This version of the form is not currently in use and is provided for reference only. Download this version of

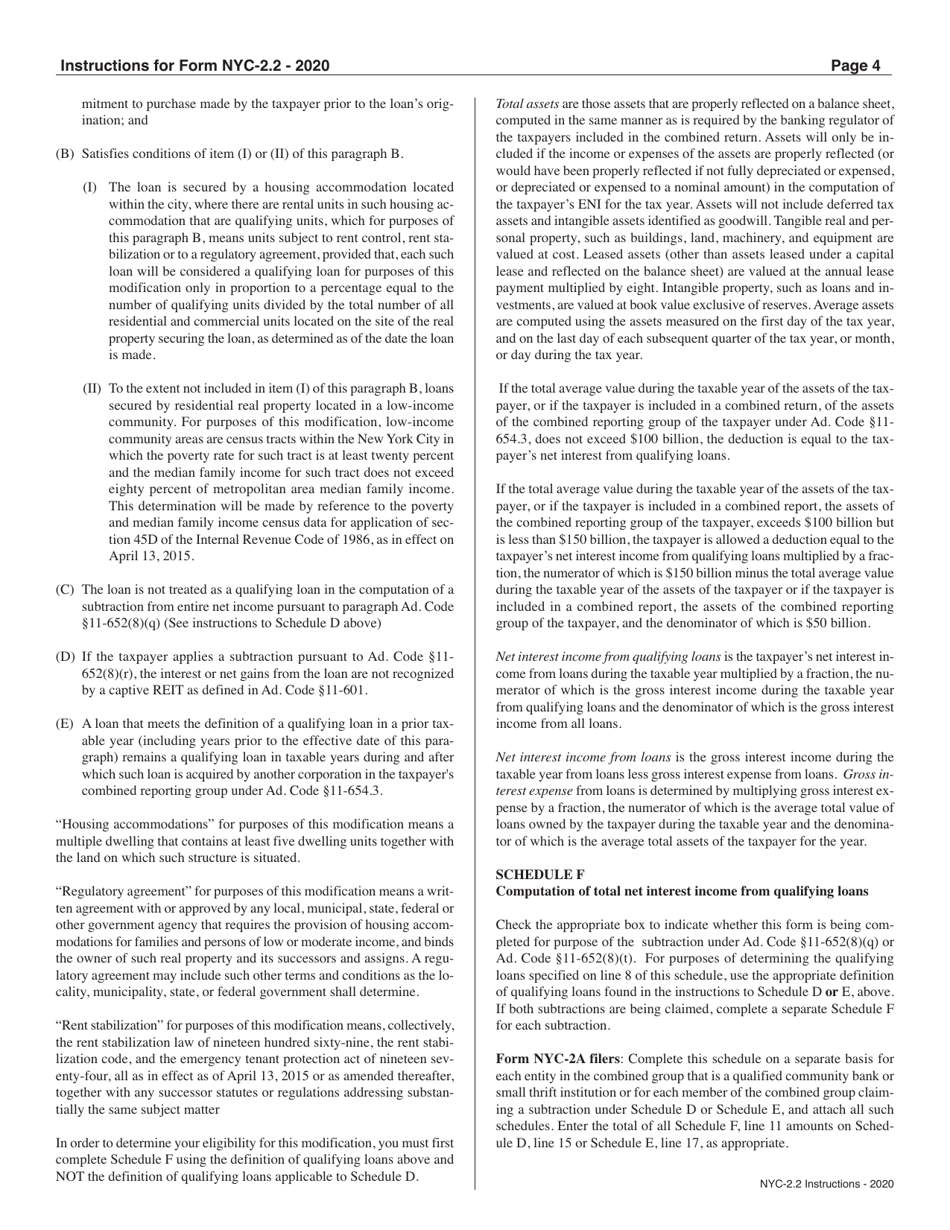

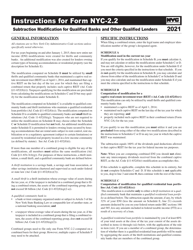

Instructions for Form NYC-2.2

for the current year.

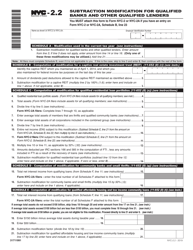

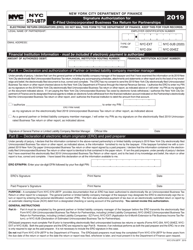

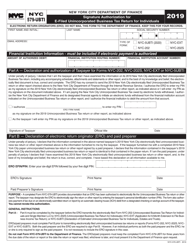

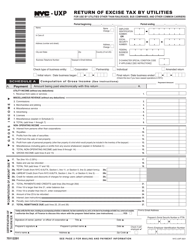

Instructions for Form NYC-2.2 Subtraction Modification for Qualified Banks and Other Qualified Lenders - New York City

This document contains official instructions for Form NYC-2.2 , Subtraction Modification for Qualified Banks and Other Qualified Lenders - a form released and collected by the New York City Department of Finance.

FAQ

Q: What is Form NYC-2.2?

A: Form NYC-2.2 is a tax form used for requesting a subtraction modification for qualified banks and other qualified lenders in New York City.

Q: Who needs to file Form NYC-2.2?

A: Form NYC-2.2 needs to be filed by qualified banks and other qualified lenders in New York City.

Q: What is a subtraction modification?

A: A subtraction modification is a tax adjustment that reduces a taxpayer's taxable income.

Q: What does the Form NYC-2.2 allow qualified banks and lenders to subtract from their taxable income?

A: Form NYC-2.2 allows qualified banks and lenders to subtract certain interest income and exempt dividend income from their taxable income.

Q: What is the purpose of the subtraction modification?

A: The purpose of the subtraction modification is to provide tax relief to qualified banks and lenders in New York City.

Q: When is the deadline for filing Form NYC-2.2?

A: The deadline for filing Form NYC-2.2 is usually April 15th, unless it falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form NYC-2.2?

A: Yes, there may be penalties for late filing of Form NYC-2.2. It is best to file the form before the deadline to avoid any penalties.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York City Department of Finance.