This version of the form is not currently in use and is provided for reference only. Download this version of

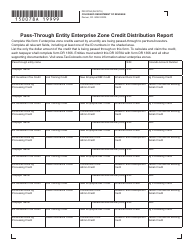

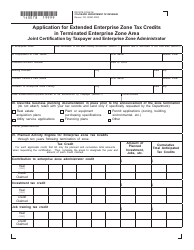

Form DR0113

for the current year.

Form DR0113 Rural Jump-Start Zone Credit Schedule - Colorado

What Is Form DR0113?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

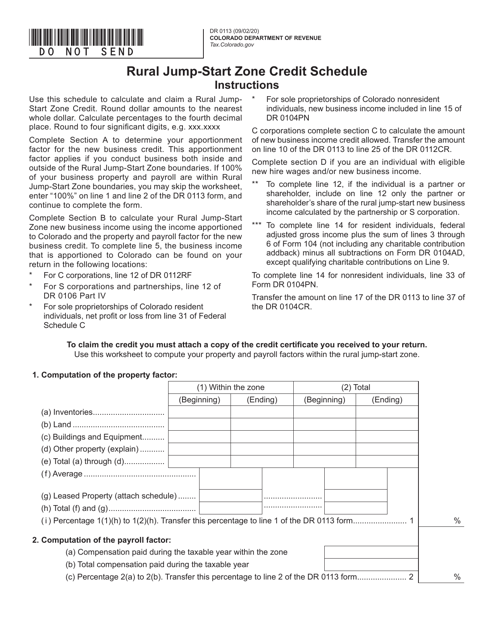

Q: What is the Form DR0113?

A: Form DR0113 is the Rural Jump-Start Zone Credit Schedule specific to Colorado.

Q: What is the Rural Jump-Start Zone Credit?

A: The Rural Jump-Start Zone Credit is a tax credit available in Colorado for businesses that create new jobs in designated rural areas.

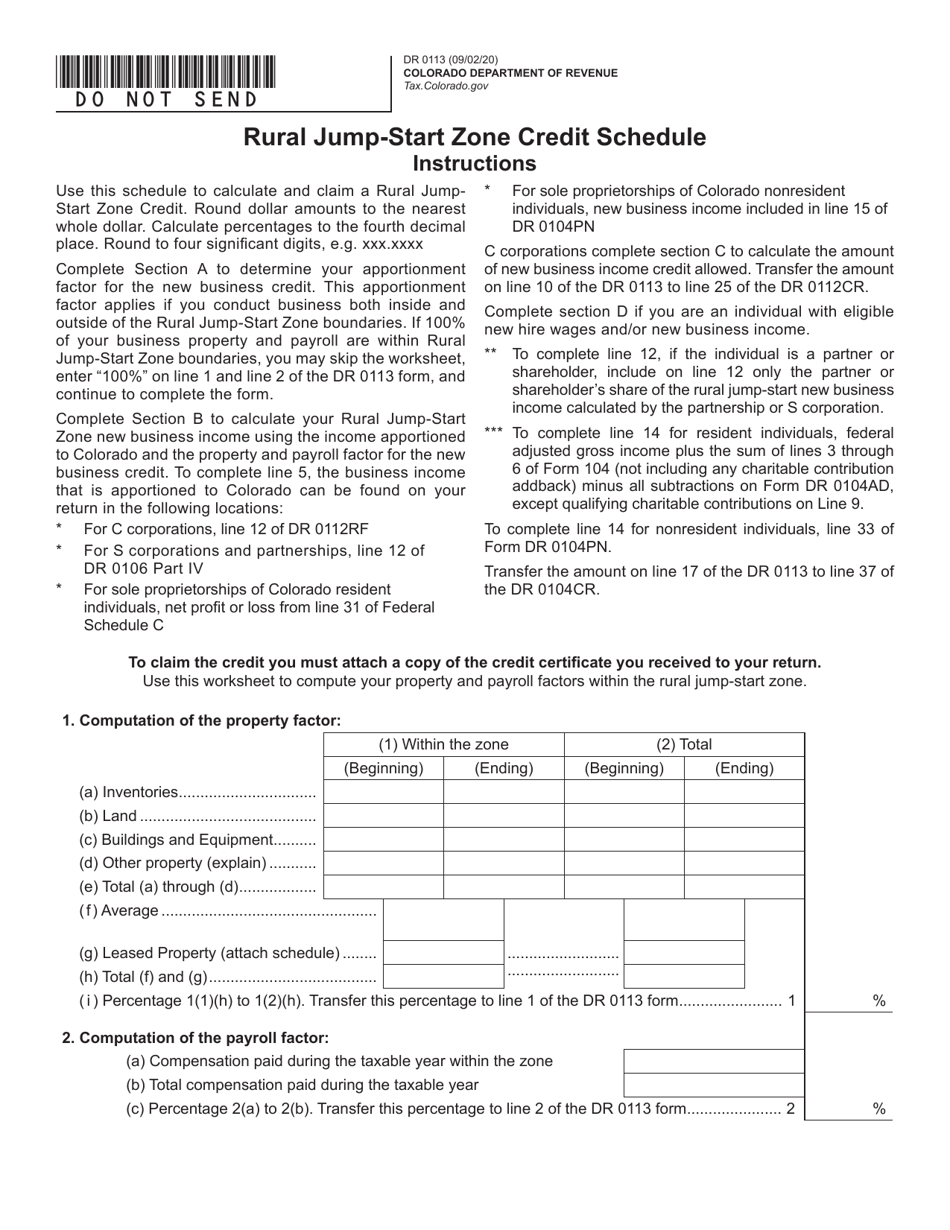

Q: How do I use Form DR0113?

A: You can use Form DR0113 to claim the Rural Jump-Start Zone Credit on your Colorado state tax return.

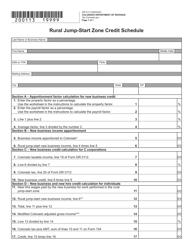

Q: What information is required on Form DR0113?

A: Form DR0113 requires you to provide details about your business, the number of new jobs created, and other related information.

Q: Is the Rural Jump-Start Zone Credit available in all areas of Colorado?

A: No, the Rural Jump-Start Zone Credit is only available in designated rural areas as specified by the Colorado Department of Revenue.

Q: Are there any eligibility criteria for the Rural Jump-Start Zone Credit?

A: Yes, to be eligible for the Rural Jump-Start Zone Credit, your business must meet certain criteria such as creating new jobs and being located in a designated rural area.

Q: Can I claim the Rural Jump-Start Zone Credit for jobs created in urban areas?

A: No, the Rural Jump-Start Zone Credit is specifically for jobs created in designated rural areas.

Q: Is the Rural Jump-Start Zone Credit refundable?

A: Yes, the Rural Jump-Start Zone Credit is refundable, which means that if the credit exceeds your tax liability, you can receive the excess as a refund.

Q: Are there any limitations or restrictions on the Rural Jump-Start Zone Credit?

A: Yes, there are limitations on the total amount of credits that can be claimed and restrictions on carrying forward or transferring unused credits.

Form Details:

- Released on September 2, 2020;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0113 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.