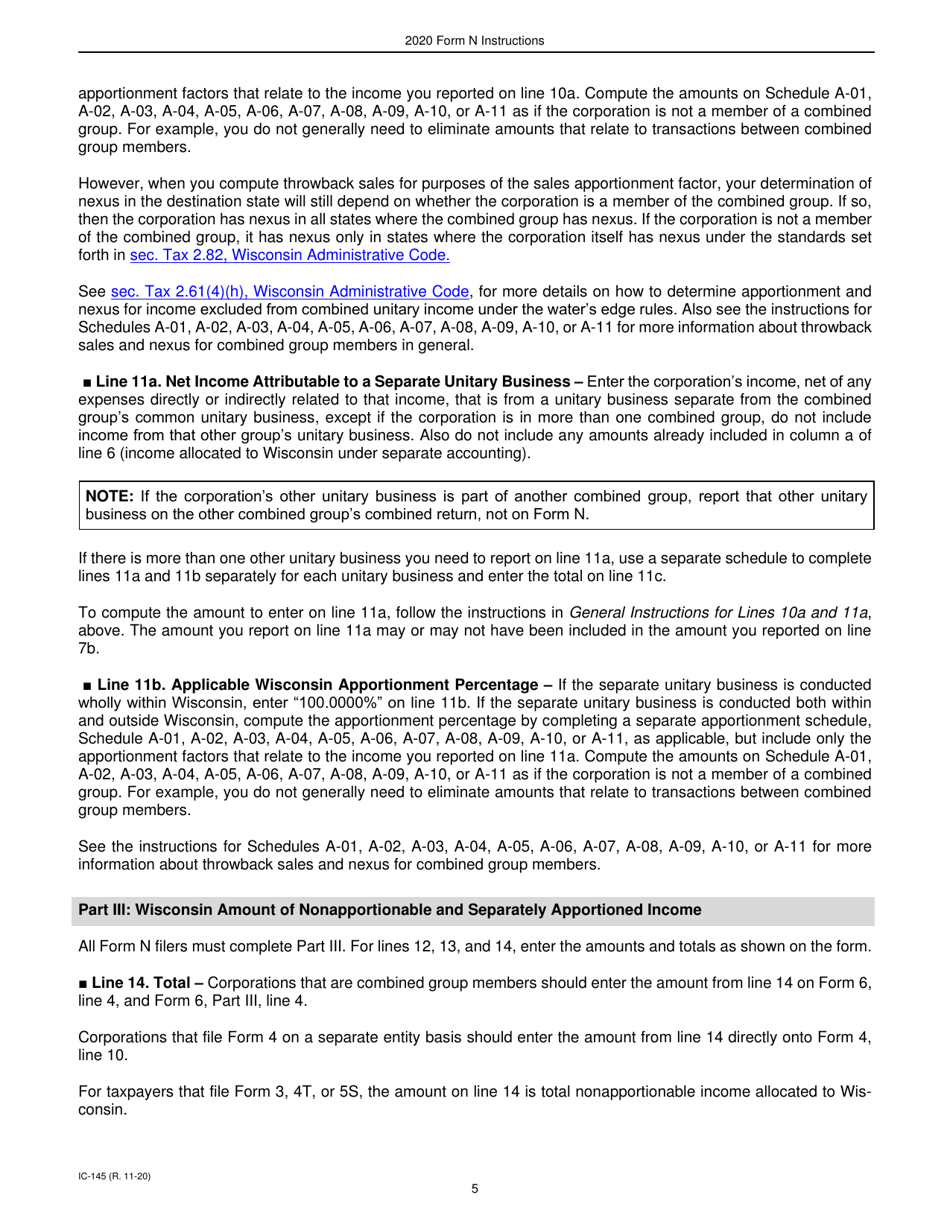

FAQ

Q: What is Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income?

A: Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income is a tax form used in Wisconsin to report nonapportionable income, separately accounted income, and separately apportioned income.

Q: Who needs to file Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income?

A: Individuals or businesses in Wisconsin with nonapportionable income, separately accounted income, or separately apportioned income must file Form N, IC-045.

Q: What types of income should be reported on Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income?

A: Form N, IC-045 should be used to report income that is not subject to apportionment, income that is accounted for separately, and income that is apportioned separately.

Q: When is the deadline for filing Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income?

A: The deadline for filing Form N, IC-045 in Wisconsin is usually April 15th, or the next business day if April 15th falls on a weekend or legal holiday.

Q: Do I need to file Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income if I have no income to report?

A: If you have no nonapportionable income, separately accounted income, or separately apportioned income to report, you do not need to file Form N, IC-045.

Q: Can I file Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income electronically?

A: Yes, you can file Form N, IC-045 electronically if you prefer. Wisconsin offers an e-file option for this form.

Q: What supporting documents do I need to include with Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income?

A: The specific supporting documents required will depend on the nature of the income being reported. You should consult the instructions provided with Form N, IC-045 for a list of required supporting documents.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.