This version of the form is not currently in use and is provided for reference only. Download this version of

Form PW-2 (IC-005)

for the current year.

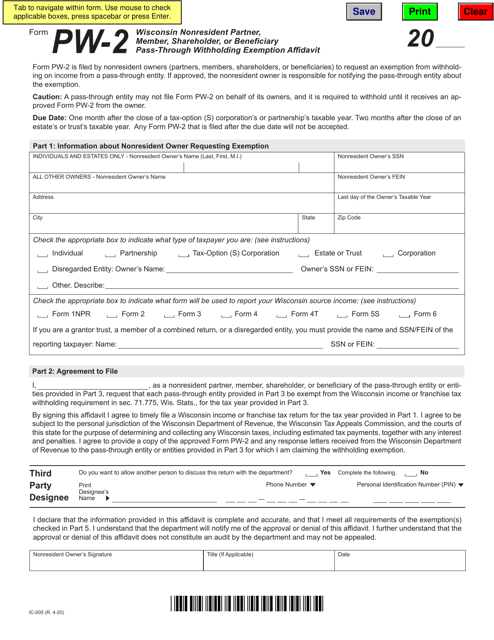

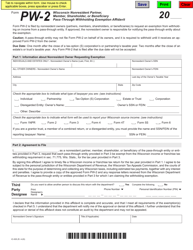

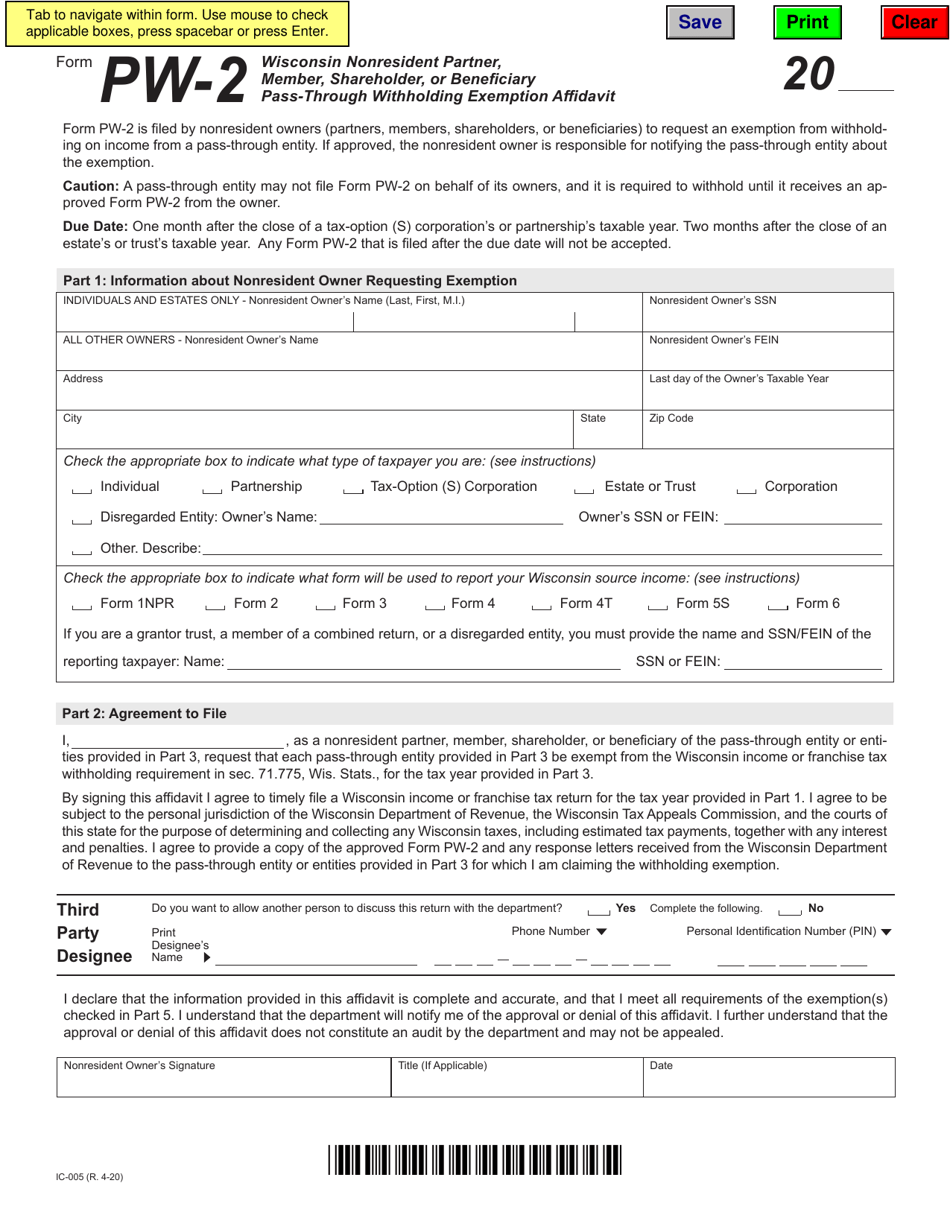

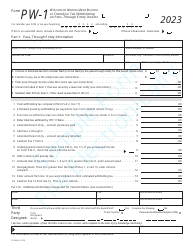

Form PW-2 (IC-005) Wisconsin Nonresident Partner, Member, Shareholder, or Beneficiary Pass-Through Withholding Exemption Affidavit - Wisconsin

What Is Form PW-2 (IC-005)?

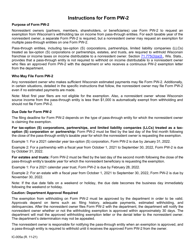

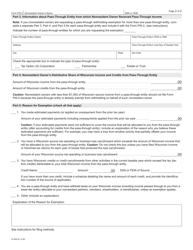

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PW-2 (IC-005)?

A: Form PW-2 (IC-005) is the Wisconsin Nonresident Partner, Member, Shareholder, or Beneficiary Pass-Through Withholding Exemption Affidavit.

Q: Who uses Form PW-2 (IC-005)?

A: Form PW-2 (IC-005) is used by nonresident partners, members, shareholders, or beneficiaries to claim exemption from pass-through withholding in Wisconsin.

Q: What is pass-through withholding?

A: Pass-through withholding refers to the requirement of withholding a portion of income from nonresident partners, members, shareholders, or beneficiaries by the pass-through entity.

Q: What is the purpose of Form PW-2 (IC-005)?

A: The purpose of Form PW-2 (IC-005) is to declare the exemption and provide necessary information to the pass-through entity so that no withholding is done on their share of income.

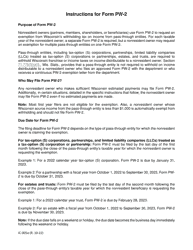

Q: When should Form PW-2 (IC-005) be submitted?

A: Form PW-2 (IC-005) should be submitted to the pass-through entity before the first distribution of income during the taxable year in which the exemption is claimed.

Q: Is there a deadline for submitting Form PW-2 (IC-005)?

A: There is no specific deadline mentioned for submitting Form PW-2 (IC-005), but it should be submitted before the first distribution of income.

Q: What happens if Form PW-2 (IC-005) is not submitted?

A: If Form PW-2 (IC-005) is not submitted, the pass-through entity may withhold taxes from the nonresident partner, member, shareholder, or beneficiary's share of income.

Q: Do I need to file Form PW-2 (IC-005) every year?

A: Form PW-2 (IC-005) needs to be filed only once unless there is a change in circumstances, such as a change in the exemption status or a change in the pass-through entity.

Q: Can I claim exemption from pass-through withholding if I am a resident of Wisconsin?

A: No, Form PW-2 (IC-005) is specifically for nonresident partners, members, shareholders, or beneficiaries to claim exemption from pass-through withholding in Wisconsin.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PW-2 (IC-005) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.