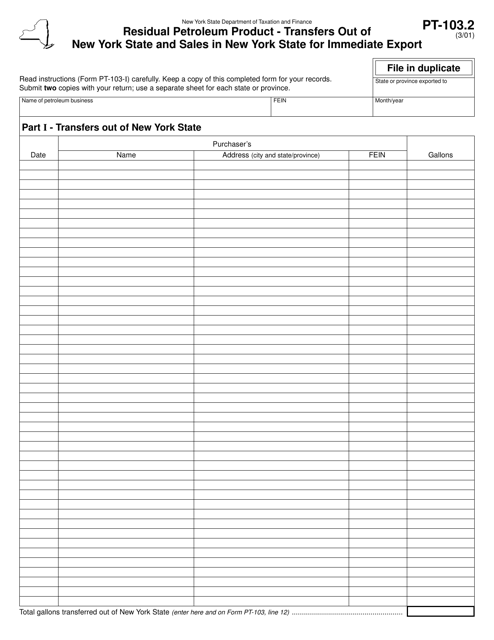

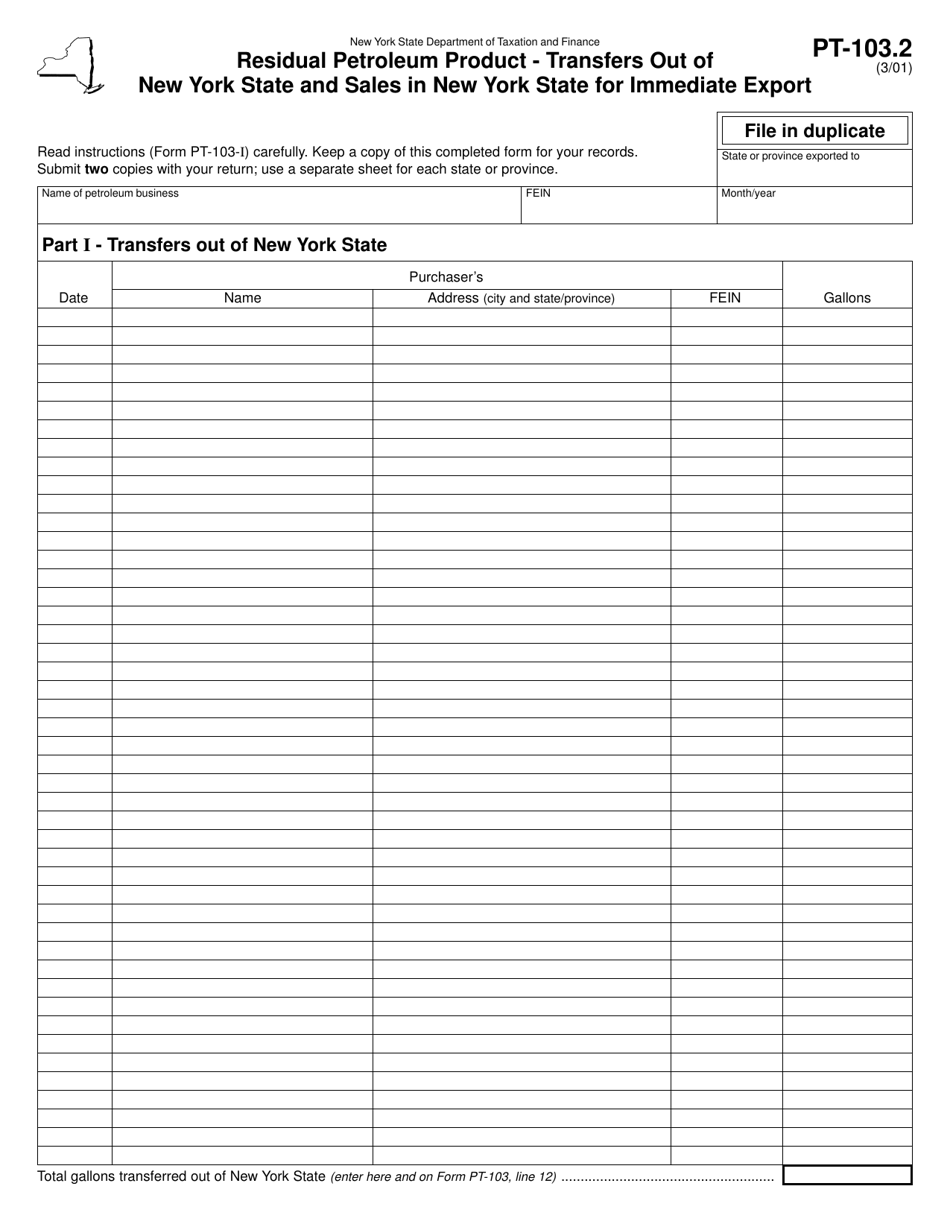

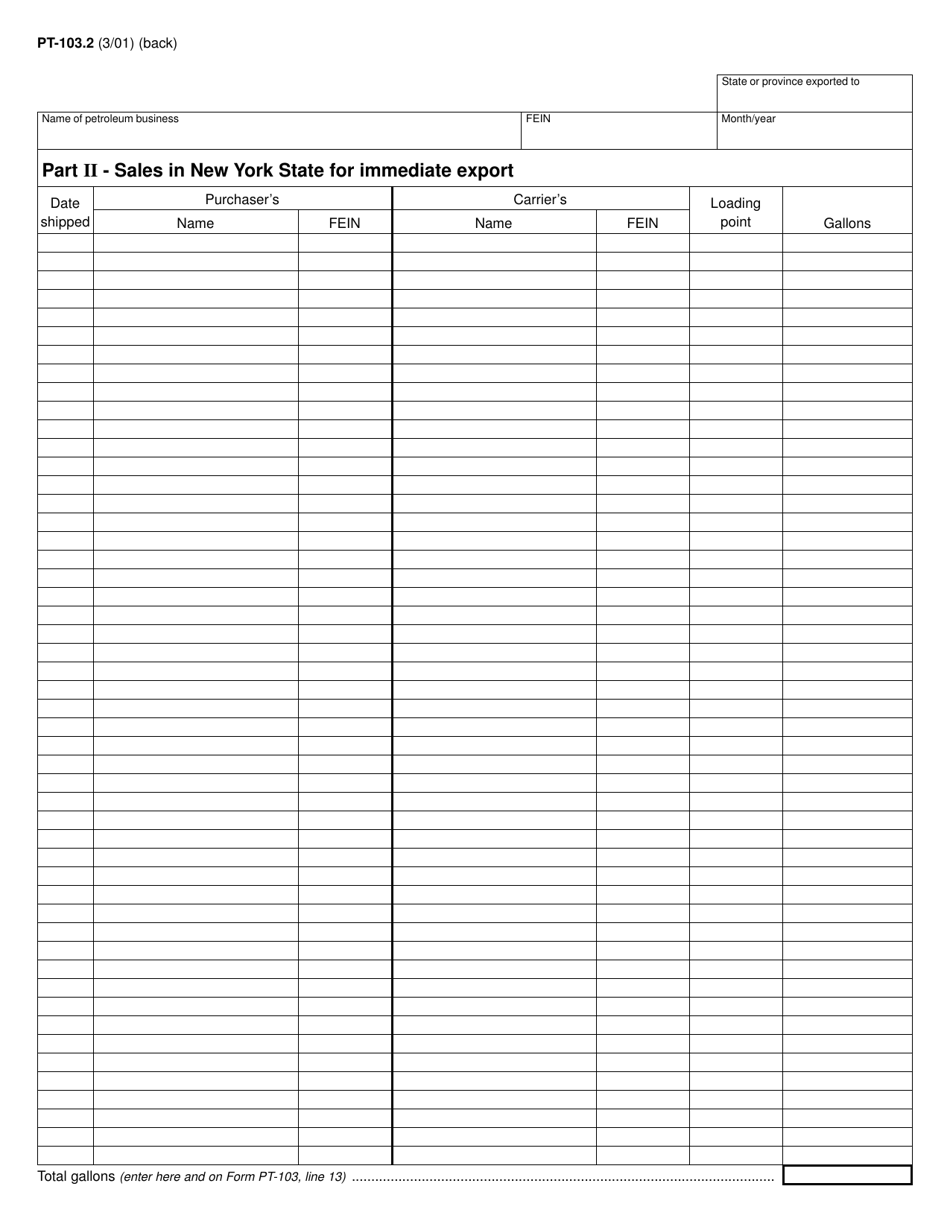

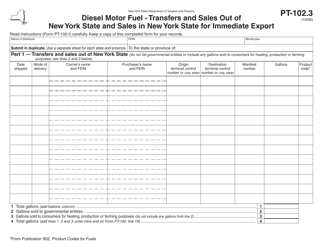

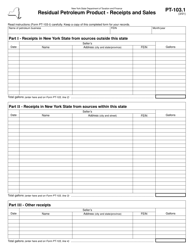

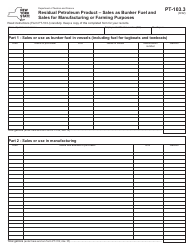

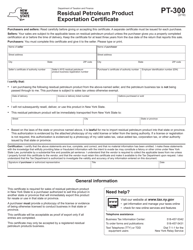

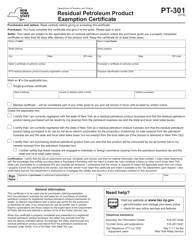

Form PT-103.2 Residual Petroleum Product - Transfers out of New York State and Sales in New York State for Immediate Export - New York

What Is Form PT-103.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PT-103.2?

A: Form PT-103.2 is a form related to the transfer and sale of residual petroleum products.

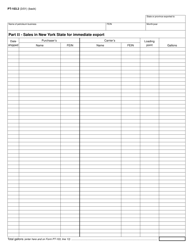

Q: What does Form PT-103.2 cover?

A: Form PT-103.2 covers transfers out of New York State and sales in New York State for immediate export.

Q: Who needs to file Form PT-103.2?

A: Anyone involved in the transfer and sale of residual petroleum products in New York State for immediate export needs to file Form PT-103.2.

Q: What is considered a residual petroleum product?

A: Residual petroleum products include substances such as fuel oil, residual fuel, and other similar products.

Q: What is the purpose of Form PT-103.2?

A: The purpose of Form PT-103.2 is to track and document the transfer and sale of residual petroleum products for immediate export in New York State.

Form Details:

- Released on March 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-103.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.