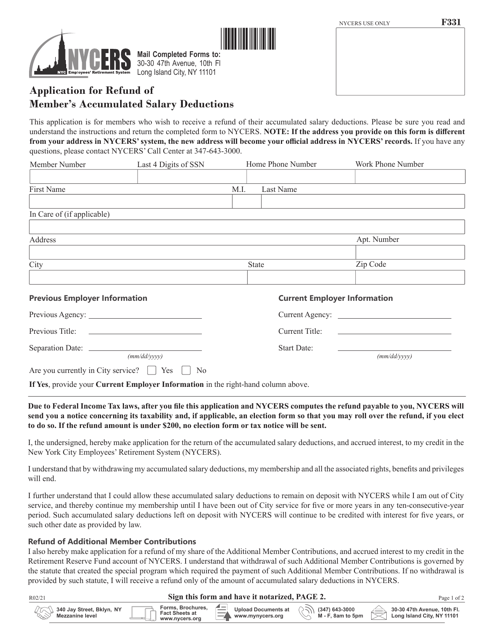

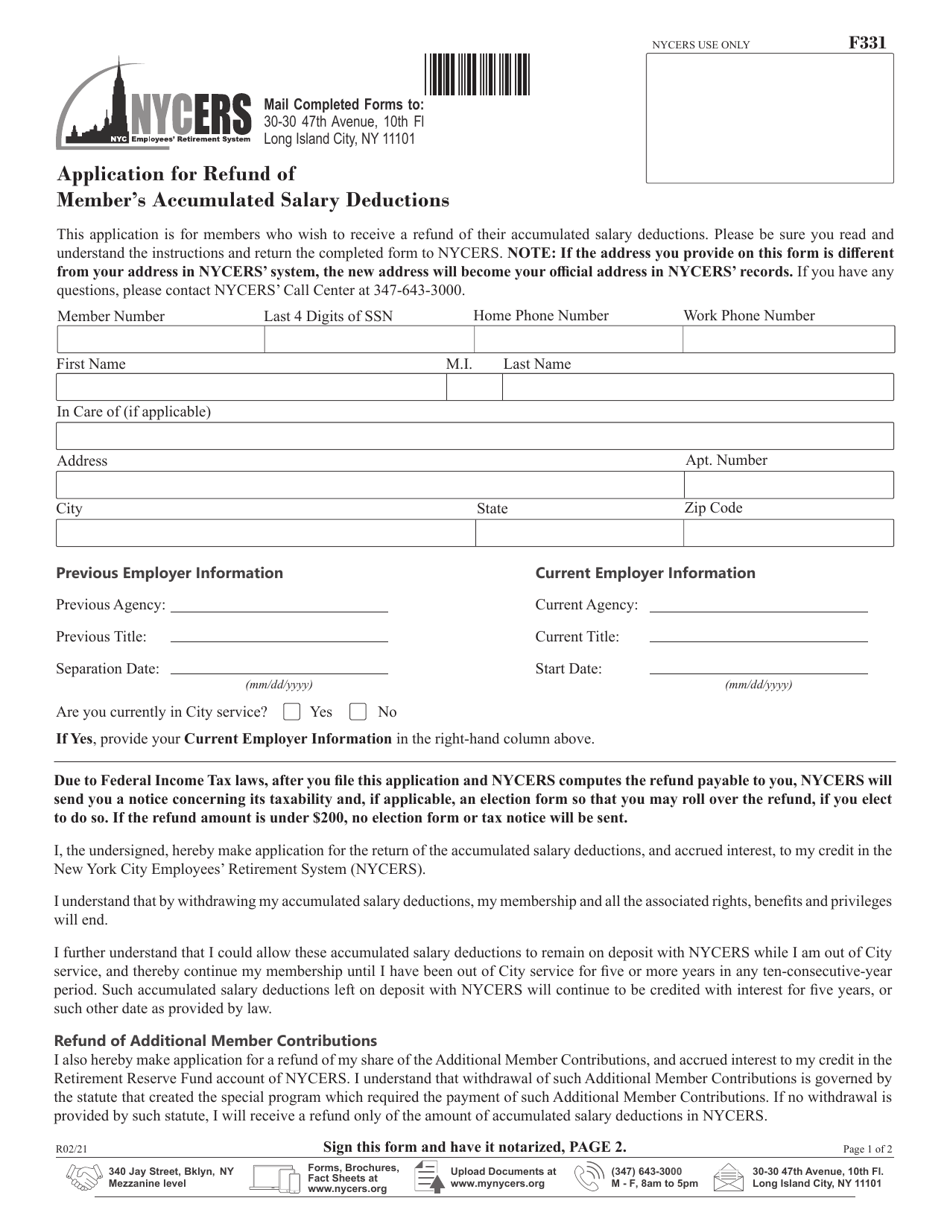

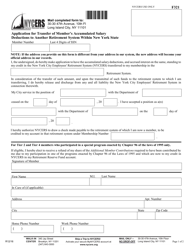

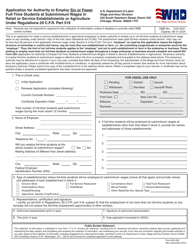

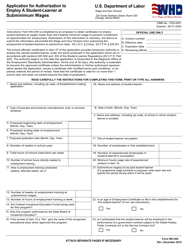

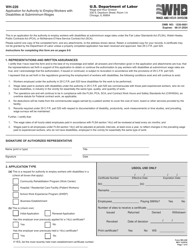

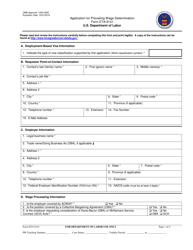

Form F331 Application for Refund of Member's Accumulated Salary Deductions - New York City

What Is Form F331?

This is a legal form that was released by the New York City Employees' Retirement System - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F331?

A: Form F331 is an application for refund of member's accumulated salary deductions in New York City.

Q: Who is eligible to use Form F331?

A: Members of the New York City Employees' Retirement System (NYCERS) and their beneficiaries are eligible to use Form F331 to apply for a refund.

Q: What are member's accumulated salary deductions?

A: Member's accumulated salary deductions refer to the contributions made by the employee to the NYCERS retirement system.

Q: How long does it take to process the refund?

A: The processing time for a refund can vary, but NYCERS aims to process applications within 60 days.

Q: What documentation do I need to include with Form F331?

A: You will need to include a photocopy of your Social Security card and a photocopy of your government-issued photo identification.

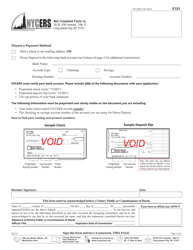

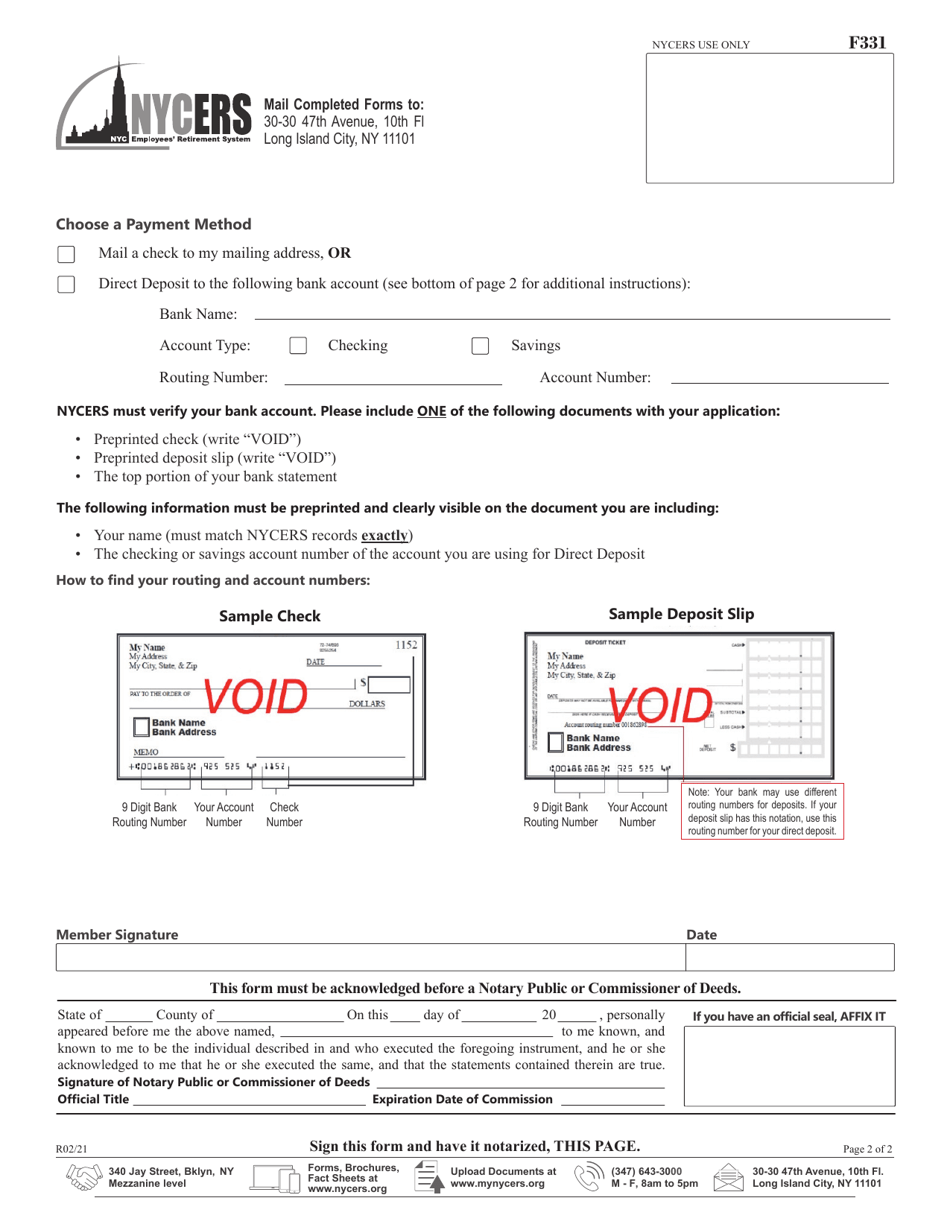

Q: Can I request a direct deposit of the refund?

A: Yes, you can request a direct deposit of the refund by providing your bank account information on Form F331.

Q: Is there a deadline for submitting Form F331?

A: Yes, there is a deadline for submitting Form F331. You must submit the form within three years of terminating employment.

Q: What if I have additional questions about Form F331?

A: If you have additional questions about Form F331, you can contact NYCERS directly for assistance.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the New York City Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F331 by clicking the link below or browse more documents and templates provided by the New York City Employees' Retirement System.