This version of the form is not currently in use and is provided for reference only. Download this version of

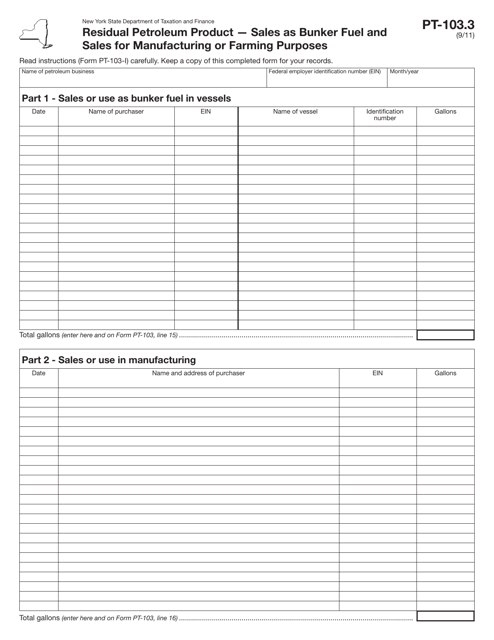

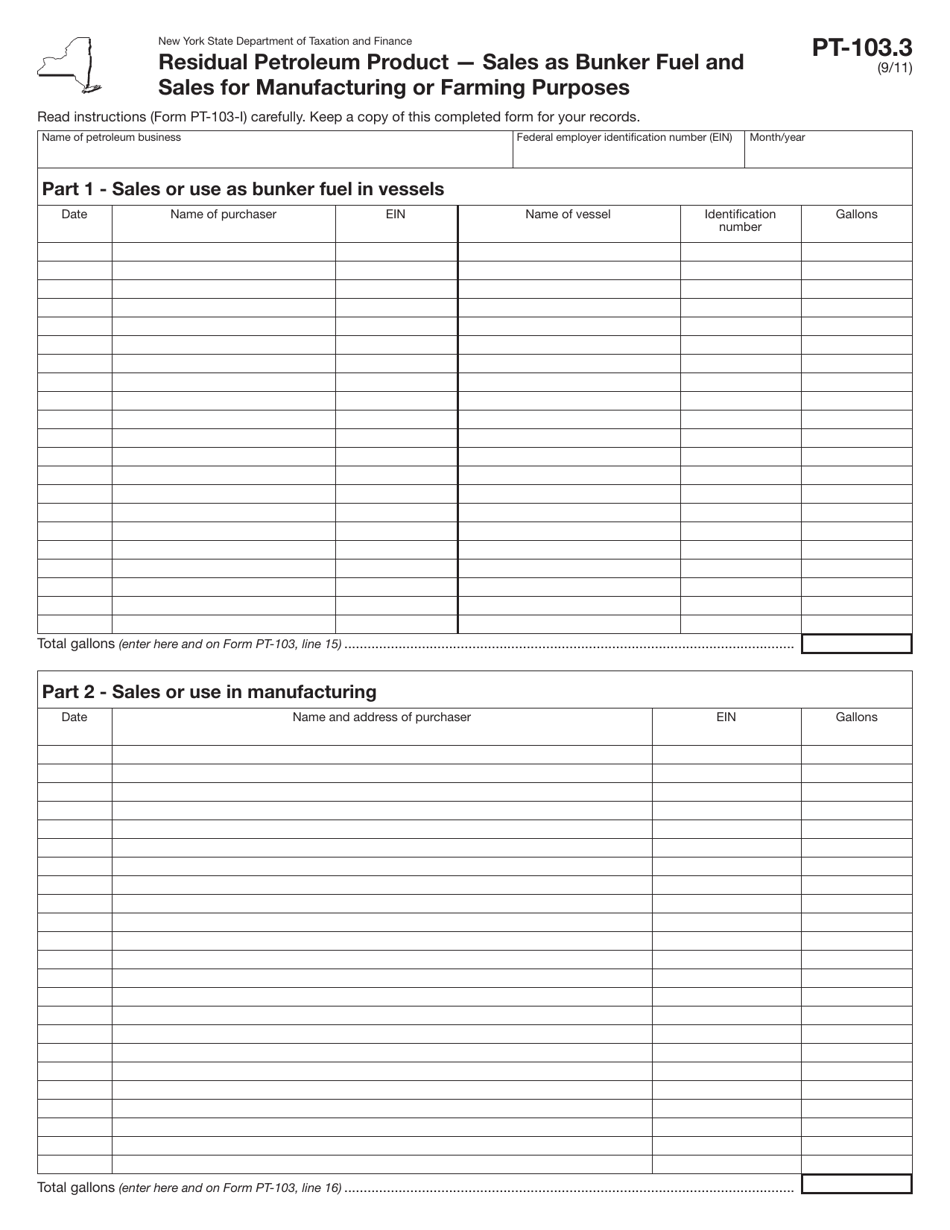

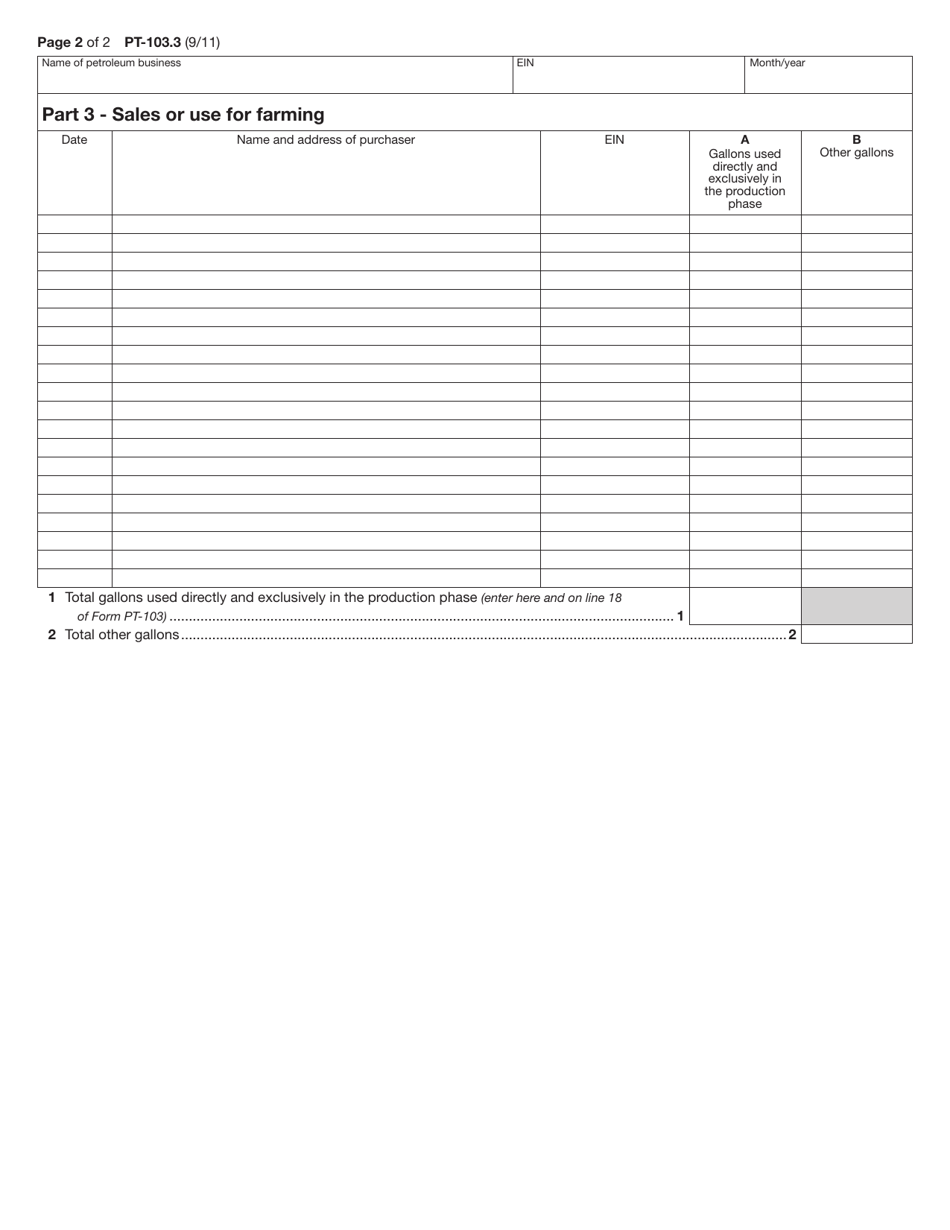

Form PT-103.3

for the current year.

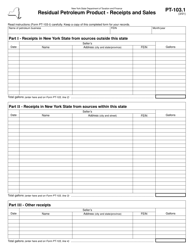

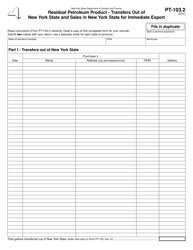

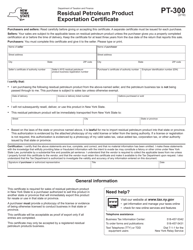

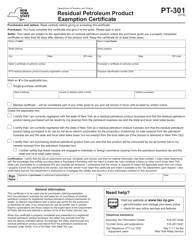

Form PT-103.3 Residual Petroleum Product - Sales as Bunker Fuel and Sales for Manufacturing or Farming Purposes - New York

What Is Form PT-103.3?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PT-103.3?

A: Form PT-103.3 is a tax form used in New York.

Q: What is a Residual Petroleum Product?

A: A Residual Petroleum Product refers to a type of fuel derived from crude oil.

Q: What is considered Sales as Bunker Fuel?

A: Sales of Residual Petroleum Product for use as fuel for ships or vessels is considered Sales as Bunker Fuel.

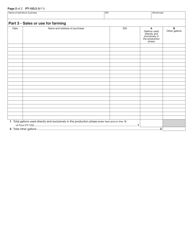

Q: What is considered Sales for Manufacturing or Farming Purposes?

A: Sales of Residual Petroleum Product for use in manufacturing processes or farming activities is considered Sales for Manufacturing or Farming Purposes.

Q: Who needs to file Form PT-103.3?

A: Any business or individual engaged in the sale of Residual Petroleum Product in New York for bunker fuel or manufacturing/farming purposes needs to file Form PT-103.3.

Q: What information is required to be reported on Form PT-103.3?

A: Form PT-103.3 requires the reporting of sales volumes and dollar amounts of Residual Petroleum Product for bunker fuel and manufacturing/farming purposes.

Q: When is Form PT-103.3 due?

A: Form PT-103.3 is typically due on a quarterly basis, with different filing deadlines depending on the reporting period.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-103.3 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.