This version of the form is not currently in use and is provided for reference only. Download this version of

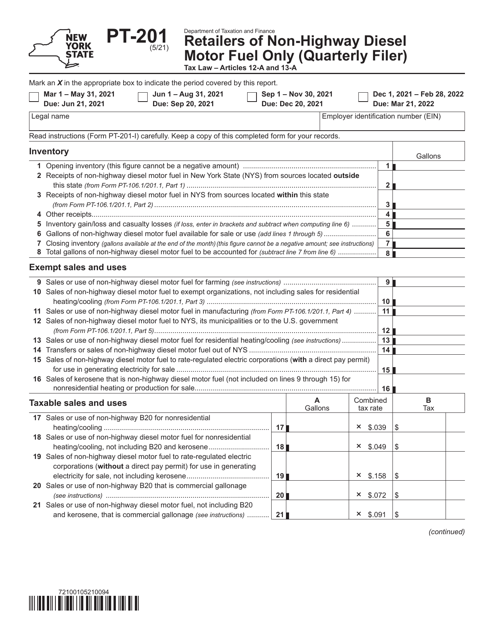

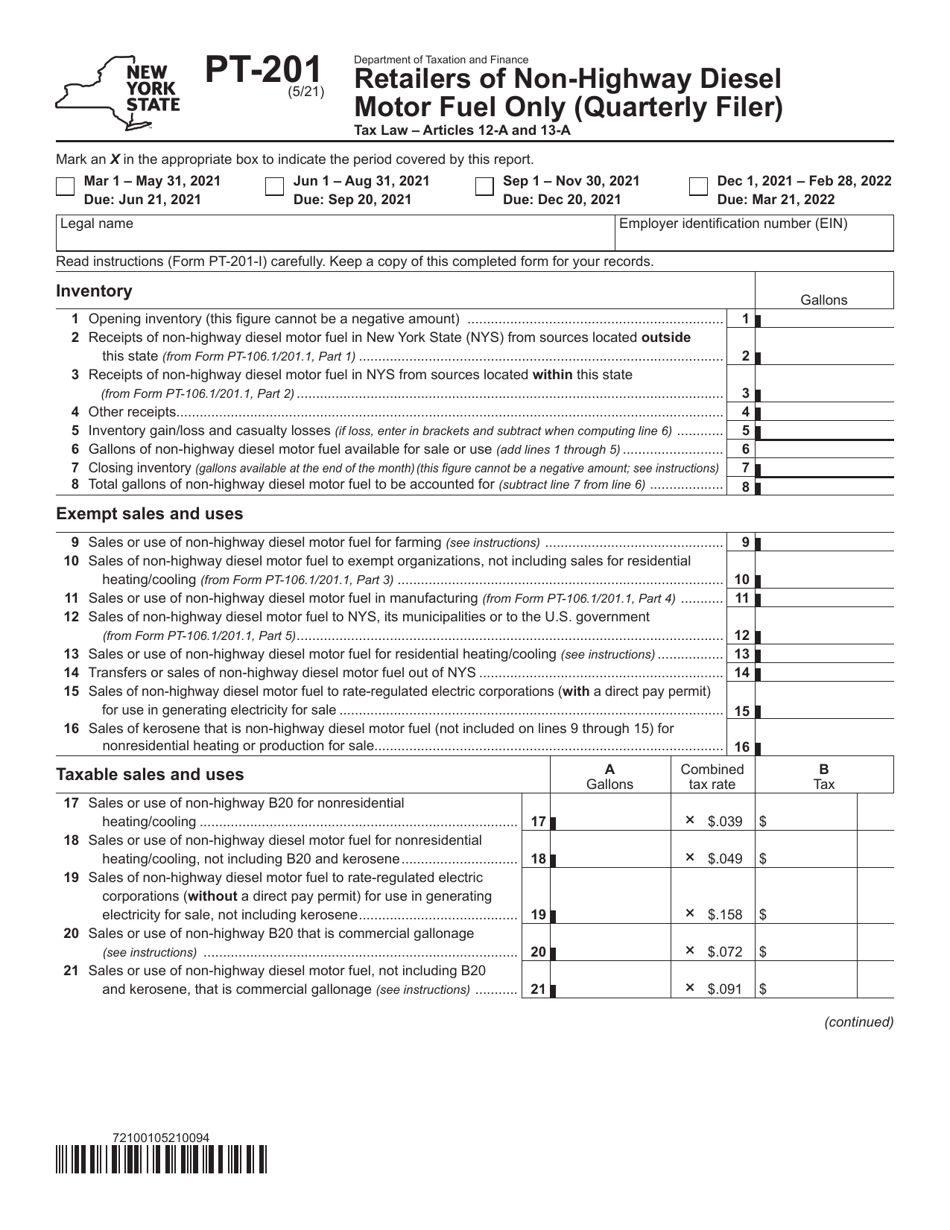

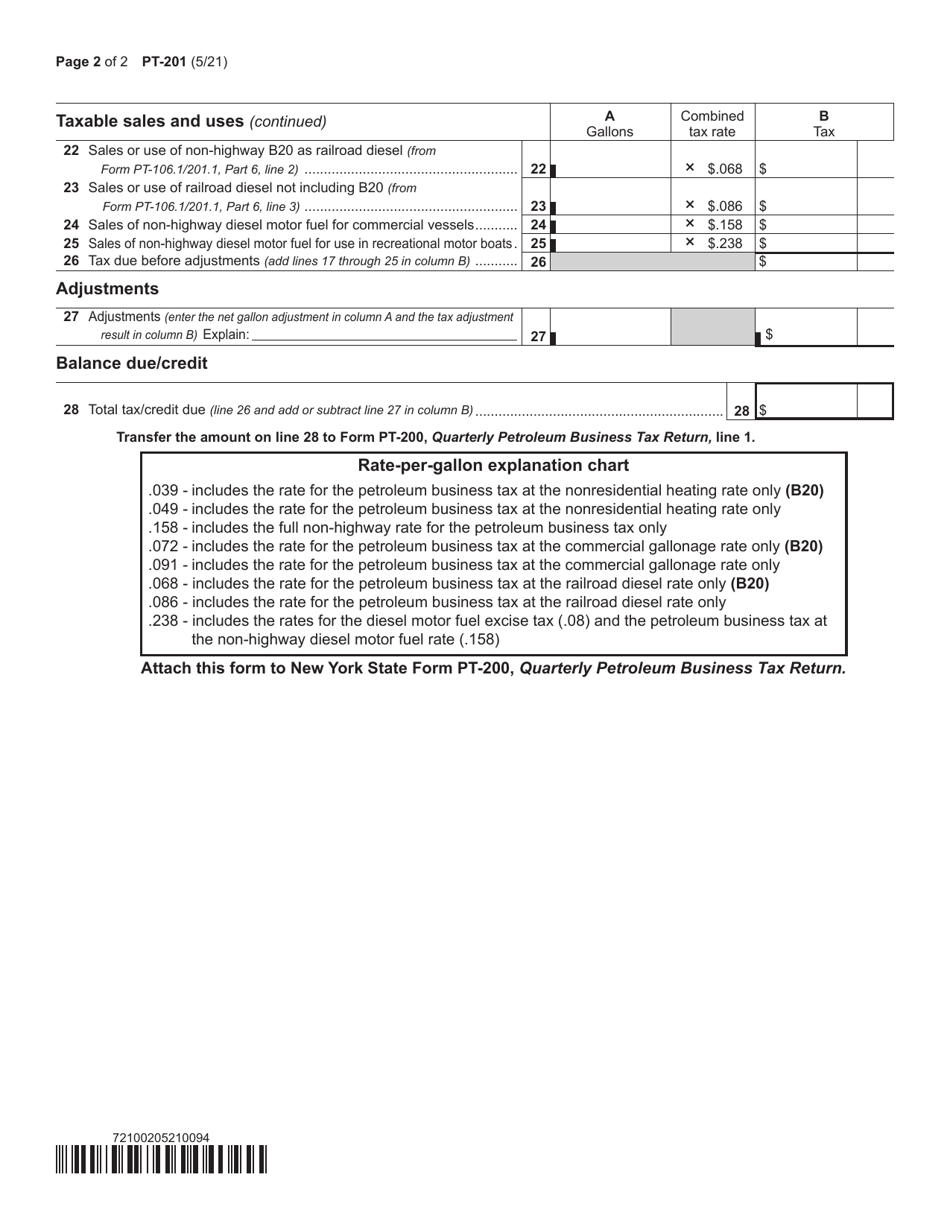

Form PT-201

for the current year.

Form PT-201 Retailers of Non-highway Diesel Motor Fuel Only (Quarterly Filer) - New York

What Is Form PT-201?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PT-201?

A: Form PT-201 is a tax form for retailers of non-highway diesel motor fuel in New York.

Q: Who needs to file Form PT-201?

A: Retailers of non-highway diesel motor fuel in New York who are classified as quarterly filers.

Q: What is non-highway diesel motor fuel?

A: Non-highway diesel motor fuel refers to diesel fuel used for off-road purposes, such as in construction equipment or agricultural machinery.

Q: What is the filing frequency for Form PT-201?

A: Form PT-201 is filed on a quarterly basis.

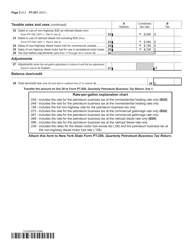

Q: What information do you need to provide on Form PT-201?

A: You will need to provide information about the quantity of non-highway diesel motor fuel sold, and the taxes due on those sales.

Q: Are there any penalties for not filing Form PT-201?

A: Yes, failure to file or late filing can result in penalties and interest charges.

Q: Is there a deadline for filing Form PT-201?

A: Yes, Form PT-201 must be filed by the due date specified by the tax authorities, which is typically the last day of the month following the end of the quarter.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-201 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.