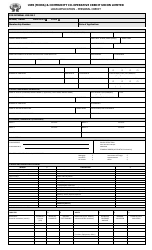

This version of the form is not currently in use and is provided for reference only. Download this version of

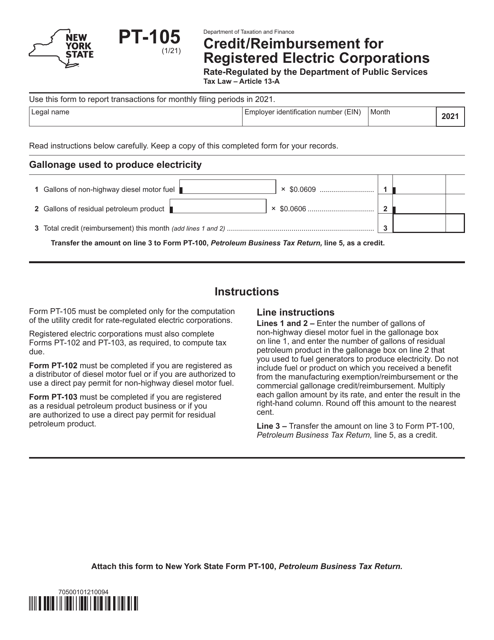

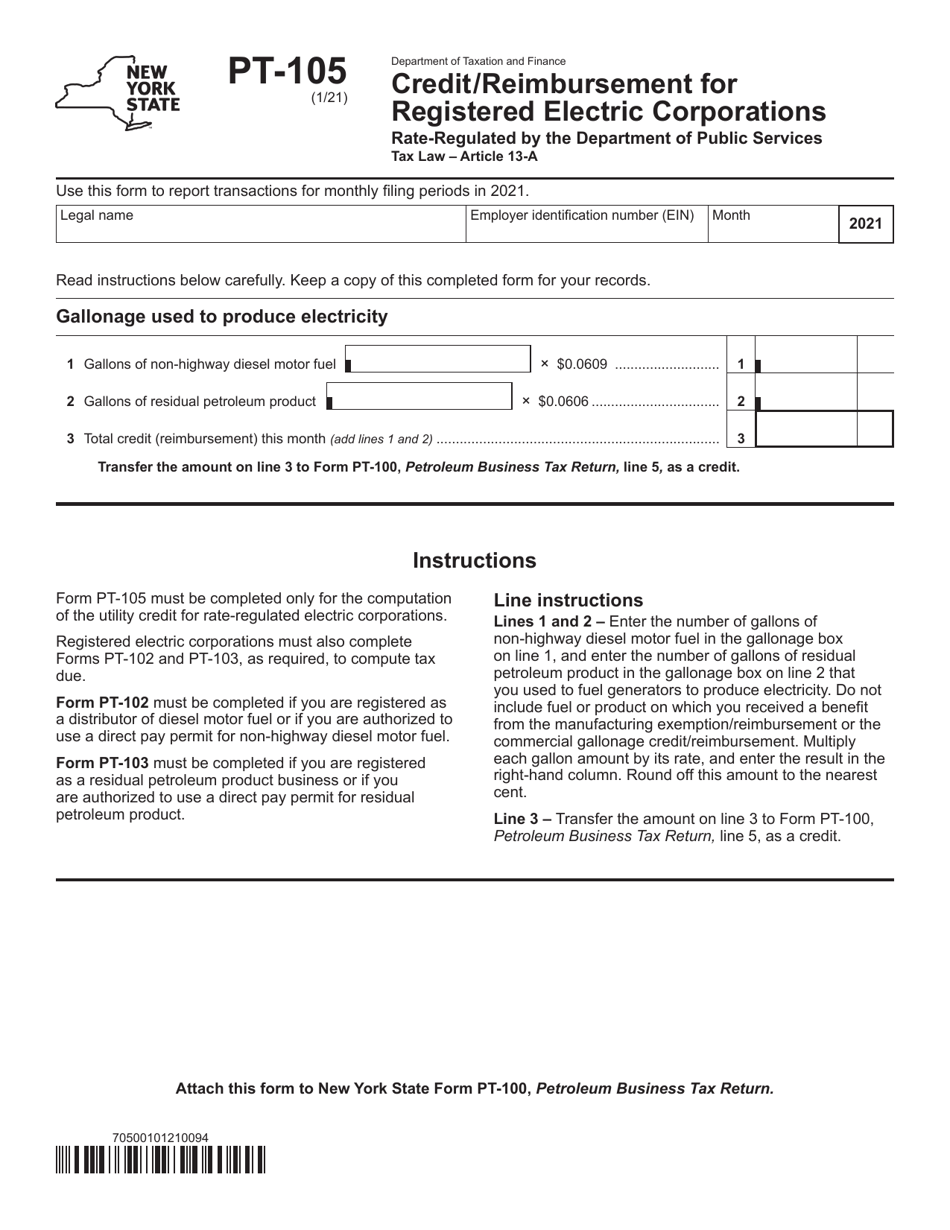

Form PT-105

for the current year.

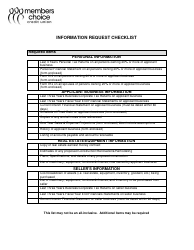

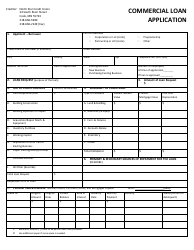

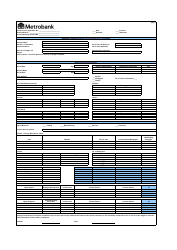

Form PT-105 Credit / Reimbursement for Registered Electric Corporations Rate-Regulated by the Department of Public Services - New York

What Is Form PT-105?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-105?

A: Form PT-105 is a form used for credit/reimbursement for registered electric corporations rate-regulated by the Department of Public Services in New York.

Q: Who uses Form PT-105?

A: Registered electric corporations rate-regulated by the Department of Public Services in New York use Form PT-105.

Q: What is the purpose of Form PT-105?

A: The purpose of Form PT-105 is to apply for credit or reimbursement for registered electric corporations rate-regulated by the Department of Public Services in New York.

Q: Are there any eligibility requirements to use Form PT-105?

A: Yes, you must be a registered electric corporation rate-regulated by the Department of Public Services in New York to use Form PT-105.

Q: Is there a deadline for submitting Form PT-105?

A: Yes, Form PT-105 must be filed by the due date specified by the Department of Public Services in New York.

Q: What information is required on Form PT-105?

A: Form PT-105 requires information such as company details, credits being claimed, and supporting documentation.

Q: Is there a fee for filing Form PT-105?

A: There is no fee for filing Form PT-105.

Q: Who should I contact for more information about Form PT-105?

A: You can contact the Department of Public Services in New York for more information about Form PT-105.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-105 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.