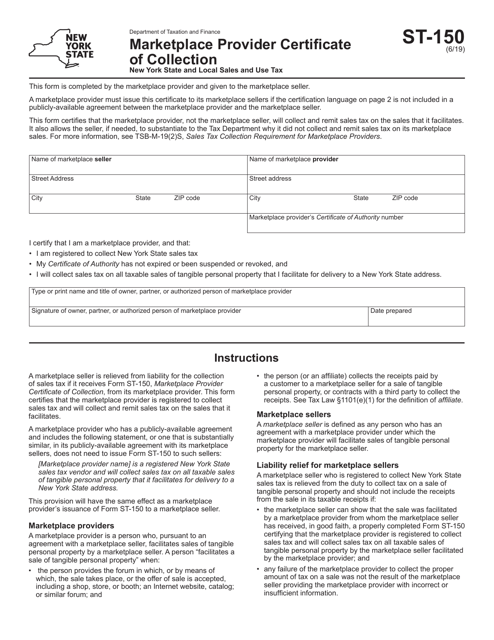

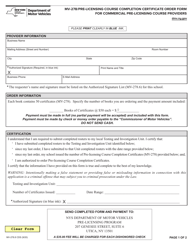

Form ST-150 Marketplace Provider Certificate of Collection - New York

What Is Form ST-150?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-150?

A: Form ST-150 is the Marketplace Provider Certificate of Collection in New York.

Q: Who needs to file Form ST-150?

A: Marketplace providers who are required to collect New York state and local sales tax must file Form ST-150.

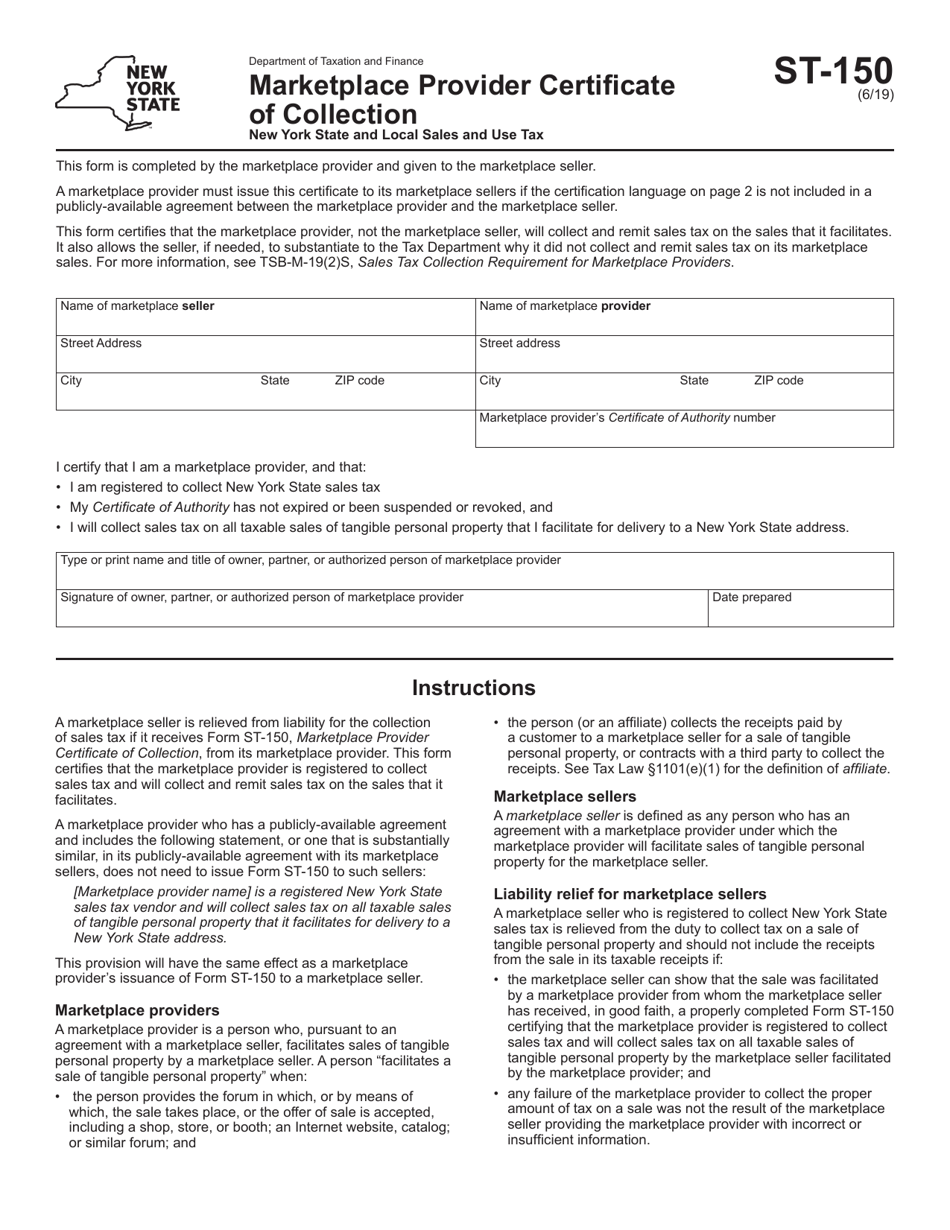

Q: What is a marketplace provider?

A: A marketplace provider is a person or business that facilitates sales between third-party sellers and customers.

Q: What information is required on Form ST-150?

A: Form ST-150 requires information such as the marketplace provider's contact information, sales platform information, and details about the sales made through the marketplace.

Q: How often should Form ST-150 be filed?

A: Form ST-150 should be filed annually.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-150 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.