This version of the form is not currently in use and is provided for reference only. Download this version of

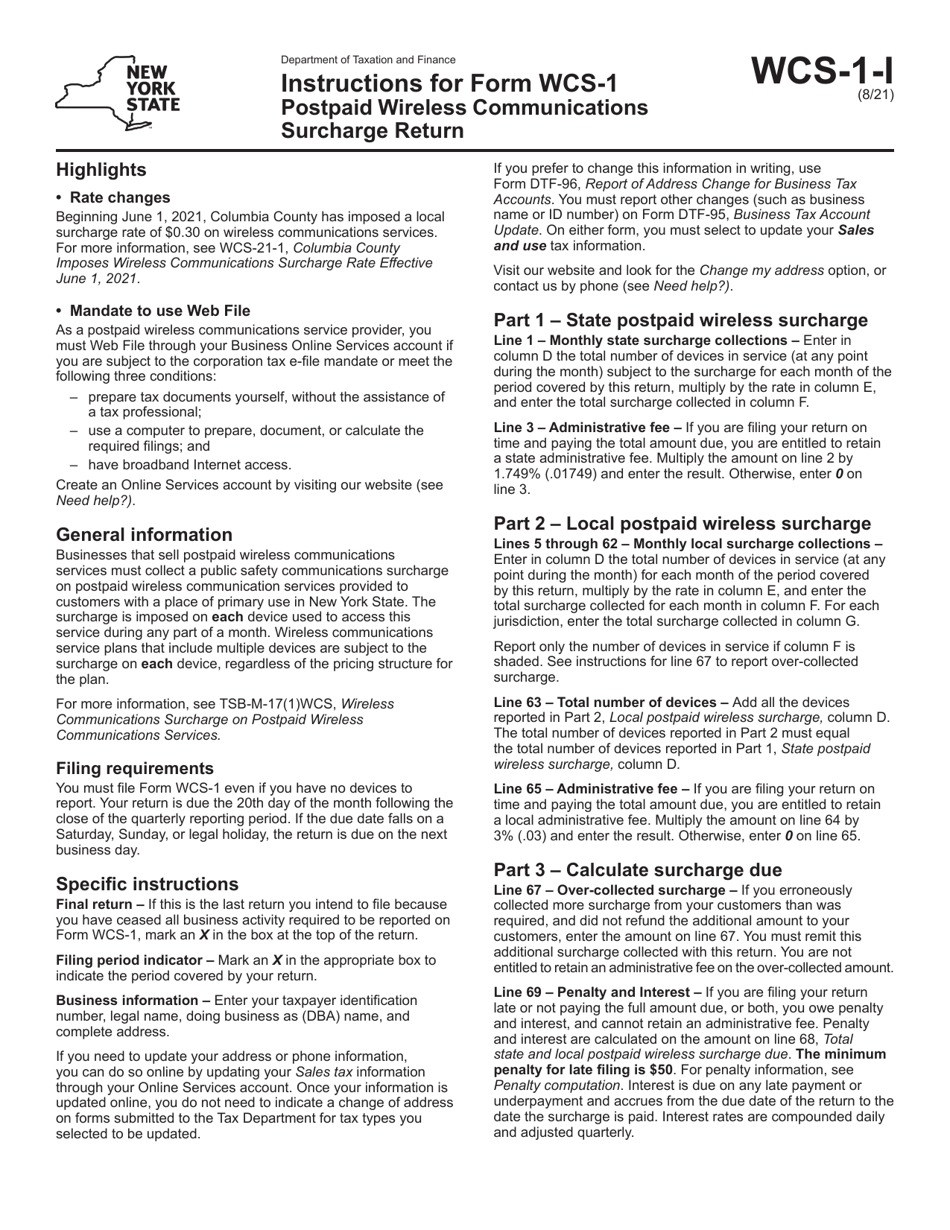

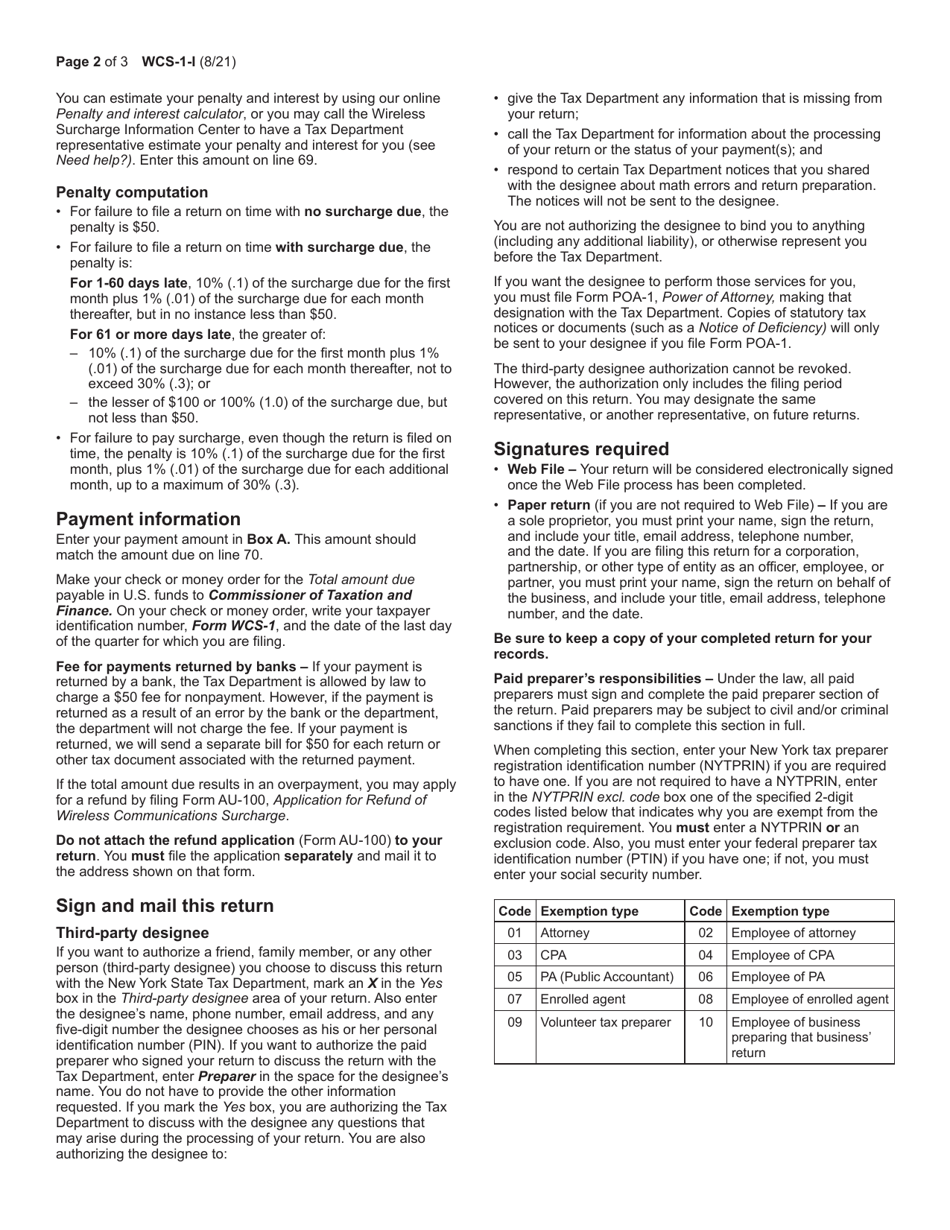

Instructions for Form WCS-1

for the current year.

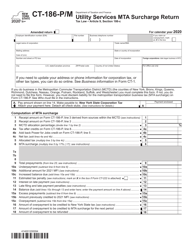

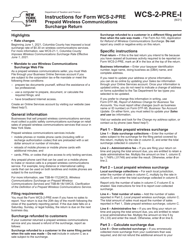

Instructions for Form WCS-1 Postpaid Wireless Communications Surcharge Return - New York

This document contains official instructions for Form WCS-1 , Postpaid Wireless Communications Surcharge Return - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form WCS-1?

A: Form WCS-1 is a return form for reporting postpaid wireless communications surcharges in the state of New York.

Q: Who needs to file Form WCS-1?

A: Any person or company that collects postpaid wireless communications surcharges in New York needs to file Form WCS-1.

Q: What are postpaid wireless communications surcharges?

A: Postpaid wireless communications surcharges are fees imposed on customers for the use of postpaid wireless communication services.

Q: What information do I need to complete Form WCS-1?

A: You will need to provide your business information, surcharge amount collected, and details of your wireless communication services.

Q: When is Form WCS-1 due?

A: Form WCS-1 is due by the last day of the month following the reporting period.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.