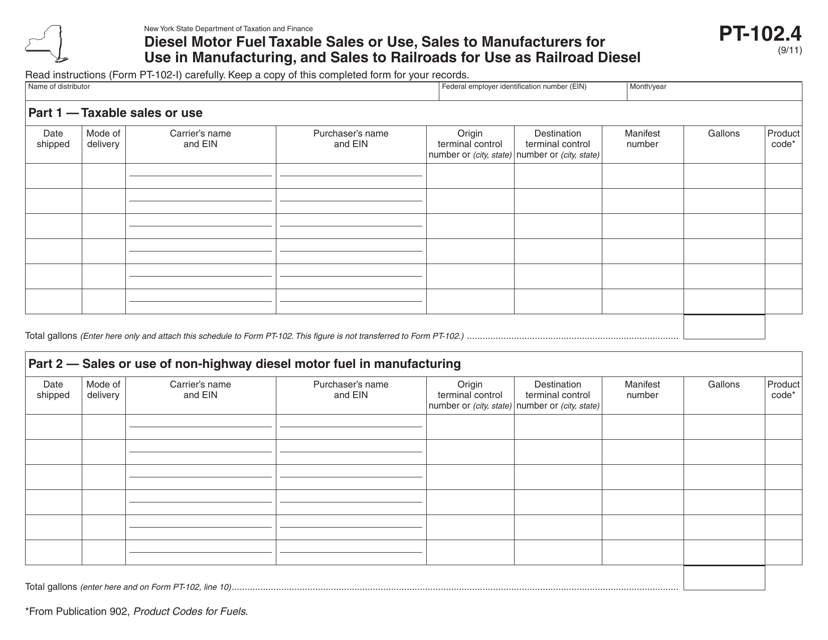

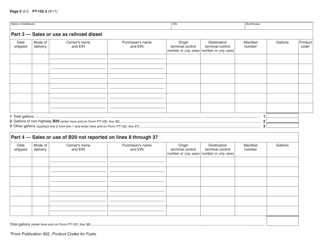

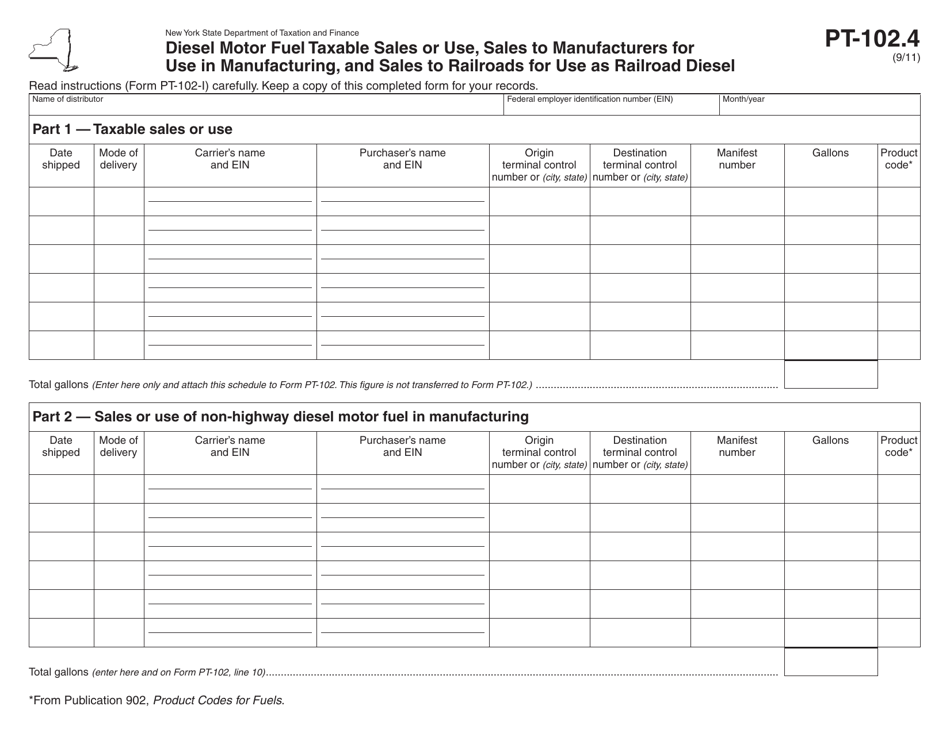

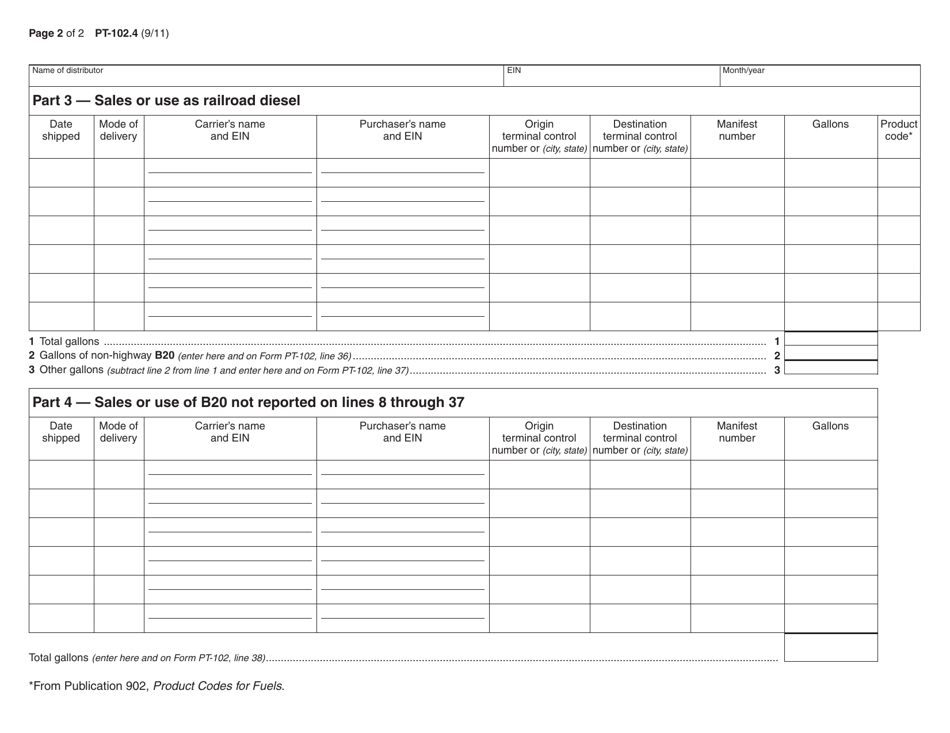

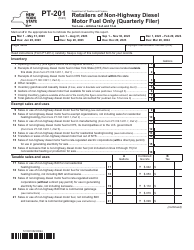

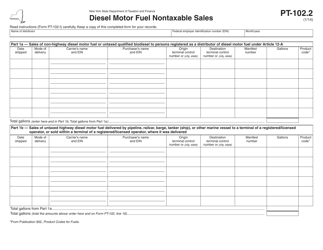

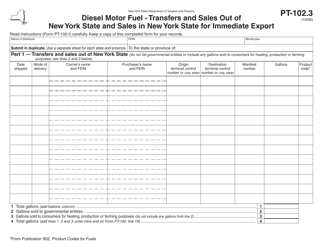

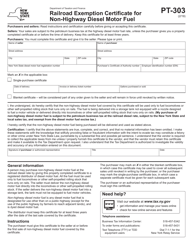

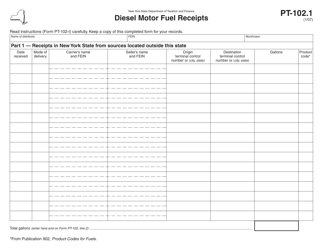

Form PT-102.4 Diesel Motor Fuel Taxable Sales or Use, Sales to Manufacturers for Use in Manufacturing, and Sales to Railroads for Use as Railroad Diesel - New York

What Is Form PT-102.4?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-102.4?

A: Form PT-102.4 is a tax form used in New York for reporting diesel motor fueltaxable sales or use, sales to manufacturers for use in manufacturing, and sales to railroads for use as railroad diesel.

Q: What is diesel motor fuel?

A: Diesel motor fuel refers to the fuel used in diesel engines for vehicles or machinery.

Q: Who needs to file Form PT-102.4?

A: Businesses and individuals in New York who sell or use diesel motor fuel, sell to manufacturers for use in manufacturing, or sell to railroads for use as railroad diesel need to file Form PT-102.4.

Q: What information is required on Form PT-102.4?

A: Form PT-102.4 requires information such as the seller's name and address, purchaser's name and address, quantity of fuel sold, purpose of the sale or use, and more.

Q: When is Form PT-102.4 due?

A: Form PT-102.4 is due on a quarterly basis, with specific due dates depending on the reporting period. It is important to refer to the instructions provided with the form to determine the exact due dates.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-102.4 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.