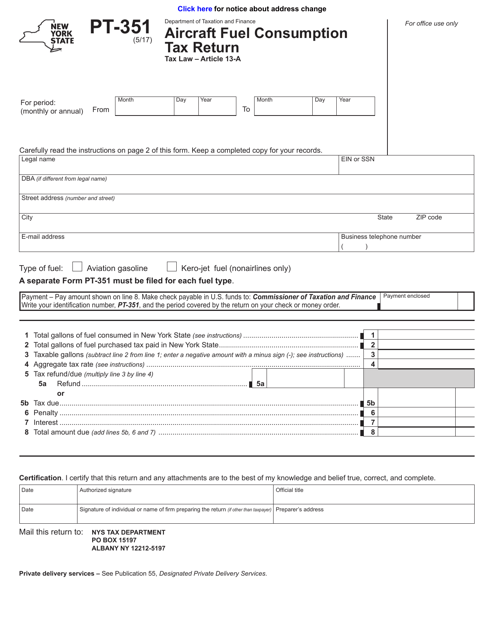

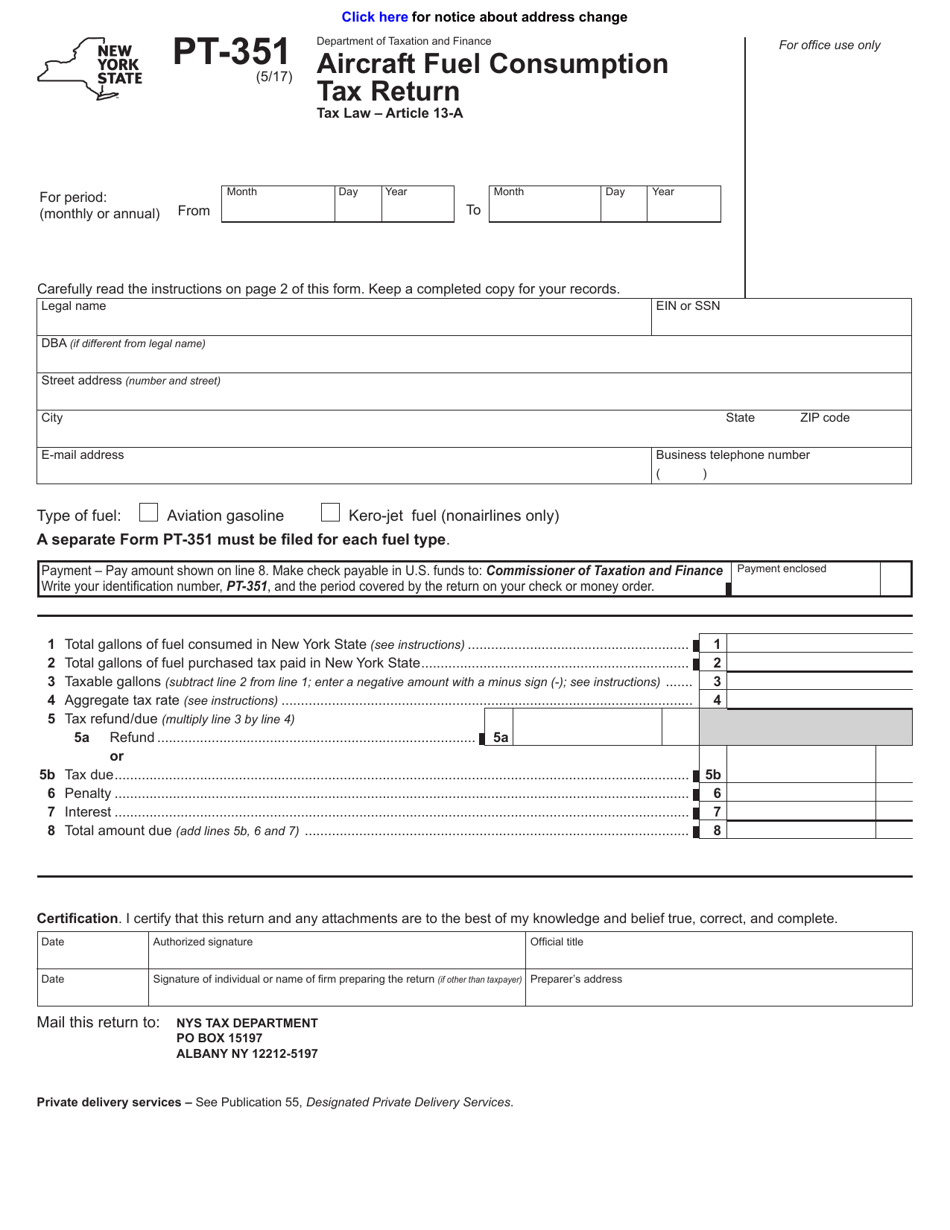

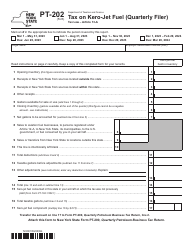

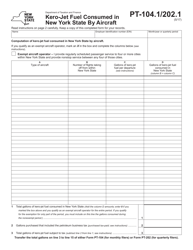

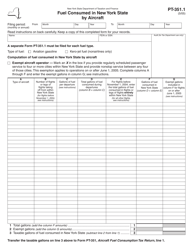

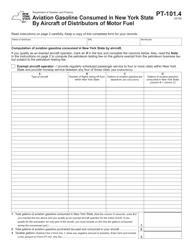

Form PT-351 Aircraft Fuel Consumption Tax Return - New York

What Is Form PT-351?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-351?

A: Form PT-351 is the Aircraft Fuel Consumption Tax Return.

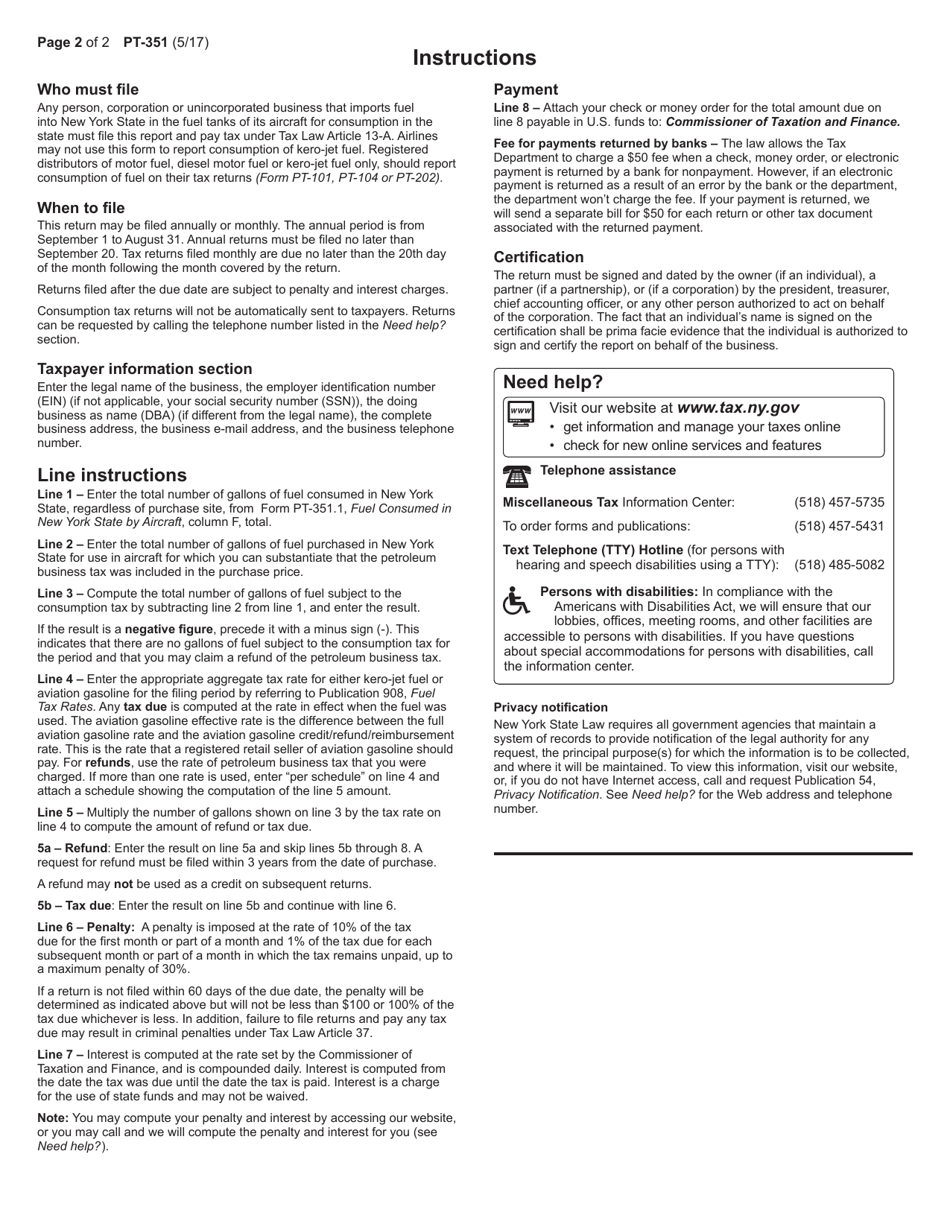

Q: Who needs to file Form PT-351?

A: Anyone in New York who sells or uses aircraft fuel needs to file Form PT-351.

Q: What is the purpose of Form PT-351?

A: Form PT-351 is used to report and pay the aircraft fuel consumption tax in New York.

Q: How often do I need to file Form PT-351?

A: Form PT-351 should be filed on a quarterly basis.

Q: Is there a deadline for filing Form PT-351?

A: Yes, Form PT-351 must be filed by the last day of the month following the end of the quarter.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-351 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.