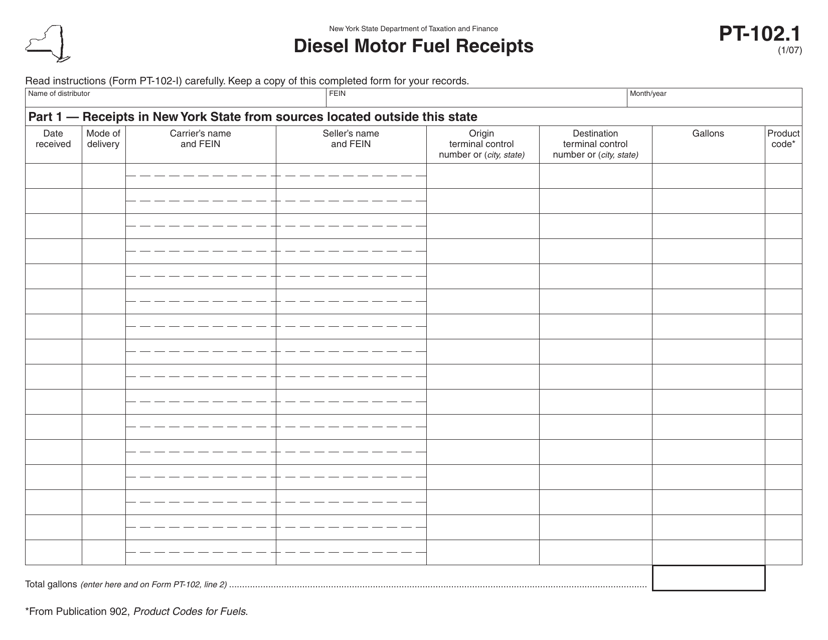

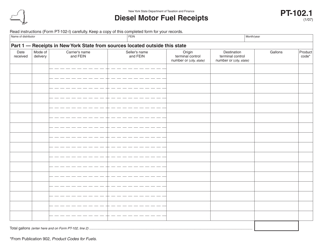

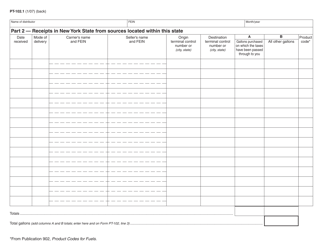

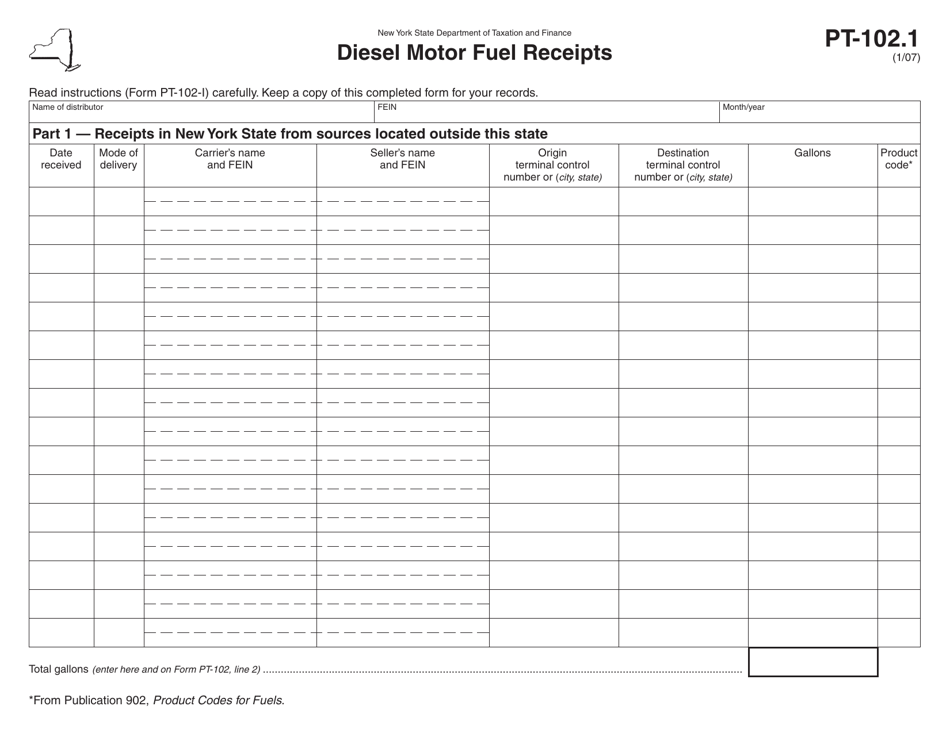

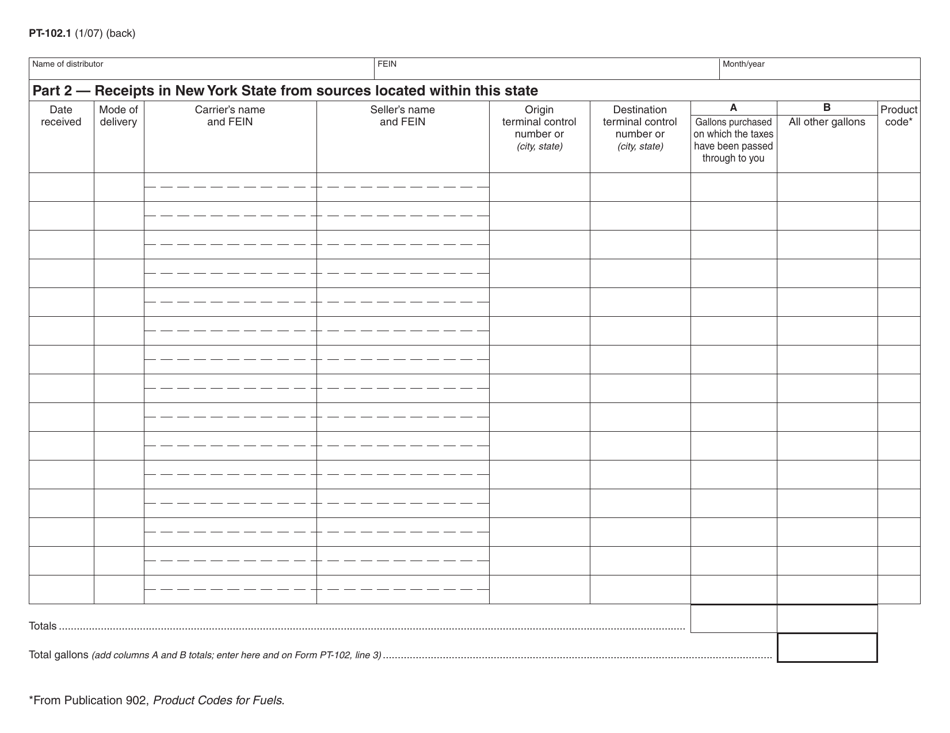

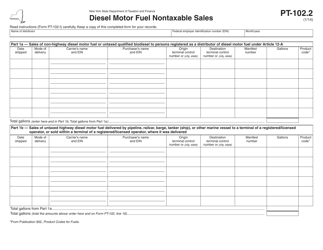

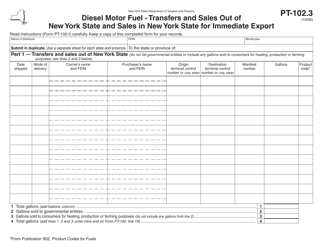

Form PT-102.1 Diesel Motor Fuel Receipts - New York

What Is Form PT-102.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-102.1?

A: Form PT-102.1 is a specific form for reporting diesel motor fuel receipts in New York.

Q: Who needs to file Form PT-102.1?

A: Anyone who sells or uses diesel motor fuel in New York may need to file Form PT-102.1.

Q: What information is required on Form PT-102.1?

A: Form PT-102.1 requires details such as the quantity of diesel motor fuel received, the supplier's name, and the date of each receipt.

Q: When is the deadline for filing Form PT-102.1?

A: The deadline for filing Form PT-102.1 typically depends on the reporting period, which is usually quarterly.

Q: Are there any penalties for late filing of Form PT-102.1?

A: Yes, there may be penalties for late filing of Form PT-102.1, so it is important to submit it on time.

Q: Is there a fee for filing Form PT-102.1?

A: No, there is no fee for filing Form PT-102.1.

Q: Do I need to keep a copy of Form PT-102.1 for my records?

A: Yes, it is recommended to keep a copy of Form PT-102.1 for your records in case of future audits or inquiries.

Q: Who can I contact for assistance or further information regarding Form PT-102.1?

A: You can contact the New York State Department of Taxation and Finance for assistance or further information regarding Form PT-102.1.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-102.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.