This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IC-304 Schedule A-06

for the current year.

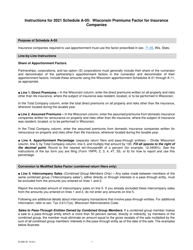

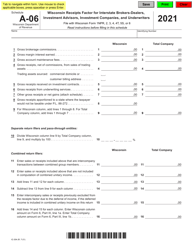

Instructions for Form IC-304 Schedule A-06 Wisconsin Receipts Factor for Interstate Brokers-Dealers, Investment Advisors, Investment Companies, and Underwriters - Wisconsin

This document contains official instructions for Form IC-304 Schedule A-06, Wisconsin Receipts Factor for Interstate Brokers-Dealers, Investment Companies, and Underwriters - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form IC-304 Schedule A-06?

A: Form IC-304 Schedule A-06 is a schedule that needs to be filed by interstate brokers-dealers, investment advisors, investment companies, and underwriters in Wisconsin.

Q: What is the purpose of Form IC-304 Schedule A-06?

A: The purpose of Form IC-304 Schedule A-06 is to determine the Wisconsin receipts factor for interstate brokers-dealers, investment advisors, investment companies, and underwriters.

Q: Who needs to file Form IC-304 Schedule A-06?

A: Interstate brokers-dealers, investment advisors, investment companies, and underwriters who operate in Wisconsin need to file Form IC-304 Schedule A-06.

Q: What does the Wisconsin receipts factor determine?

A: The Wisconsin receipts factor determines the portion of a company's total receipts that is attributed to Wisconsin for tax calculation purposes.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.