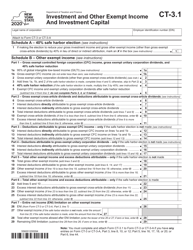

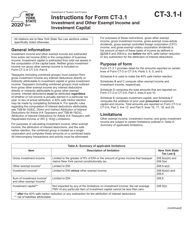

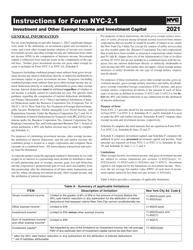

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form NYC-2.1

for the current year.

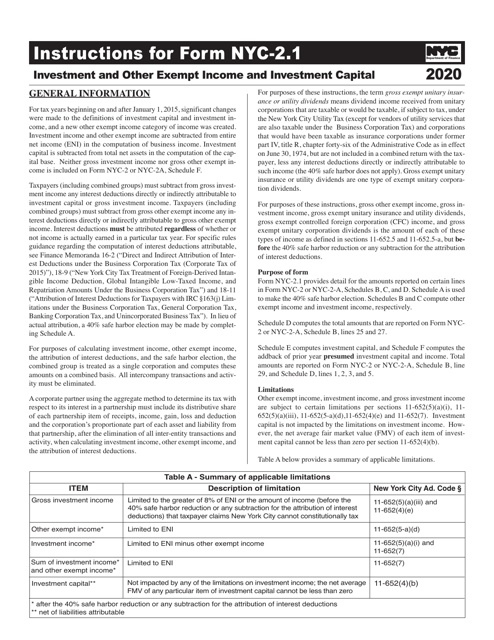

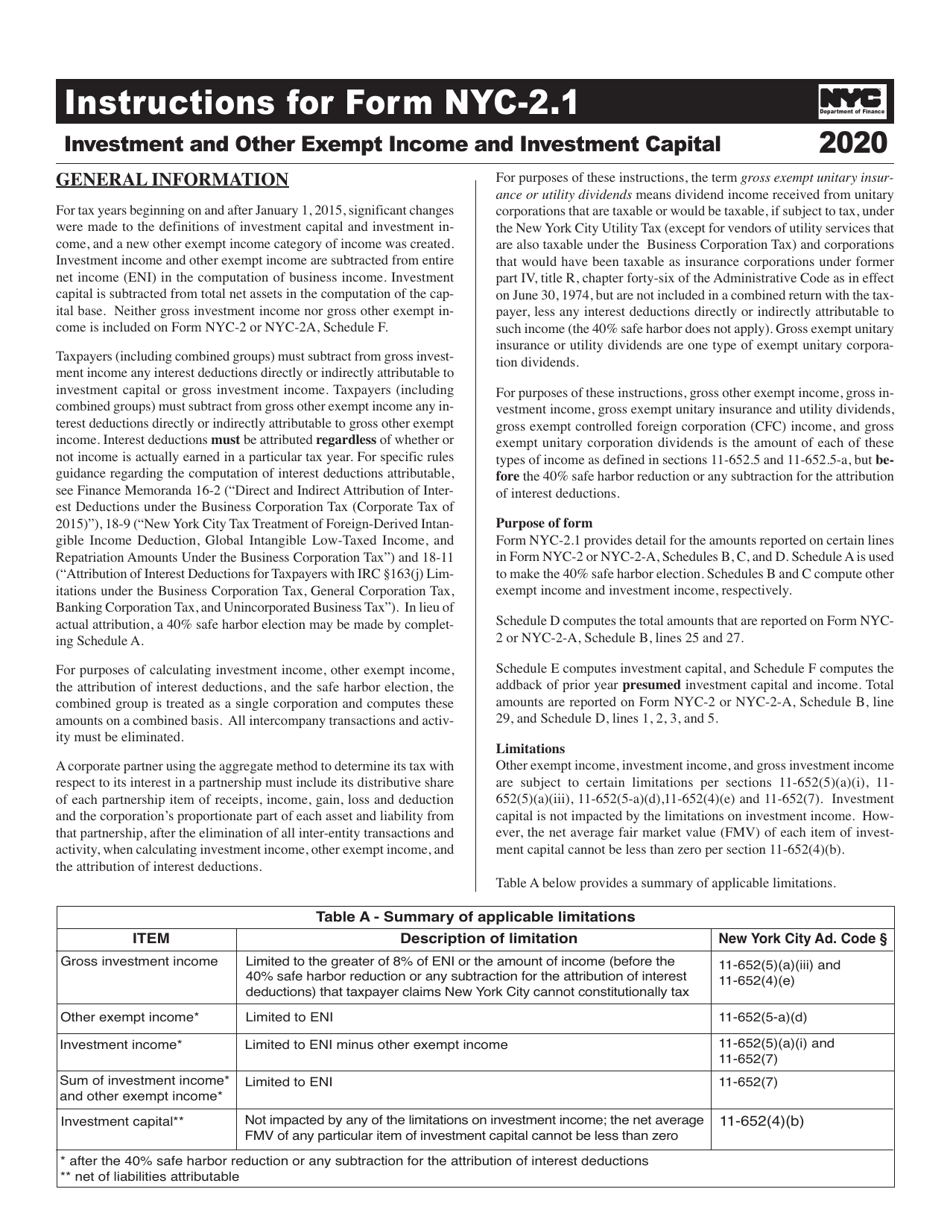

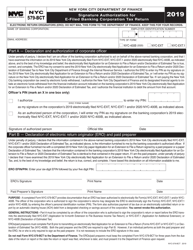

Instructions for Form NYC-2.1 Investment and Other Exempt Income and Investment Capital - New York City

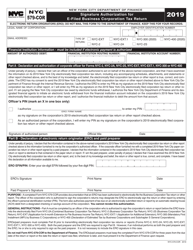

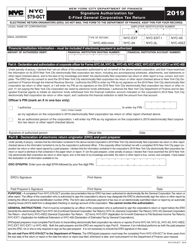

This document contains official instructions for Form NYC-2.1 , Investment and Other Exempt Income and Investment Capital - a form released and collected by the New York City Department of Finance.

FAQ

Q: What is Form NYC-2.1?

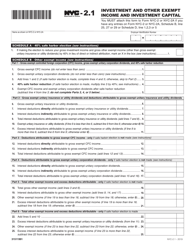

A: Form NYC-2.1 is a form used to report investment and other exempt income and investment capital in New York City.

Q: Who needs to file Form NYC-2.1?

A: Individuals and businesses who have investment and other exempt income and investment capital in New York City may need to file Form NYC-2.1.

Q: What is considered investment and other exempt income?

A: Investment and other exempt income includes dividends, interest, capital gains, and other income that is exempt from taxation.

Q: What is investment capital?

A: Investment capital refers to the total value of your investments, including stocks, bonds, real estate, and other assets.

Q: Is Form NYC-2.1 only for residents of New York City?

A: No, Form NYC-2.1 is also required for non-residents who have investment and other exempt income and investment capital in New York City.

Q: What is the deadline for filing Form NYC-2.1?

A: The deadline for filing Form NYC-2.1 is usually April 15th, or the same deadline as the federal income tax return.

Q: Are there any penalties for not filing Form NYC-2.1?

A: Yes, failure to file Form NYC-2.1 or providing false information can result in penalties and interest charges.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York City Department of Finance.