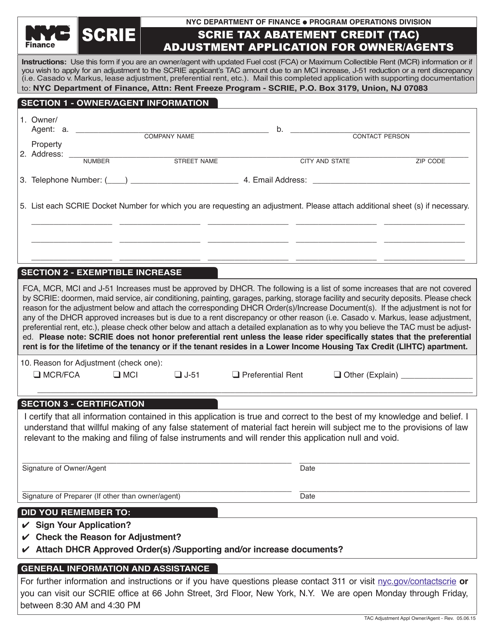

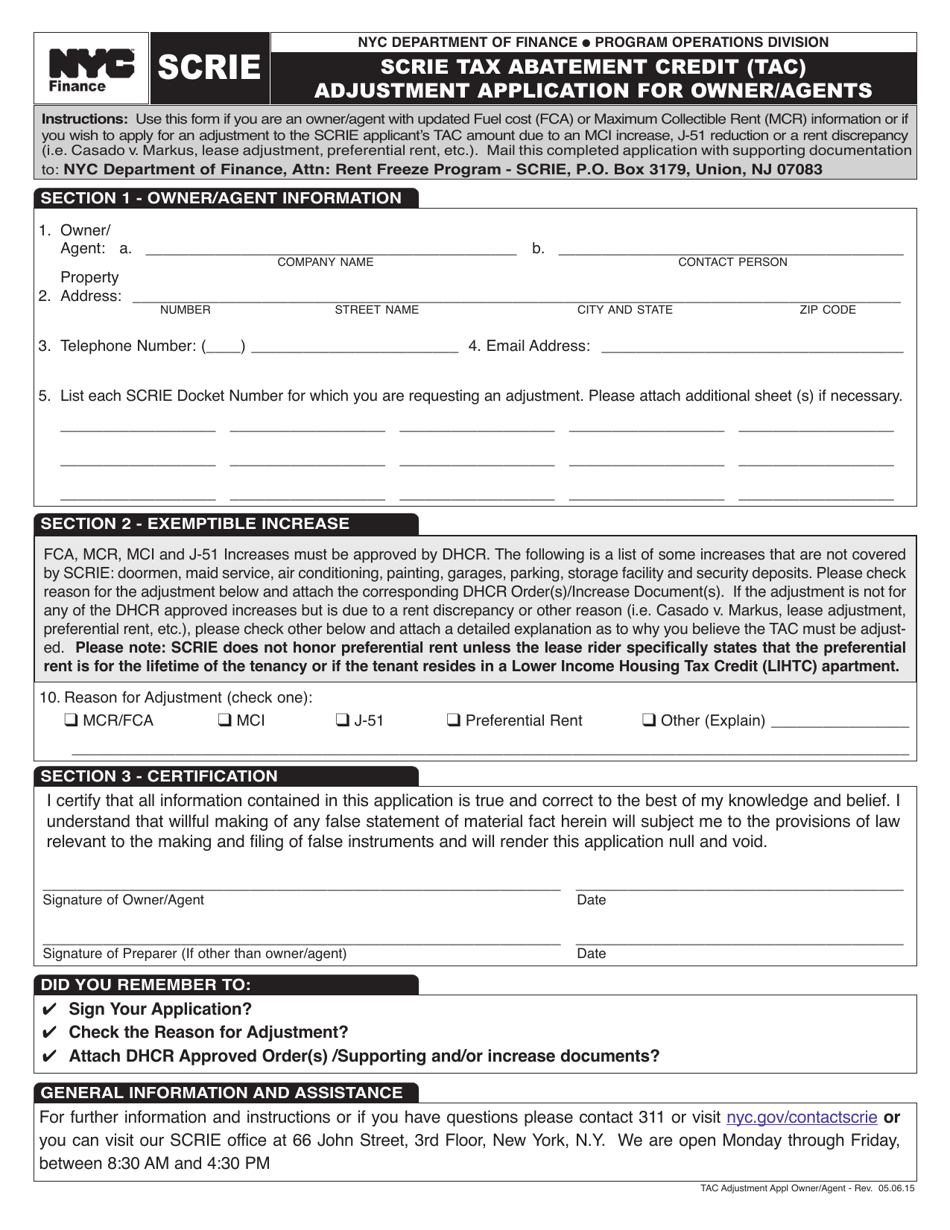

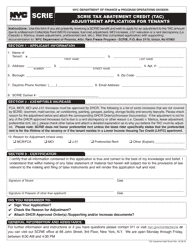

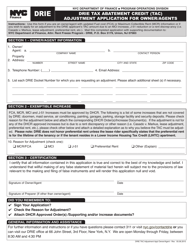

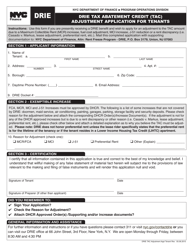

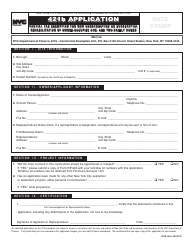

Scrie Tax Abatement Credit (Tac) Adjustment Application for Owner / Agents - New York City

Scrie Tax Abatement Credit (Tac) Adjustment Application for Owner/Agents is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is a Tax Abatement Credit (TAC) Adjustment Application?

A: A Tax Abatement Credit (TAC) Adjustment Application is a form used by property owner/agents in New York City to apply for adjustments to their property tax abatement.

Q: Who can use the Tax Abatement Credit (TAC) Adjustment Application?

A: The Tax Abatement Credit (TAC) Adjustment Application is specifically for property owner/agents in New York City.

Q: What is the purpose of the Tax Abatement Credit (TAC) Adjustment Application?

A: The purpose of the Tax Abatement Credit (TAC) Adjustment Application is to request adjustments to property tax abatements for eligible properties in New York City.

Q: How do I obtain a Tax Abatement Credit (TAC) Adjustment Application?

A: You can obtain a Tax Abatement Credit (TAC) Adjustment Application by contacting the New York City Department of Housing Preservation and Development (HPD).

Q: What information is required on the Tax Abatement Credit (TAC) Adjustment Application?

A: The Tax Abatement Credit (TAC) Adjustment Application requires property information, income information, tenant information, and other relevant details.

Q: Are there any fees associated with submitting the Tax Abatement Credit (TAC) Adjustment Application?

A: There are no fees associated with submitting the Tax Abatement Credit (TAC) Adjustment Application.

Q: What is the deadline for submitting the Tax Abatement Credit (TAC) Adjustment Application?

A: The deadline for submitting the Tax Abatement Credit (TAC) Adjustment Application varies and is determined by the New York City Department of Housing Preservation and Development (HPD).

Q: How long does it take to process the Tax Abatement Credit (TAC) Adjustment Application?

A: The processing time for the Tax Abatement Credit (TAC) Adjustment Application can vary, but typically takes several weeks.

Form Details:

- Released on May 6, 2015;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.