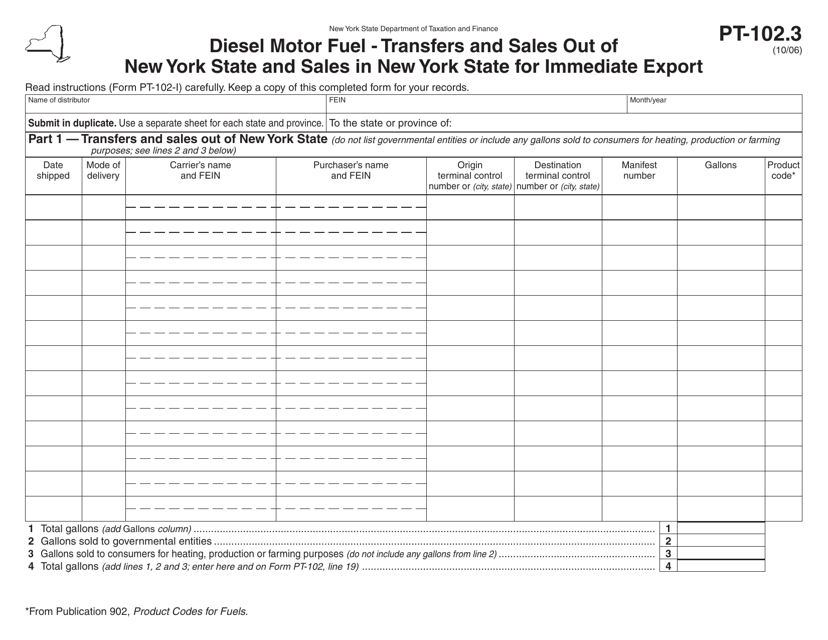

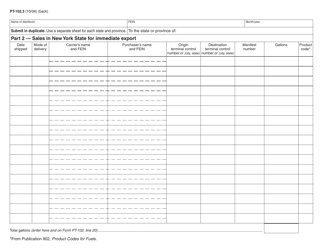

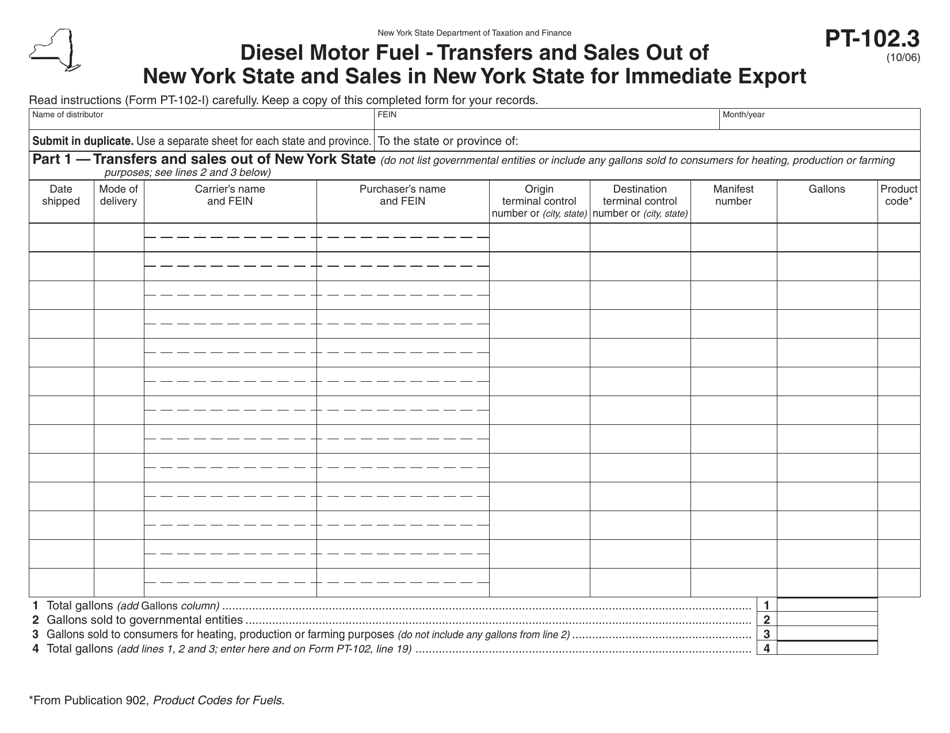

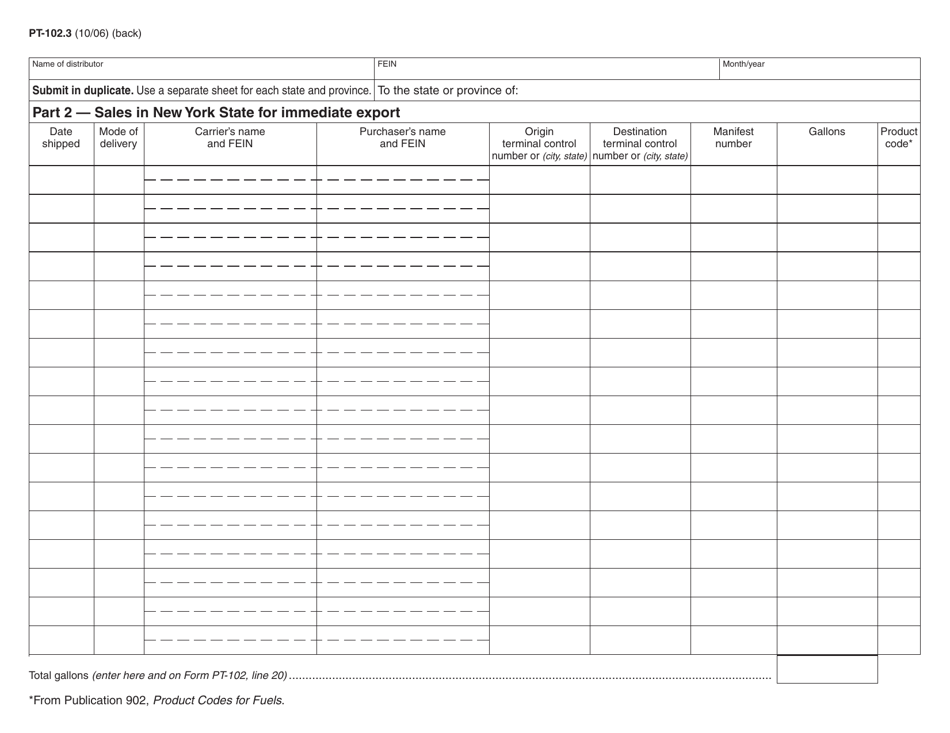

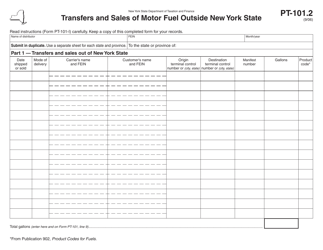

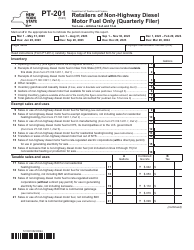

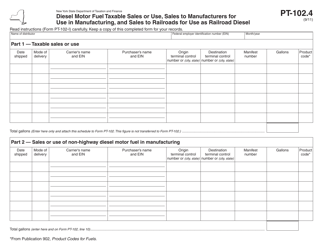

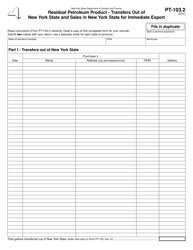

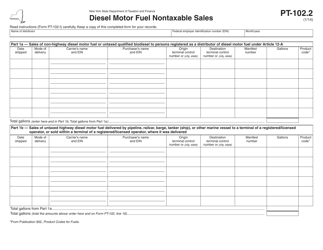

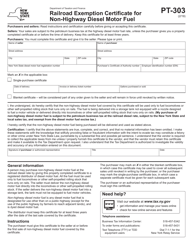

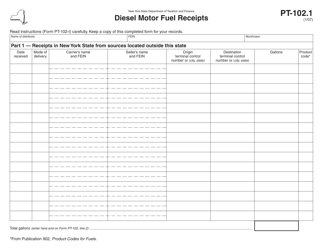

Form PT-102.3 Diesel Motor Fuel - Transfers and Sales out of New York State and Sales in New York State for Immediate Export - New York

What Is Form PT-102.3?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-102.3?

A: Form PT-102.3 is a form for reporting diesel motor fuel transfers and sales in and out of New York State.

Q: What does the form cover?

A: The form covers diesel motor fuel transfers and sales out of New York State and sales in New York State for immediate export.

Q: Who needs to file Form PT-102.3?

A: Anyone involved in the transfer or sale of diesel motor fuel in or out of New York State for immediate export needs to file Form PT-102.3.

Q: When is Form PT-102.3 due?

A: Form PT-102.3 is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for not filing Form PT-102.3?

A: Yes, failure to file Form PT-102.3 or filing it late can result in penalties and interest charges.

Q: Can I file Form PT-102.3 electronically?

A: Yes, the New York State Department of Taxation and Finance provides an electronic filing option for Form PT-102.3.

Q: Who can I contact for more information about Form PT-102.3?

A: You can contact the New York State Department of Taxation and Finance directly for more information about Form PT-102.3.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-102.3 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.