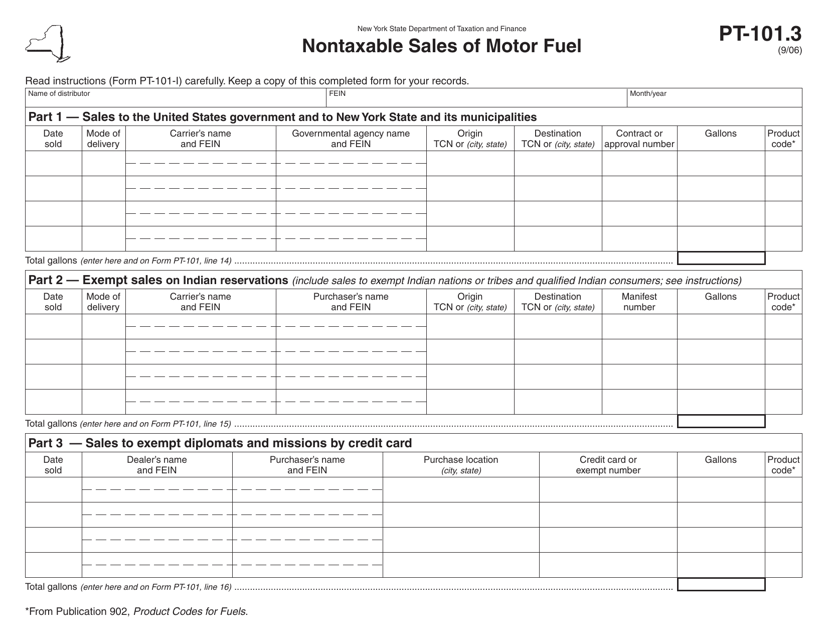

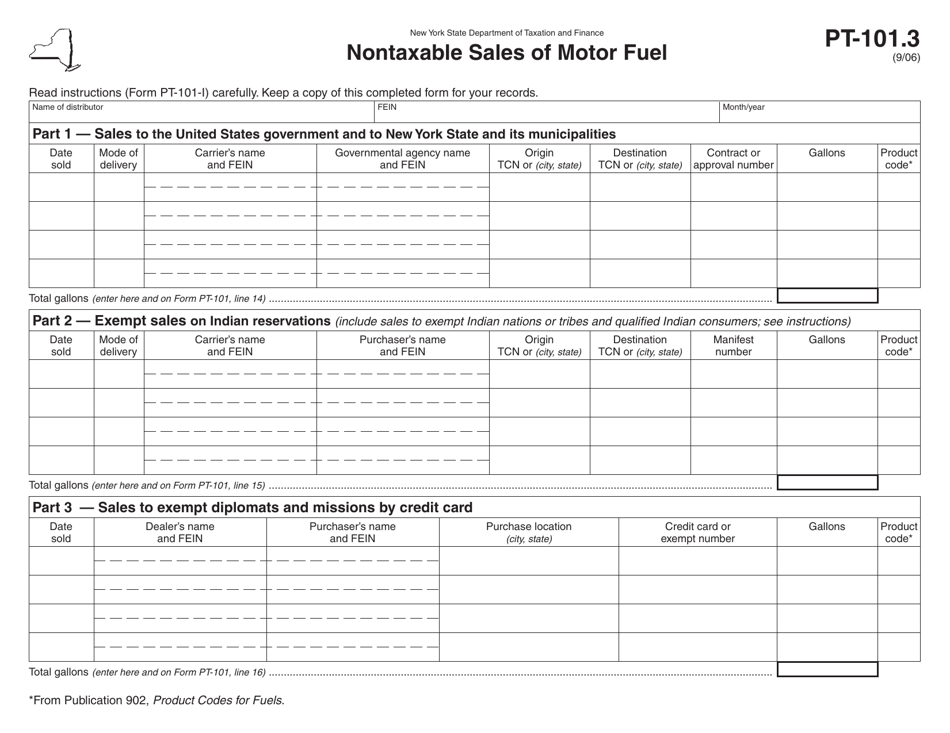

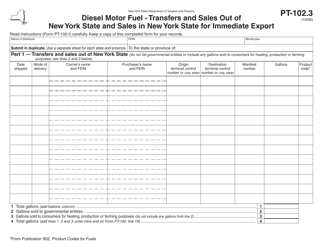

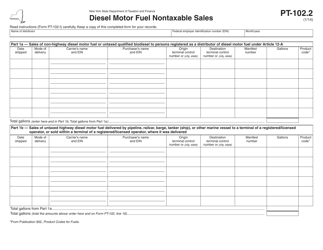

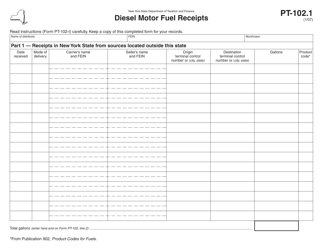

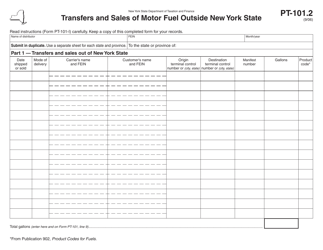

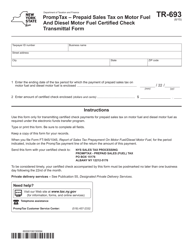

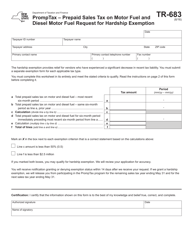

Form PT-101.3 Nontaxable Sales of Motor Fuel - New York

What Is Form PT-101.3?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-101.3?

A: Form PT-101.3 is a form used in New York for reporting nontaxable sales of motor fuel.

Q: What are nontaxable sales of motor fuel?

A: Nontaxable sales of motor fuel are sales that are exempt from sales tax in New York.

Q: Who needs to file Form PT-101.3?

A: Anyone who has made nontaxable sales of motor fuel in New York needs to file Form PT-101.3.

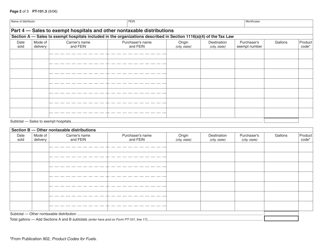

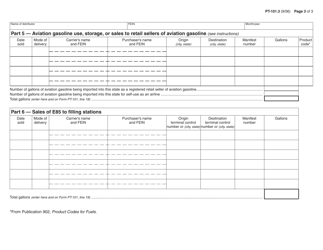

Q: What information should be reported on Form PT-101.3?

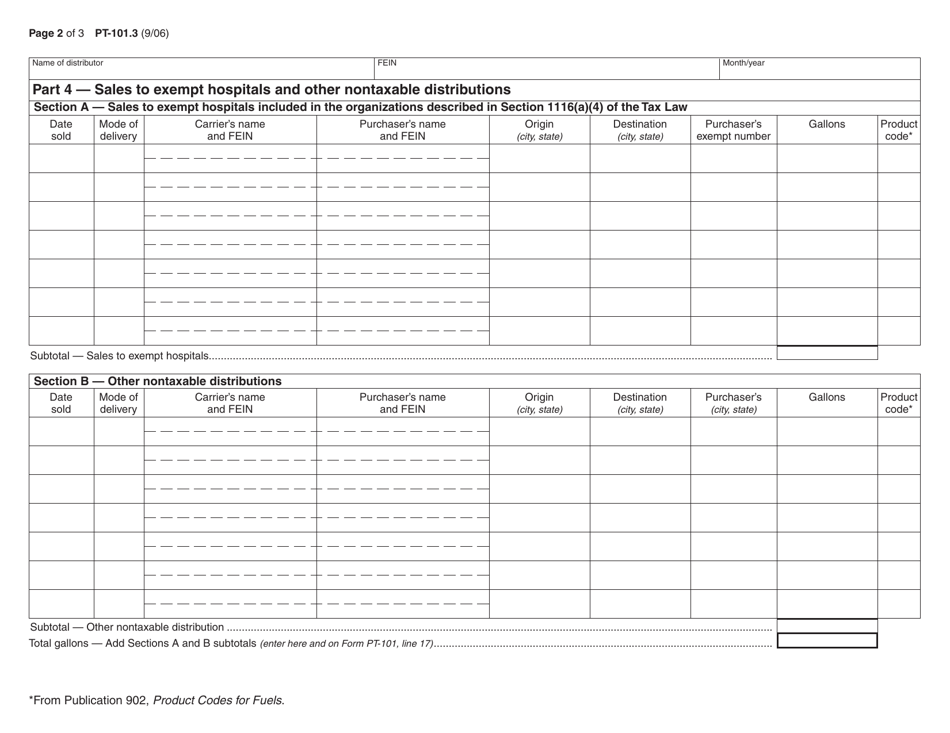

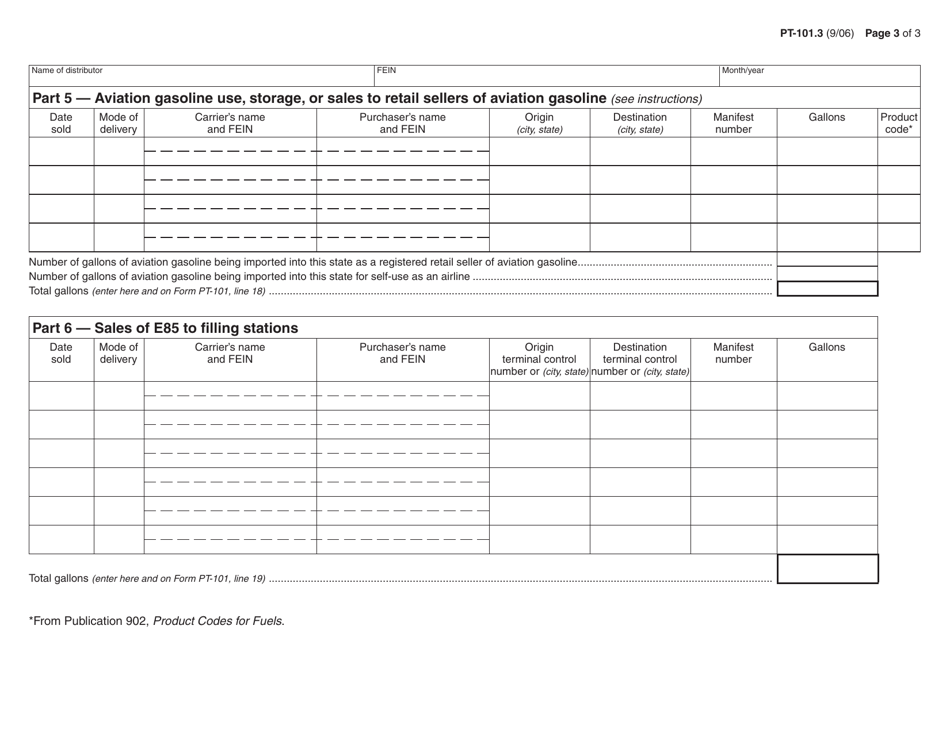

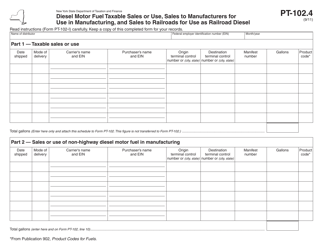

A: Form PT-101.3 requires reporting of the quantity and type of motor fuel sold, as well as the type of exemption claimed.

Q: Are there any penalties for not filing Form PT-101.3?

A: Yes, there can be penalties for not filing Form PT-101.3, so it is important to comply with the filing requirements.

Q: Is Form PT-101.3 required for taxable sales of motor fuel?

A: No, Form PT-101.3 is only required for reporting nontaxable sales of motor fuel.

Form Details:

- Released on September 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-101.3 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.