This version of the form is not currently in use and is provided for reference only. Download this version of

Form MT-903-FUT

for the current year.

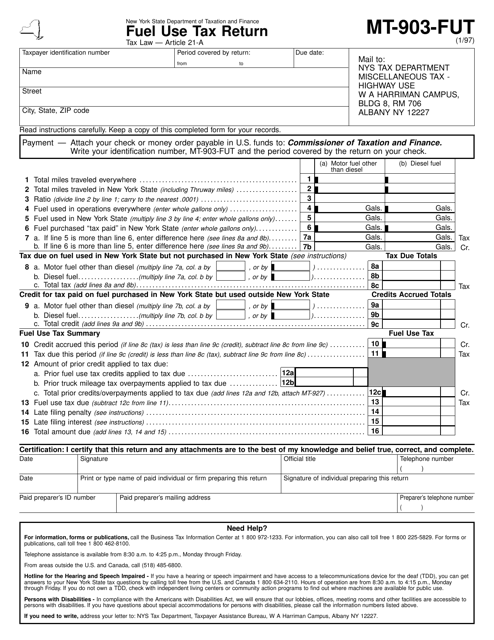

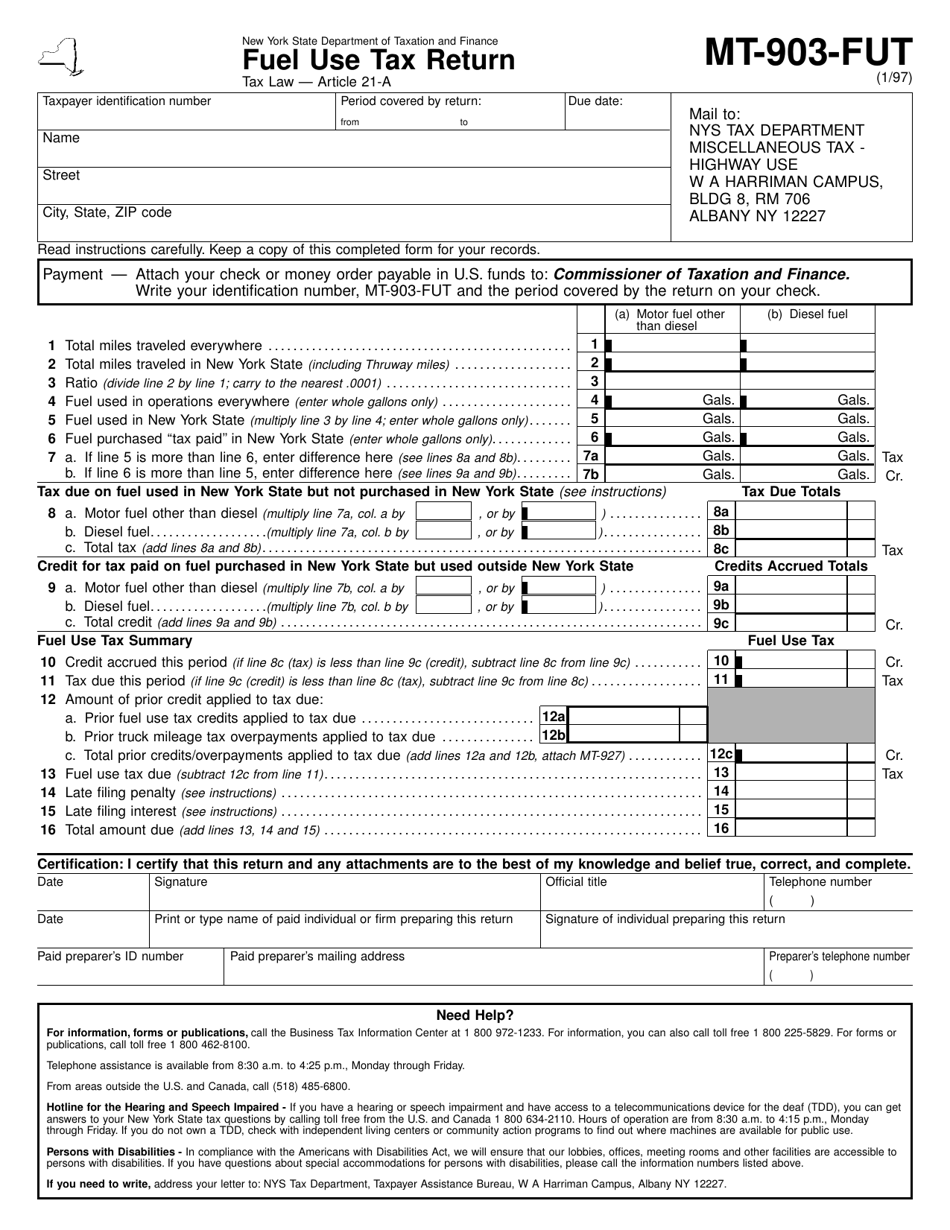

Form MT-903-FUT Fuel Use Tax Return - New York

What Is Form MT-903-FUT?

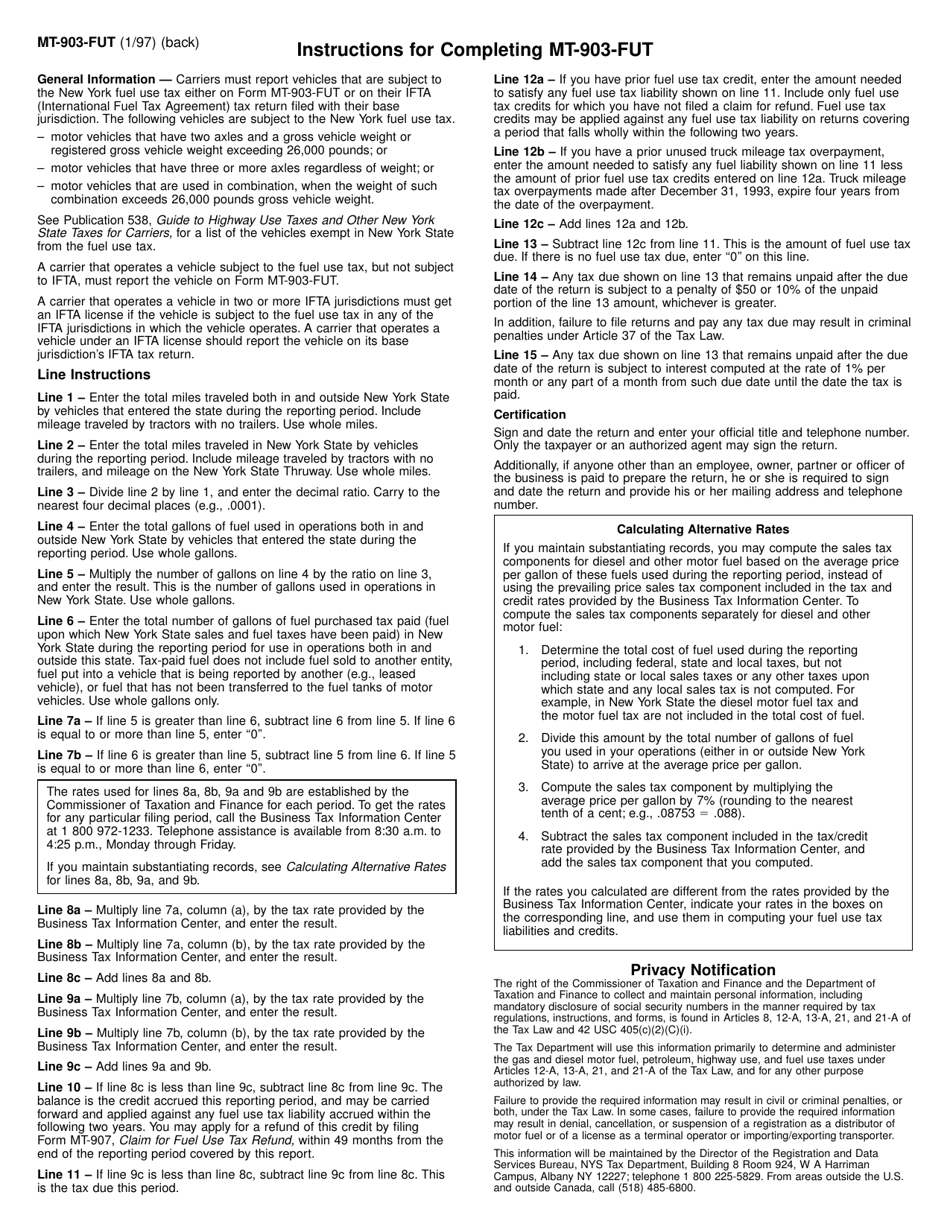

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-903-FUT?

A: Form MT-903-FUT is the Fuel Use Tax Return form for the state of New York.

Q: Who is required to file Form MT-903-FUT?

A: Motor carriers who operate qualified motor vehicles with a gross weight of more than 18,000 pounds in New York are required to file Form MT-903-FUT.

Q: What is Fuel Use Tax?

A: Fuel Use Tax is a tax imposed on the use of motor fuel and diesel motor fuel in New York. It is paid by motor carriers.

Q: What information is required on Form MT-903-FUT?

A: Form MT-903-FUT requires motor carriers to provide information about their vehicles, distance traveled in New York, and the amount of fuel consumed.

Q: When is Form MT-903-FUT due?

A: Form MT-903-FUT is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

Q: How can I file Form MT-903-FUT?

A: Form MT-903-FUT can be filed electronically or by mail. Electronic filing is the preferred method.

Q: Are there any penalties for late filing of Form MT-903-FUT?

A: Yes, there are penalties for late filing of Form MT-903-FUT. Motor carriers may be subject to late filing fees and interest charges.

Q: Is Form MT-903-FUT specific to New York state?

A: Yes, Form MT-903-FUT is specific to New York and is used to report fuel use tax for motor carriers operating in the state.

Q: Is Form MT-903-FUT the only form required to report fuel use tax in New York?

A: No, motor carriers may also be required to file other forms, such as Form MT-903 or Form TMT-1, depending on their specific operations.

Form Details:

- Released on January 1, 1997;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-903-FUT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.