This version of the form is not currently in use and is provided for reference only. Download this version of

Form PT-104

for the current year.

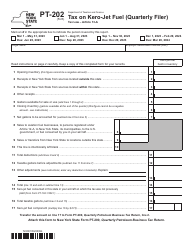

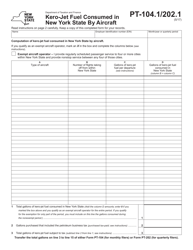

Form PT-104 Tax on Kero-Jet Fuel - New York

What Is Form PT-104?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

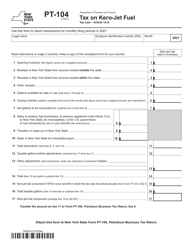

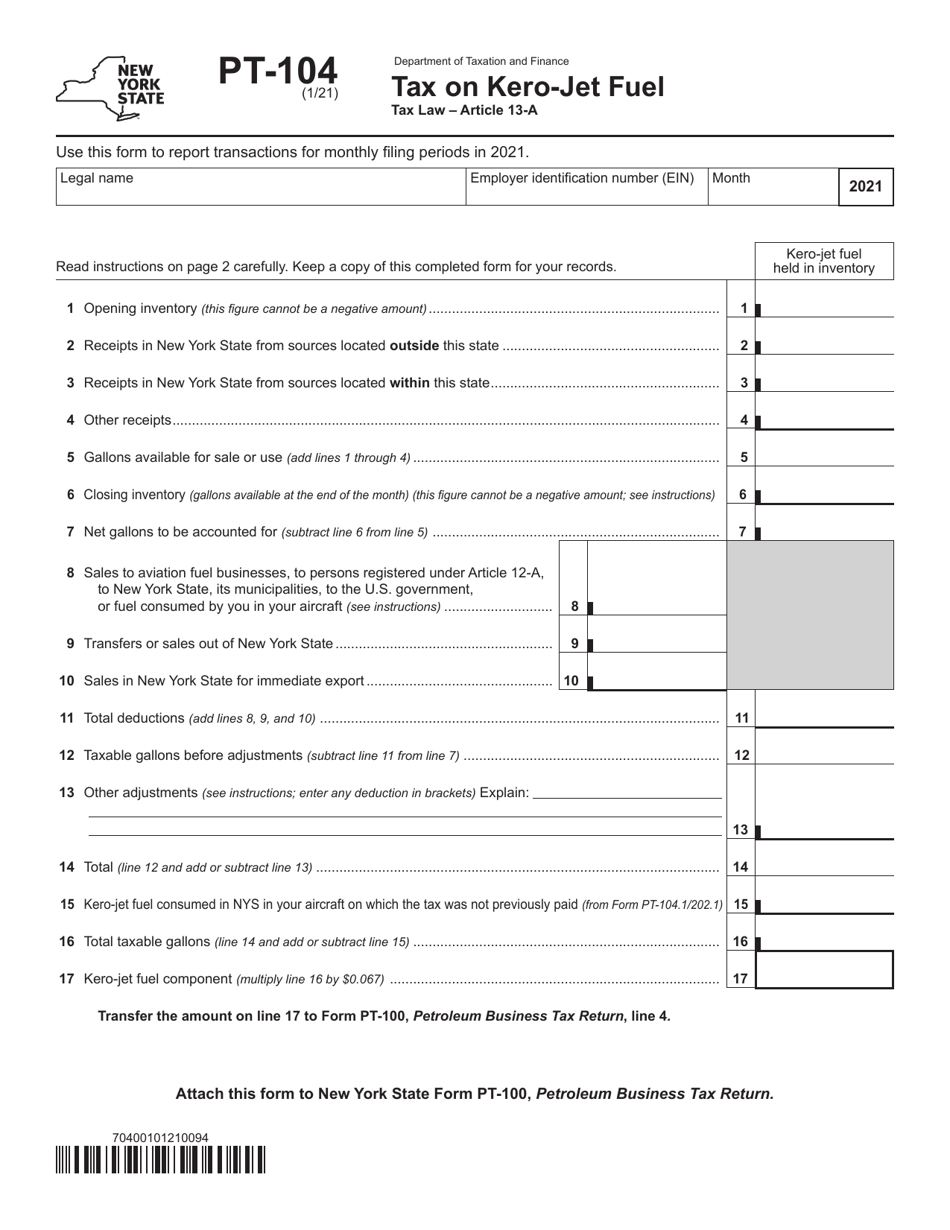

Q: What is Form PT-104?

A: Form PT-104 is a tax form used in New York to report and pay taxes on Kero-Jet Fuel.

Q: Who needs to file Form PT-104?

A: Anyone who sells or uses Kero-Jet Fuel in New York is required to file Form PT-104.

Q: What is the purpose of Form PT-104?

A: The purpose of Form PT-104 is to calculate and remit the tax owed on Kero-Jet Fuel sales and usage in New York.

Q: How often do I need to file Form PT-104?

A: Form PT-104 is filed on a quarterly basis. It is due on the last day of the month following the end of the quarter.

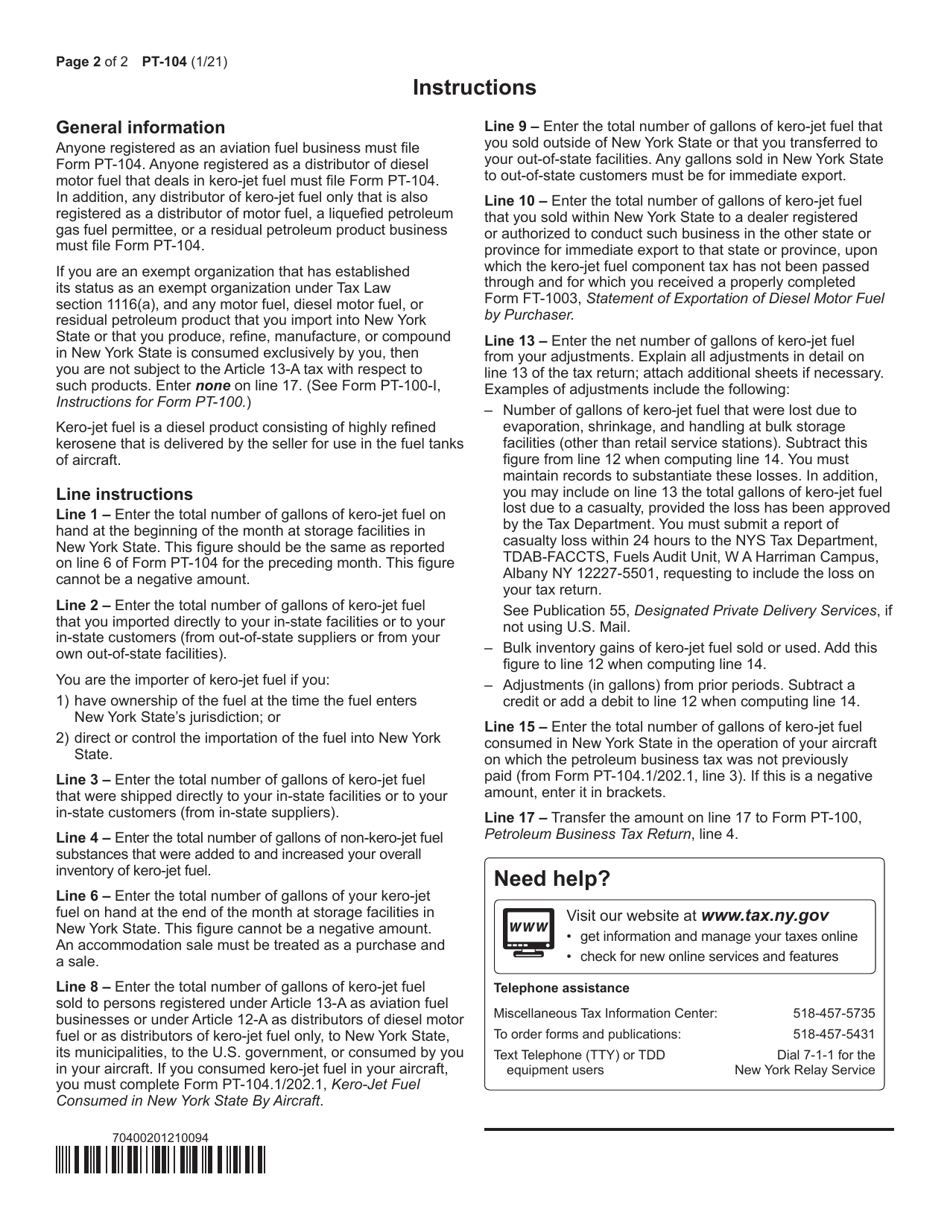

Q: Are there any exemptions or deductions available for Kero-Jet Fuel tax?

A: Yes, there are certain exemptions and deductions available for Kero-Jet Fuel tax in New York. You should consult the instructions for Form PT-104 for more information.

Q: What happens if I fail to file Form PT-104 or pay the tax?

A: Failure to file Form PT-104 or pay the tax can result in penalties and interest charges. It is important to comply with the filing and payment obligations to avoid these consequences.

Q: Can I file Form PT-104 electronically?

A: Yes, the New York State Department of Taxation and Finance provides an electronic filing option for Form PT-104.

Q: Can I request an extension to file Form PT-104?

A: Yes, you can request an extension to file Form PT-104. The request must be made before the original due date of the form.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-104 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.