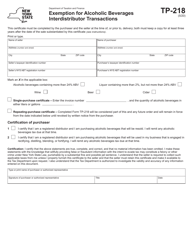

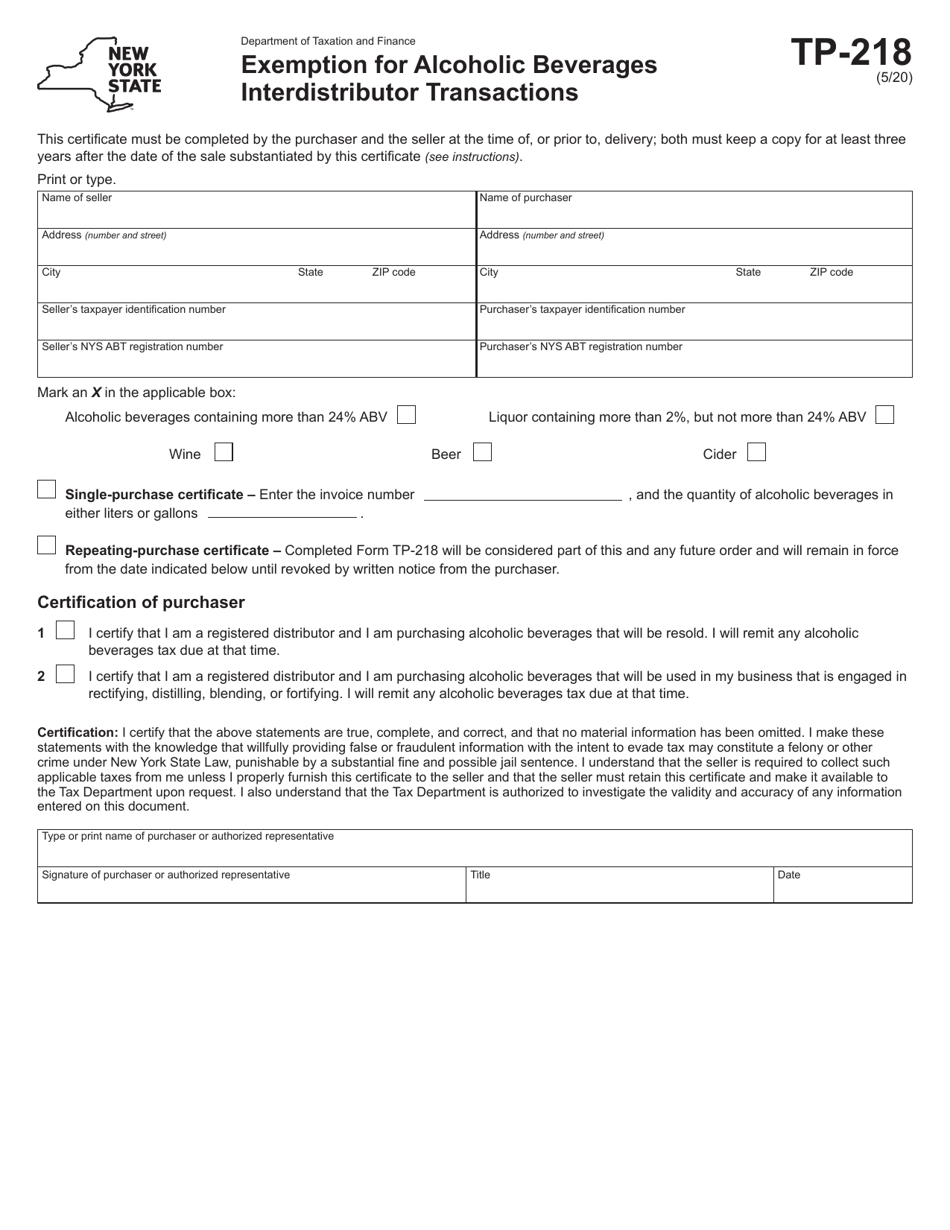

Form TP-218 Exemption for Alcoholic Beverages Interdistributor Transactions - New York

What Is Form TP-218?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-218?

A: Form TP-218 is a tax exemption form for interdistributor transactions of alcoholic beverages in New York.

Q: Who needs to file Form TP-218?

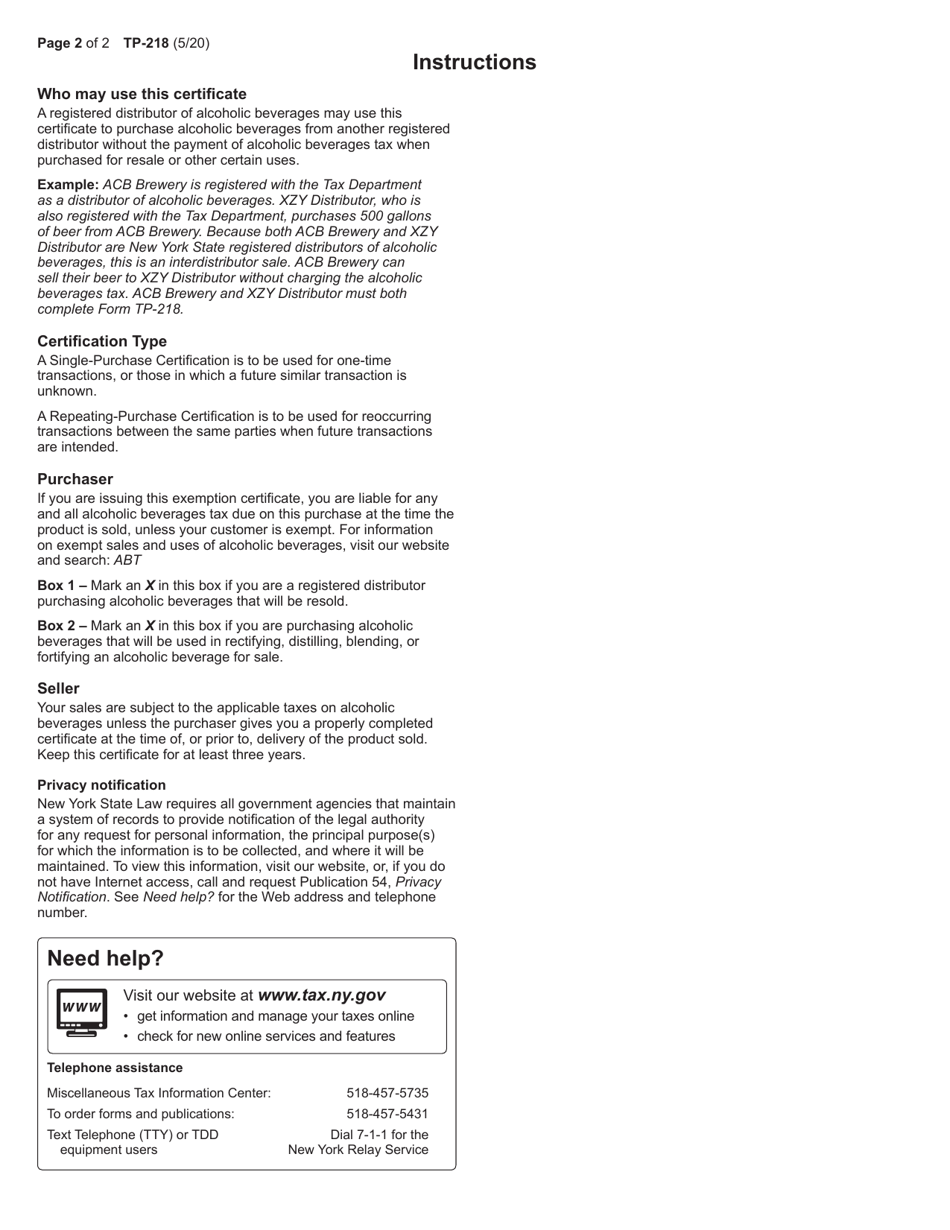

A: Distributors and wholesalers of alcoholic beverages in New York who engage in interdistributor transactions.

Q: What is an interdistributor transaction?

A: An interdistributor transaction is a sale or transfer of alcoholic beverages between distributors or wholesalers.

Q: Why would someone file Form TP-218?

A: Filing Form TP-218 allows distributors and wholesalers to claim an exemption from certain taxes on interdistributor transactions.

Q: When is the deadline to file Form TP-218?

A: Form TP-218 should be filed within 20 days of the date of the interdistributor transaction.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-218 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.