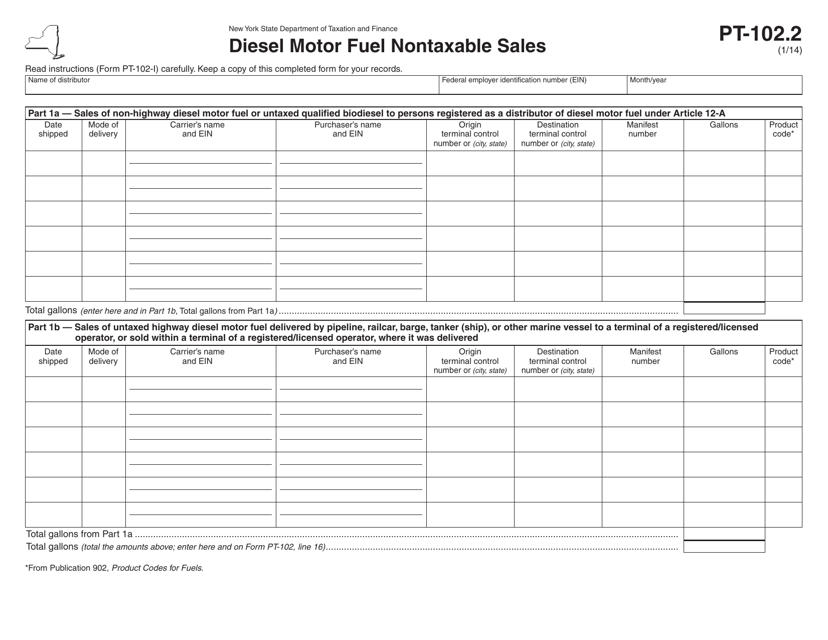

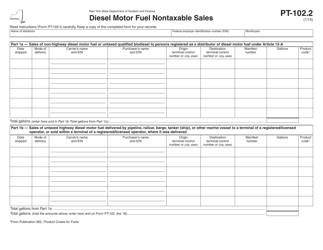

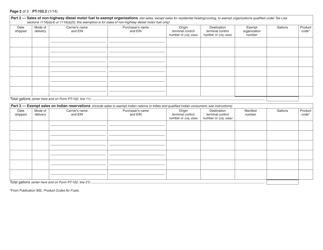

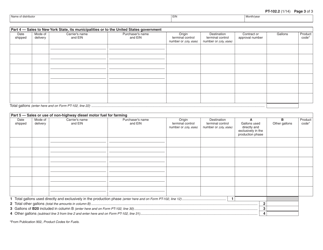

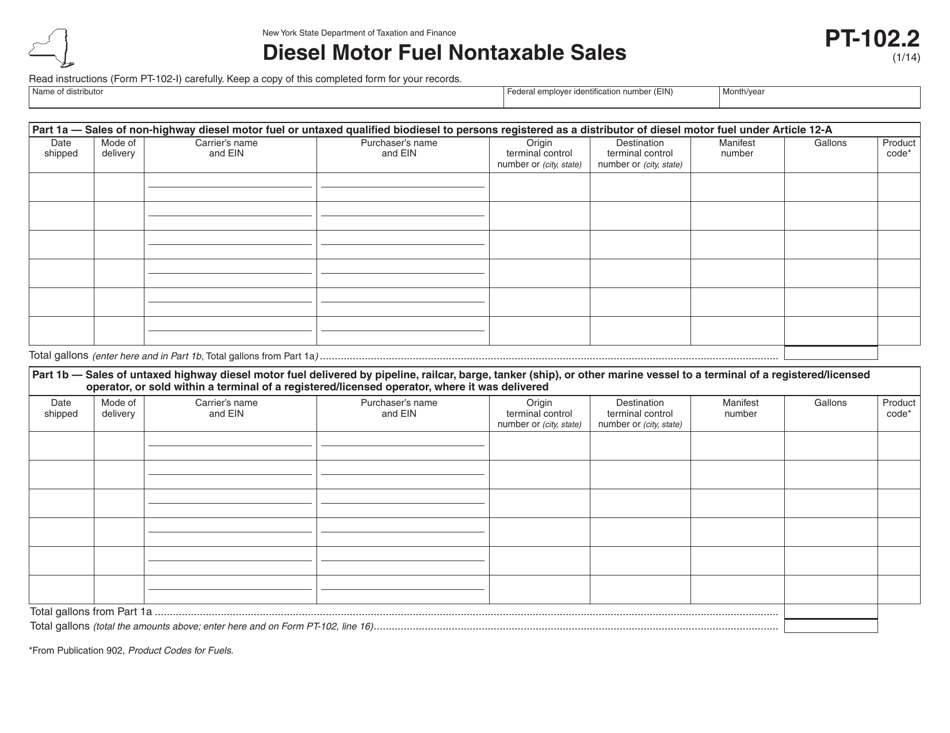

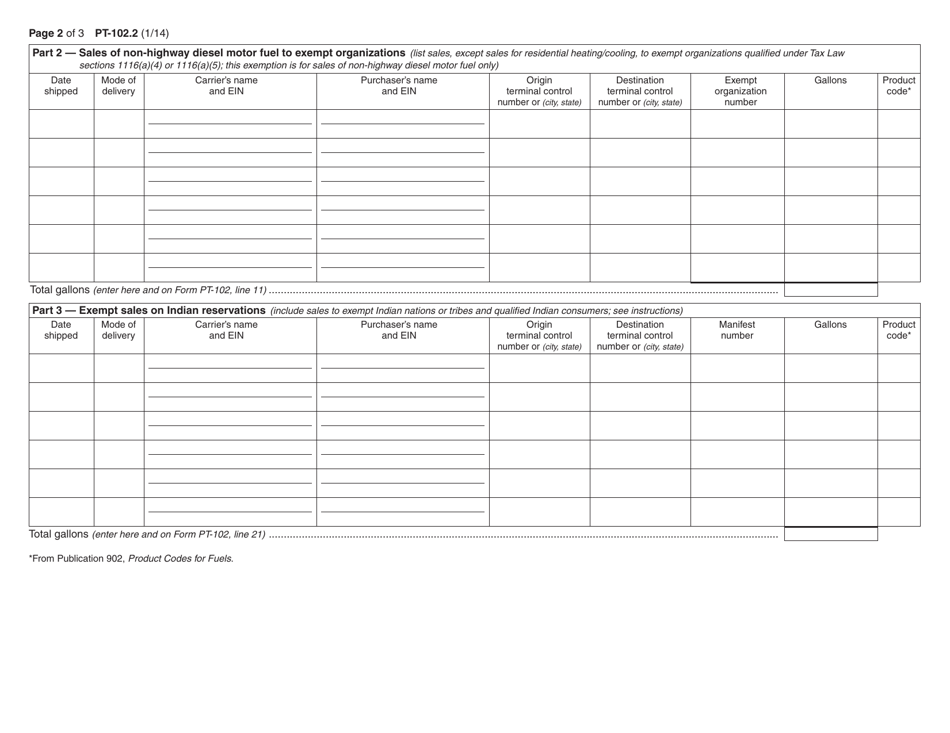

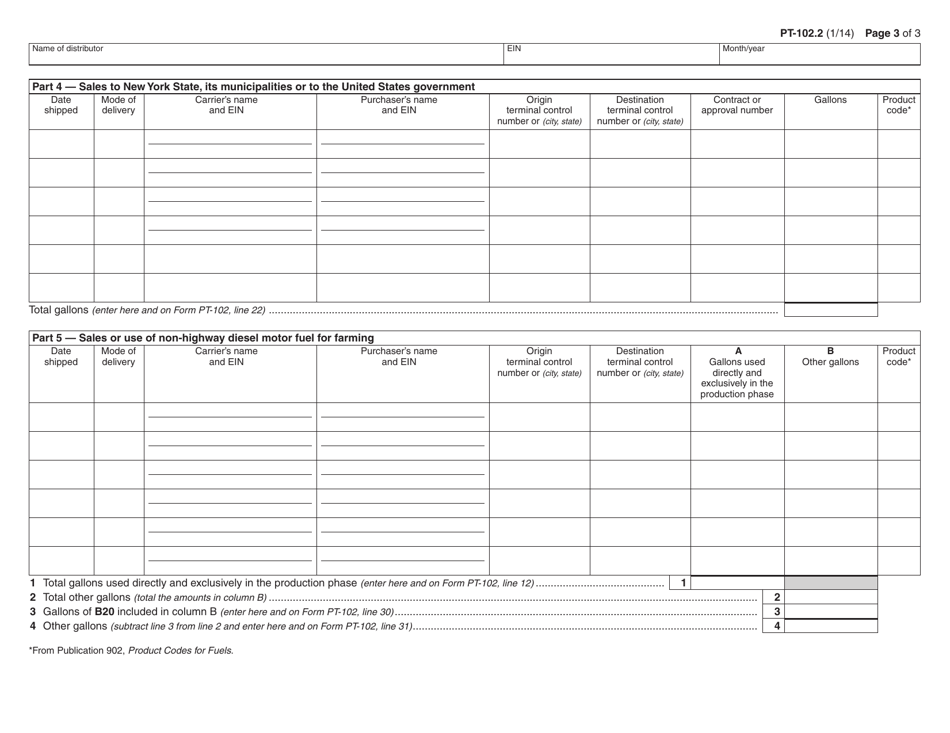

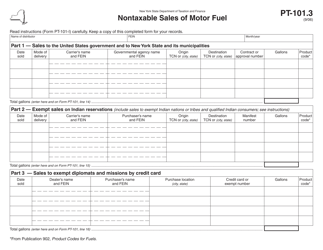

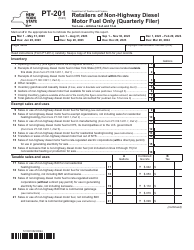

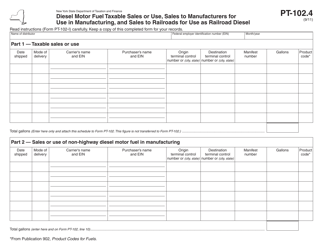

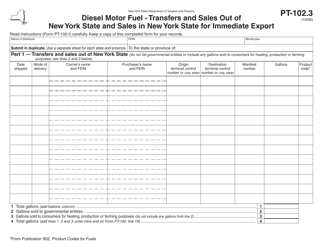

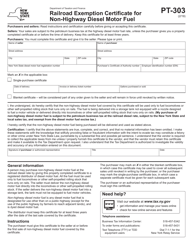

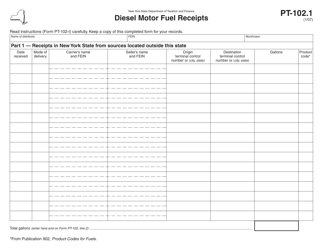

Form PT-102.2 Diesel Motor Fuel Nontaxable Sales - New York

What Is Form PT-102.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-102.2?

A: Form PT-102.2 is a form used for reporting nontaxable sales of diesel motor fuel in New York.

Q: Who needs to file Form PT-102.2?

A: Any entity or individual engaged in the sale of diesel motor fuel in New York and making nontaxable sales needs to file Form PT-102.2.

Q: What are nontaxable sales of diesel motor fuel?

A: Nontaxable sales of diesel motor fuel refer to sales that are exempt from the state and local motor fuel taxes in New York.

Q: When is the deadline to file Form PT-102.2?

A: The deadline to file Form PT-102.2 is typically the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form PT-102.2?

A: Yes, there may be penalties for late filing of Form PT-102.2. It is important to file the form by the deadline to avoid any penalties.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-102.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.