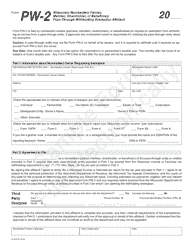

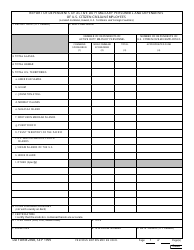

This version of the form is not currently in use and is provided for reference only. Download this version of

Form W-221

for the current year.

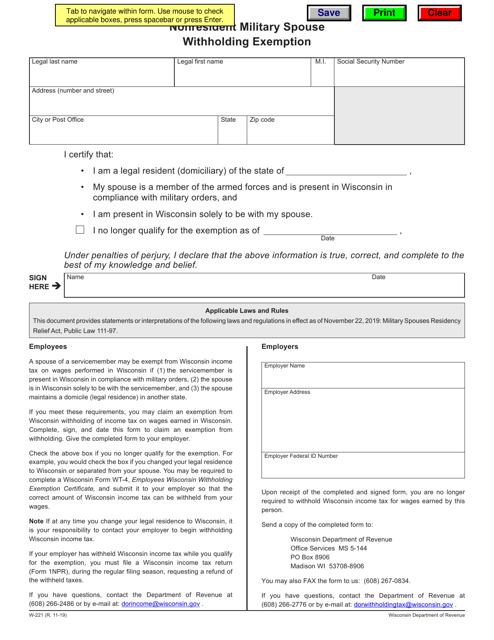

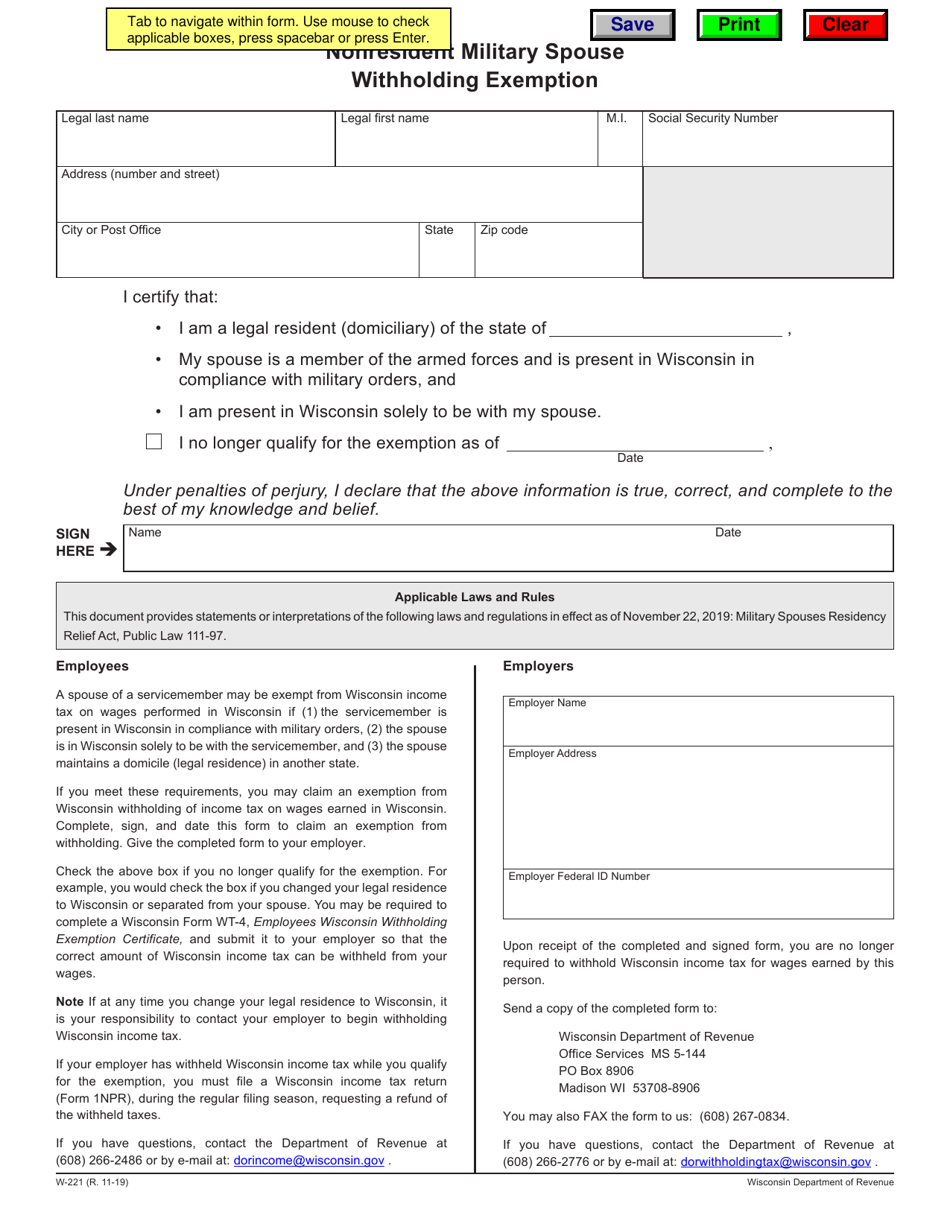

Form W-221 Nonresident Military Spouse Withholding Exemption - Wisconsin

What Is Form W-221?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

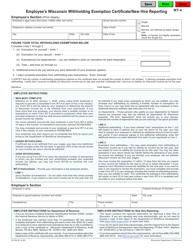

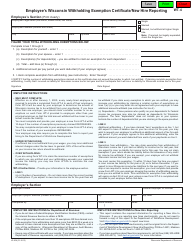

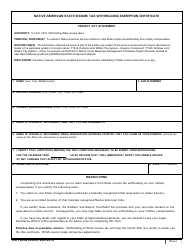

Q: What is Form W-221?

A: Form W-221 is a tax form used by nonresident military spouses to claim withholding exemption in the state of Wisconsin.

Q: Who can use Form W-221?

A: Nonresident military spouses can use Form W-221 if they meet certain requirements.

Q: What is the purpose of Form W-221?

A: The purpose of Form W-221 is to allow nonresident military spouses to reduce or eliminate Wisconsin income tax withholding.

Q: How do I qualify for the withholding exemption?

A: To qualify for the withholding exemption, you must be a nonresident military spouse and meet other specific criteria set by the Wisconsin Department of Revenue.

Q: When do I need to file Form W-221?

A: Form W-221 should be filed as soon as possible after you become a nonresident military spouse in order to claim the withholding exemption for the tax year.

Q: Is there a deadline for filing Form W-221?

A: There is no specific deadline for filing Form W-221, but it should be filed as soon as possible to ensure proper withholding exemption.

Q: What other documents do I need to submit with Form W-221?

A: You may need to submit supporting documentation such as a copy of your military spouse's orders and a copy of your federal tax return.

Q: Can I still claim the withholding exemption if I am not a nonresident military spouse?

A: No, Form W-221 is specifically for nonresident military spouses.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-221 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.