This version of the form is not currently in use and is provided for reference only. Download this version of

Form PT-202

for the current year.

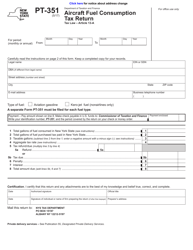

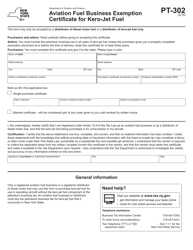

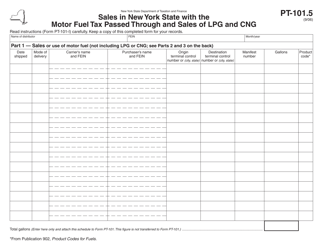

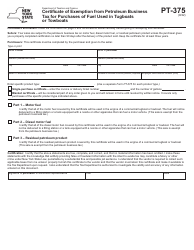

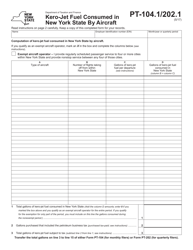

Form PT-202 Tax on Kero-Jet Fuel (Quarterly Filer) - New York

What Is Form PT-202?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

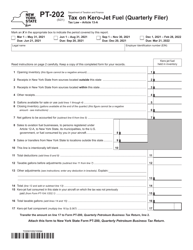

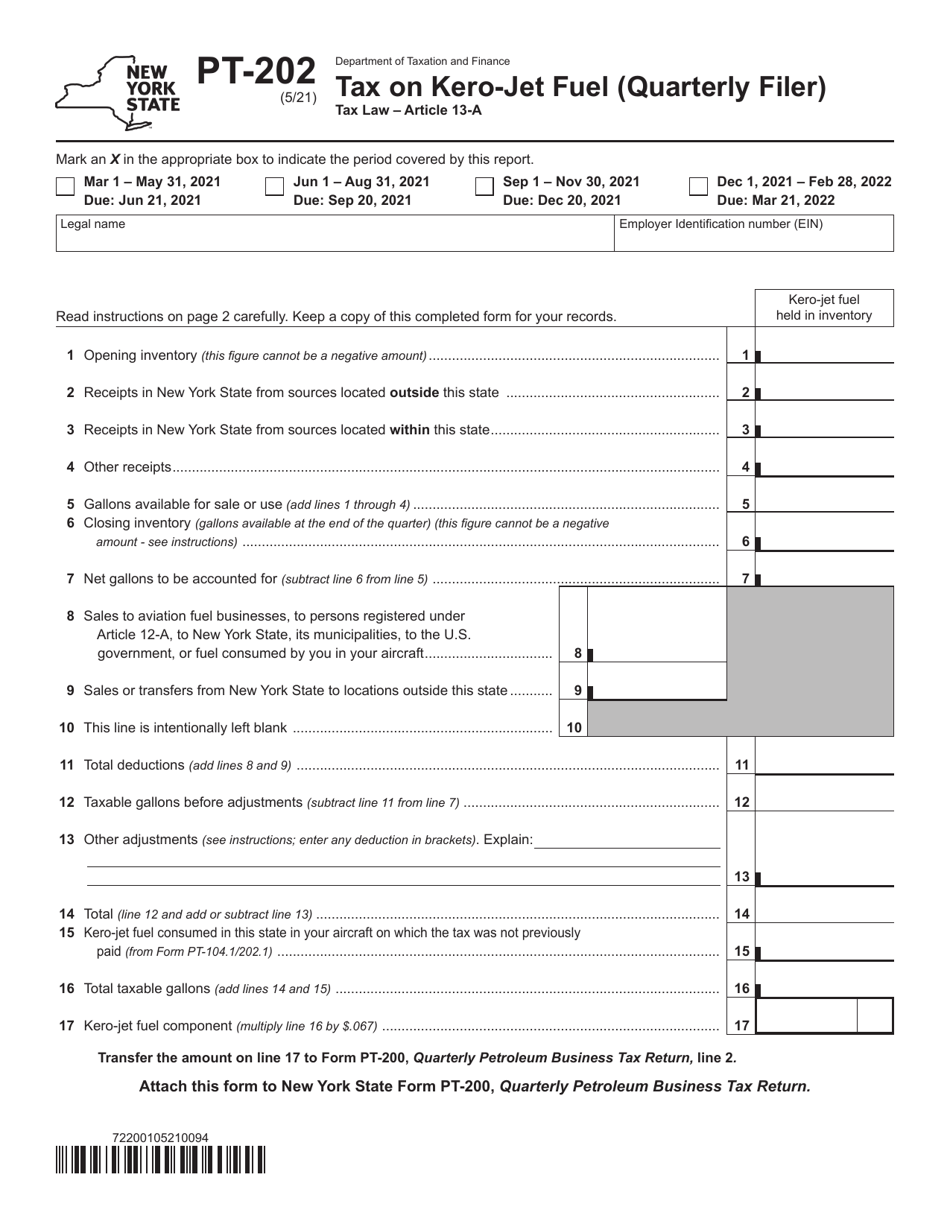

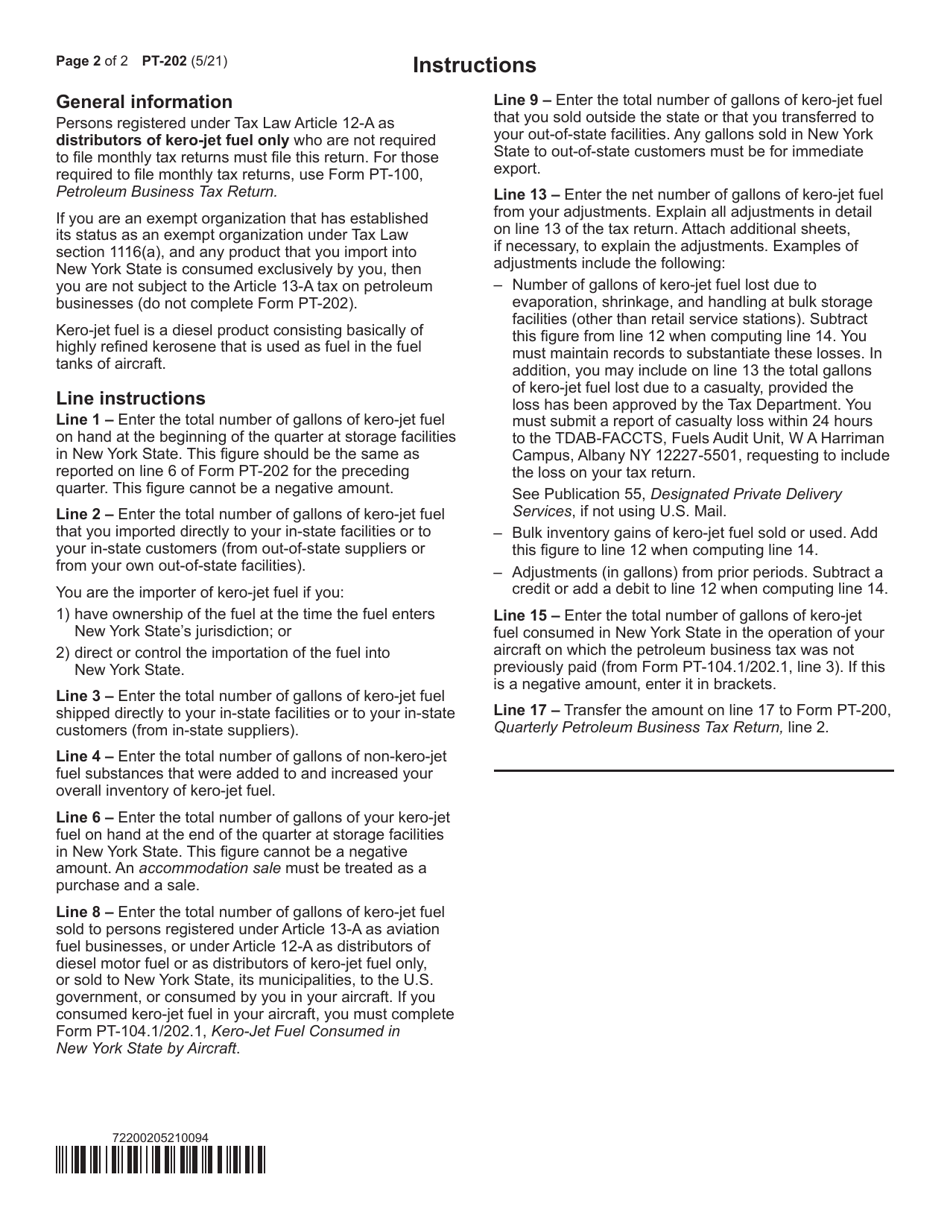

Q: What is Form PT-202?

A: Form PT-202 is a tax form used to report and pay taxes on Kero-Jet Fuel in New York.

Q: Who needs to file Form PT-202?

A: Quarterly filers in New York who handle or purchase Kero-Jet Fuel must file Form PT-202.

Q: When is Form PT-202 due?

A: Form PT-202 is due quarterly, with specific due dates listed on the form.

Q: What taxes are included on Form PT-202?

A: Form PT-202 includes taxes on Kero-Jet Fuel in New York.

Q: Are there any penalties for not filing Form PT-202?

A: Yes, failure to file Form PT-202 or pay the taxes due may result in penalties and interest.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-202 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.