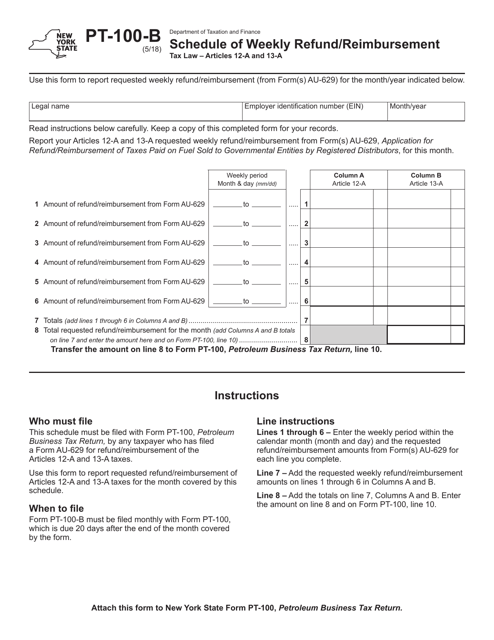

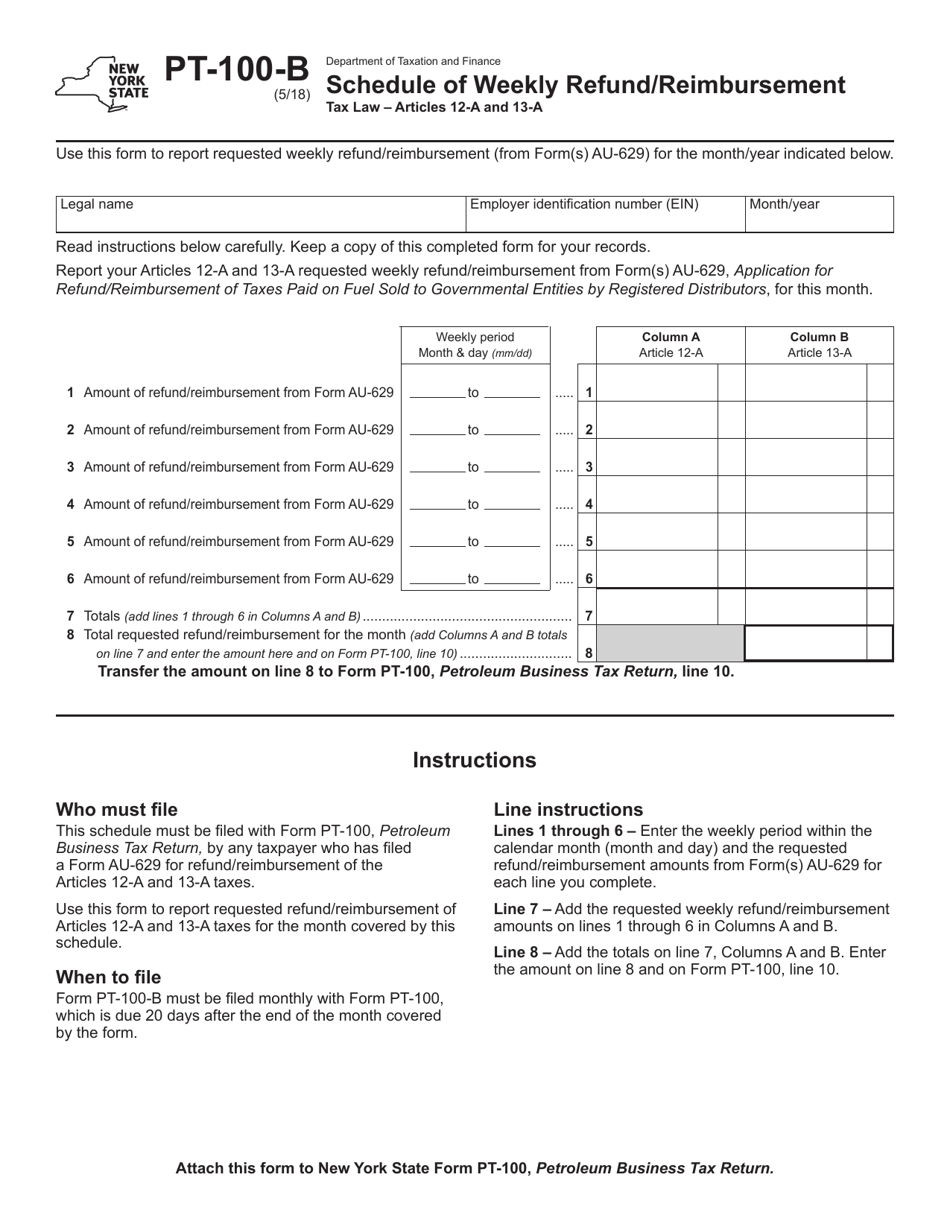

Form PT-100-B Schedule of Weekly Refund / Reimbursement - New York

What Is Form PT-100-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-100-B?

A: Form PT-100-B is a schedule used in New York to report weekly refund or reimbursement information.

Q: What is the purpose of Form PT-100-B?

A: The purpose of Form PT-100-B is to provide detailed information on weekly refunds or reimbursements in New York.

Q: Who is required to file Form PT-100-B?

A: Businesses in New York that need to report weekly refund or reimbursement information are required to file Form PT-100-B.

Q: How often should Form PT-100-B be filed?

A: Form PT-100-B should be filed on a weekly basis.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-100-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.