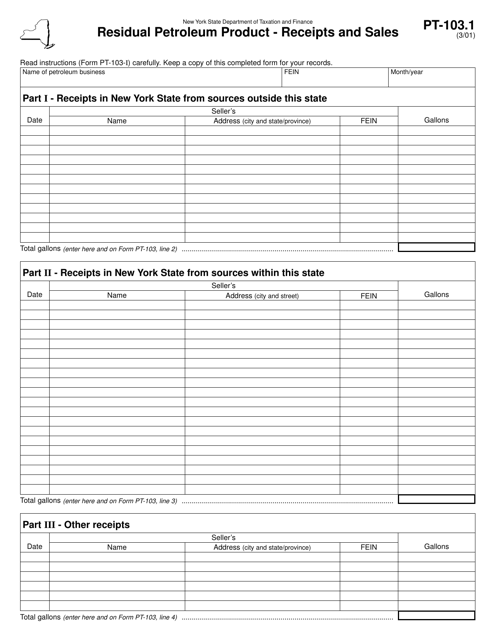

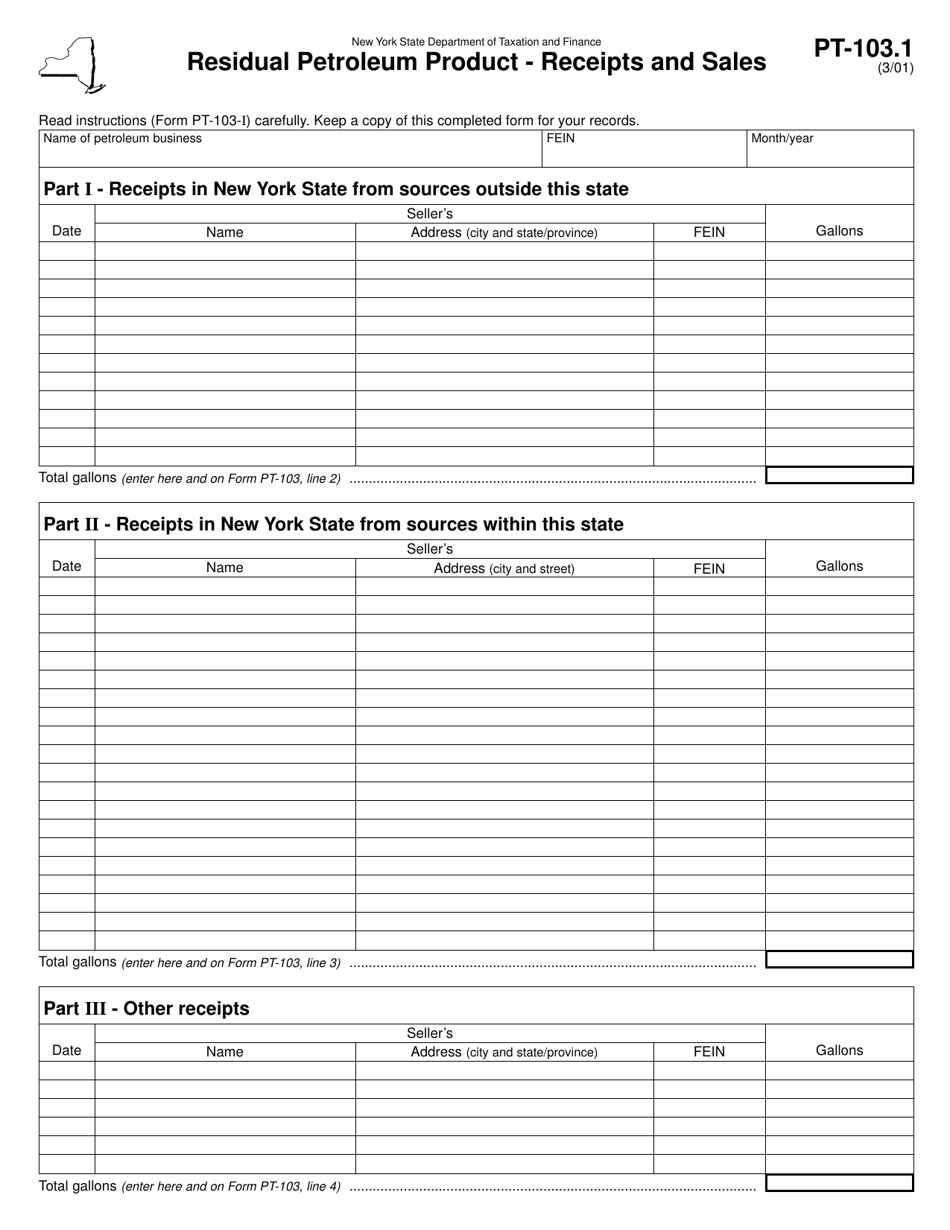

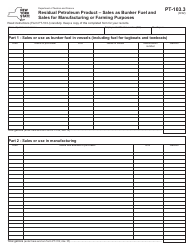

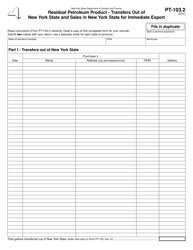

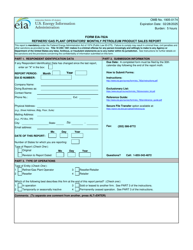

Form PT-103.1 Residual Petroleum Product - Receipts and Sales - New York

What Is Form PT-103.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PT-103.1?

A: Form PT-103.1 is a document related to the reporting of Residual Petroleum Product - Receipts and Sales in New York.

Q: What is Residual Petroleum Product?

A: Residual Petroleum Product refers to the byproducts of the refining process of crude oil, such as asphalt, residual fuel oil, and petroleum coke.

Q: What is the purpose of Form PT-103.1?

A: The purpose of Form PT-103.1 is to report the receipts and sales of Residual Petroleum Products in New York.

Q: Who needs to file Form PT-103.1?

A: Businesses involved in the import, production, and distribution of Residual Petroleum Products in New York need to file Form PT-103.1.

Q: Are there any deadlines for filing Form PT-103.1?

A: Yes, the deadlines for filing Form PT-103.1 vary depending on the reporting period. It is important to check the instructions provided with the form for specific deadlines.

Form Details:

- Released on March 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-103.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.