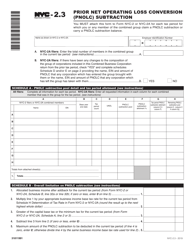

This version of the form is not currently in use and is provided for reference only. Download this version of

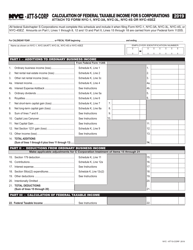

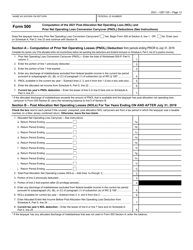

Instructions for Form NYC-2.3

for the current year.

Instructions for Form NYC-2.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York City

This document contains official instructions for Form NYC-2.3 , Prior Net Operating Loss Conversion (Pnolc) Subtraction - a form released and collected by the New York City Department of Finance.

FAQ

Q: What is Form NYC-2.3?

A: Form NYC-2.3 is a form used for calculating Prior Net Operating Loss Conversion (PNOLC) Subtraction in New York City.

Q: What is Prior Net Operating Loss Conversion (PNOLC) Subtraction?

A: PNOLC Subtraction is a deduction that can be claimed when converting a prior net operating loss (NOL) into a PNOLC.

Q: Who needs to file Form NYC-2.3?

A: Individuals, partnerships, and corporations with a net operating loss (NOL) in New York City need to file Form NYC-2.3.

Q: How do I calculate PNOLC Subtraction?

A: The PNOLC Subtraction is calculated by multiplying the prior NOL balance by a conversion factor.

Q: What is the purpose of PNOLC Subtraction?

A: The purpose of PNOLC Subtraction is to reduce the taxable income in New York City by deducting the converted prior NOL.

Q: Is PNOLC Subtraction the same as NOL deduction?

A: No, PNOLC Subtraction is a separate deduction specific to New York City, while NOL deduction can be claimed for federal tax purposes.

Q: When is the deadline to file Form NYC-2.3?

A: The deadline to file Form NYC-2.3 is usually the same as the deadline for filing the New York City tax return, which is generally April 15th.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York City Department of Finance.