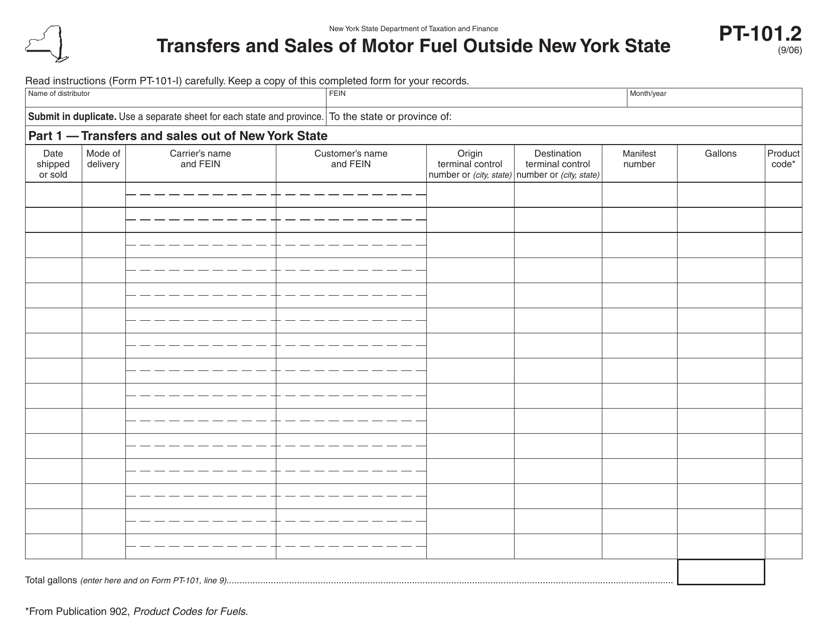

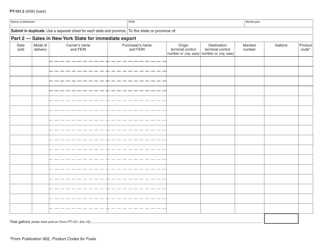

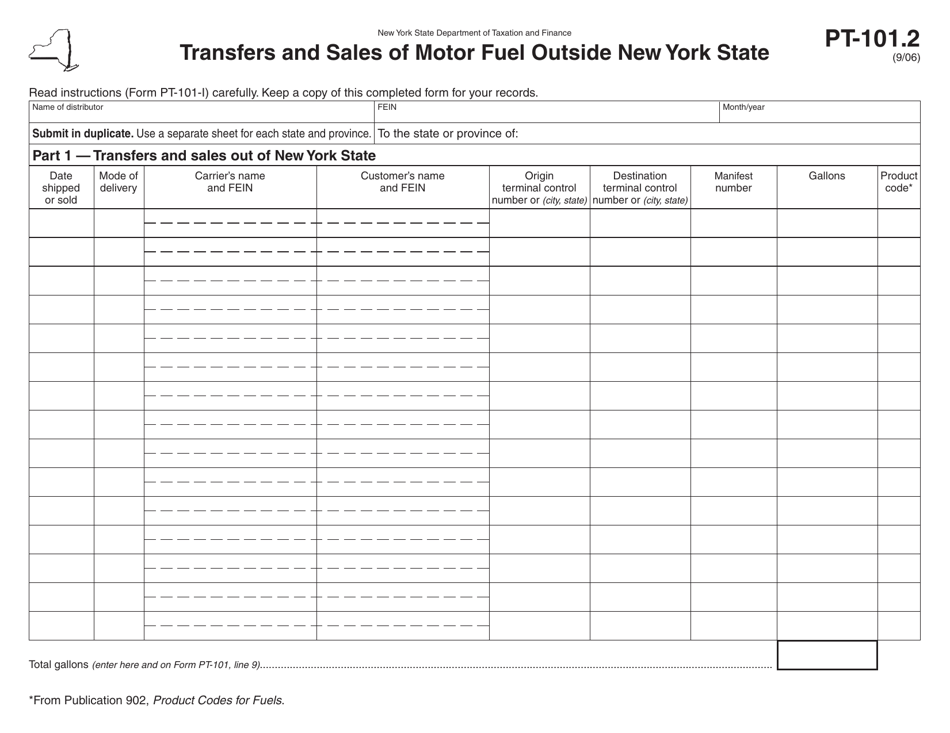

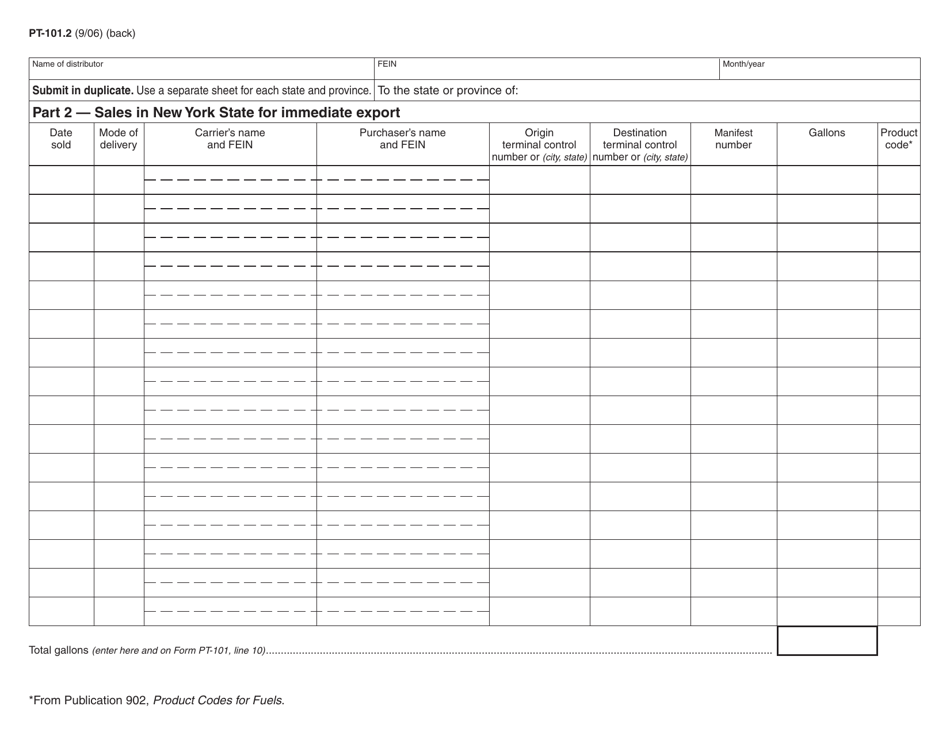

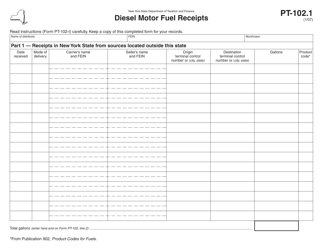

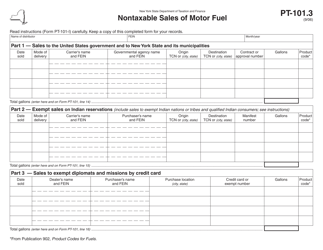

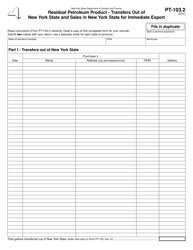

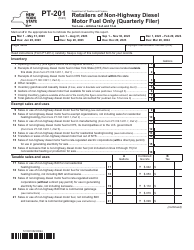

Form PT-101.2 Transfers and Sales of Motor Fuel Outside New York State - New York

What Is Form PT-101.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-101.2?

A: Form PT-101.2 is a document used for reporting transfers and sales of motor fuel outside New York State.

Q: Who needs to use Form PT-101.2?

A: The Form PT-101.2 is used by anyone who sells or transfers motor fuel outside of New York State.

Q: What is the purpose of Form PT-101.2?

A: The purpose of Form PT-101.2 is to report the quantity of motor fuel sold or transferred outside of New York State, for tax and regulatory purposes.

Q: How often do I need to file Form PT-101.2?

A: Form PT-101.2 must be filed on a monthly basis.

Q: Are there any penalties for not filing Form PT-101.2?

A: Yes, failure to file Form PT-101.2 or filing it late can result in penalties and interest charges.

Q: Do I need to include documentation with Form PT-101.2?

A: Yes, you may be required to attach supporting documentation such as invoices and bills of lading with Form PT-101.2.

Q: What should I do if I have questions about Form PT-101.2?

A: If you have any questions about Form PT-101.2, you should contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- Released on September 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-101.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.