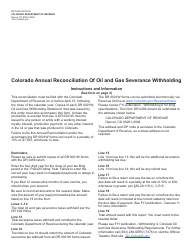

This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0021W

for the current year.

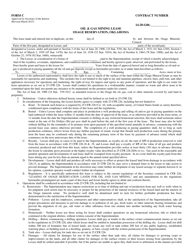

Form DR0021W Oil & Gas Severance Withholding Statement - Colorado

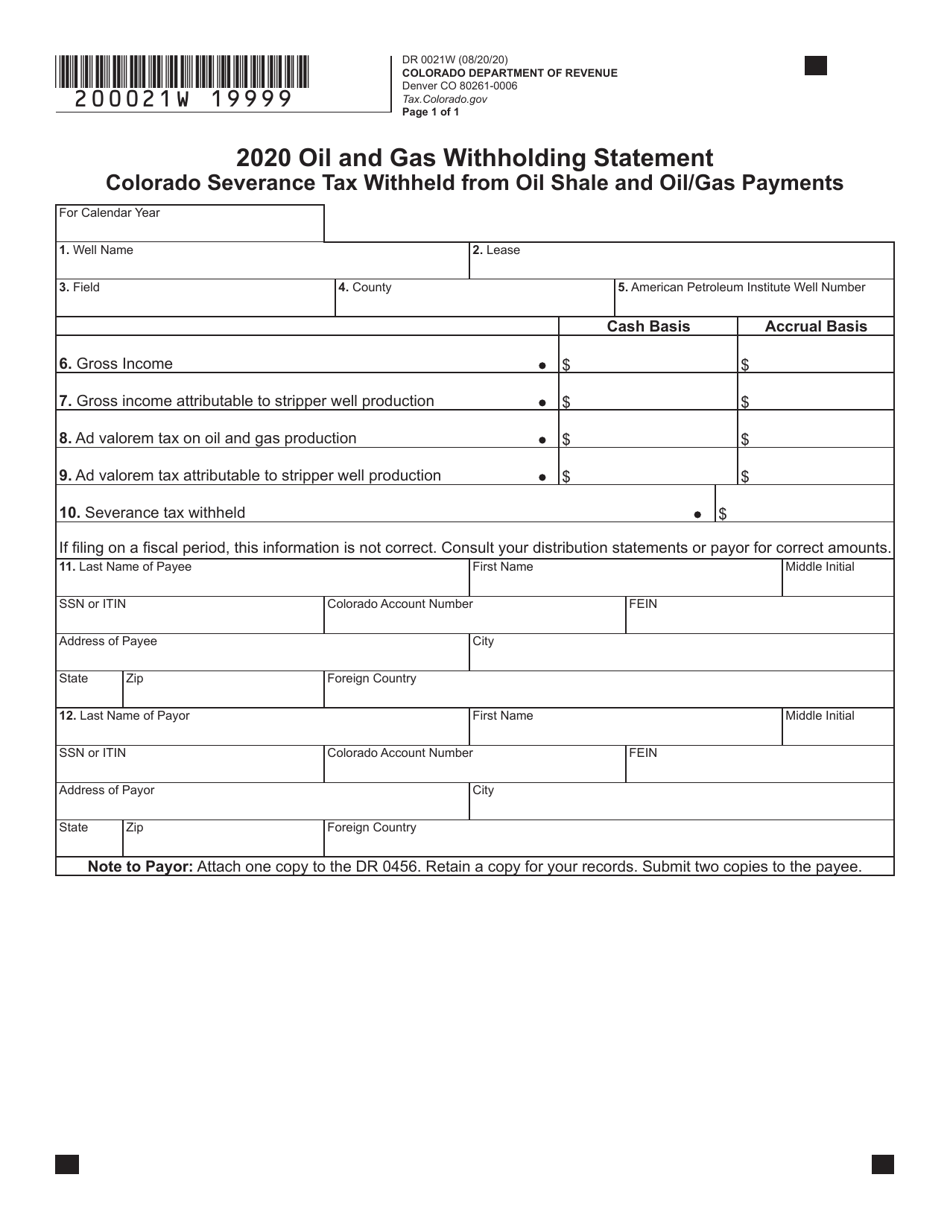

What Is Form DR0021W?

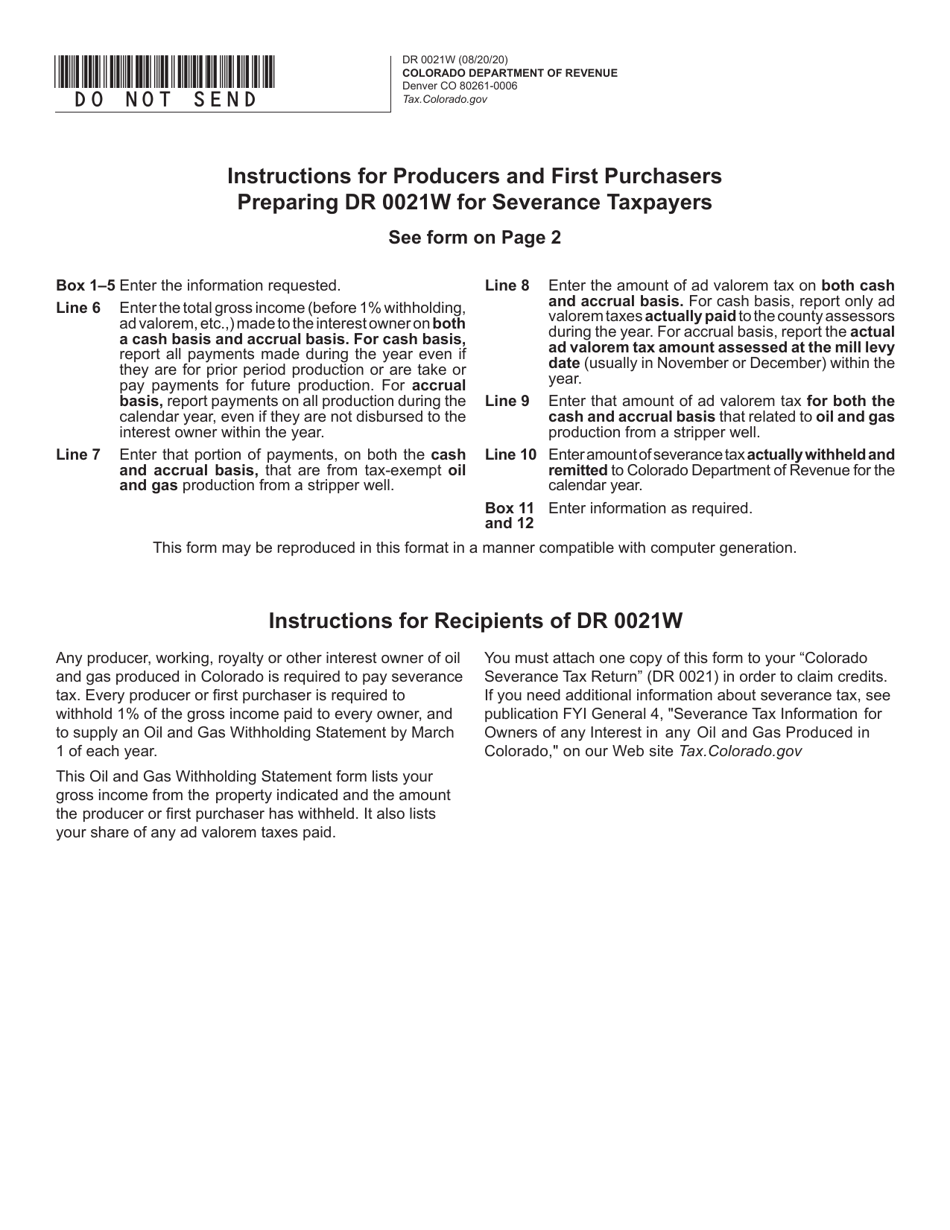

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

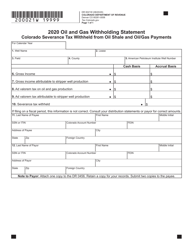

Q: What is Form DR0021W?

A: Form DR0021W is the Oil & Gas Severance Withholding Statement for Colorado.

Q: Who needs to file Form DR0021W?

A: Oil and gas companies operating in Colorado need to file Form DR0021W.

Q: What is the purpose of Form DR0021W?

A: The purpose of Form DR0021W is to report and remit oil and gas severance tax withholding payments to the Colorado Department of Revenue.

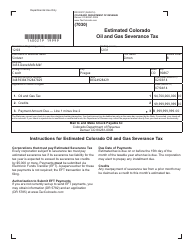

Q: When is Form DR0021W due?

A: Form DR0021W is due on the 15th day of the month following the calendar quarter in which the severance tax liability was incurred.

Form Details:

- Released on August 20, 2020;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0021W by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.