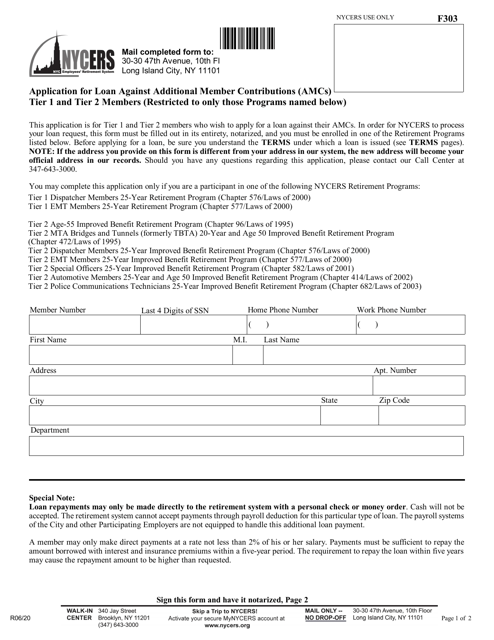

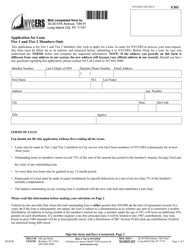

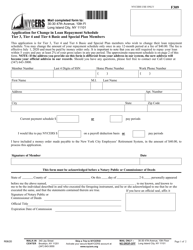

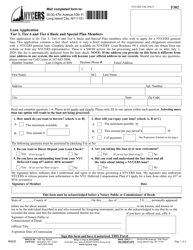

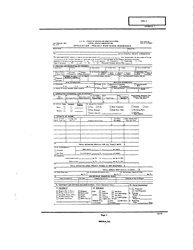

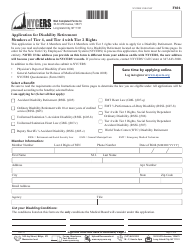

Form F303 Application for Loan Against Additional Member Contributions (Amcs) Tier 1 and Tier 2 Members - New York City

What Is Form F303?

This is a legal form that was released by the New York City Employees' Retirement System - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F303?

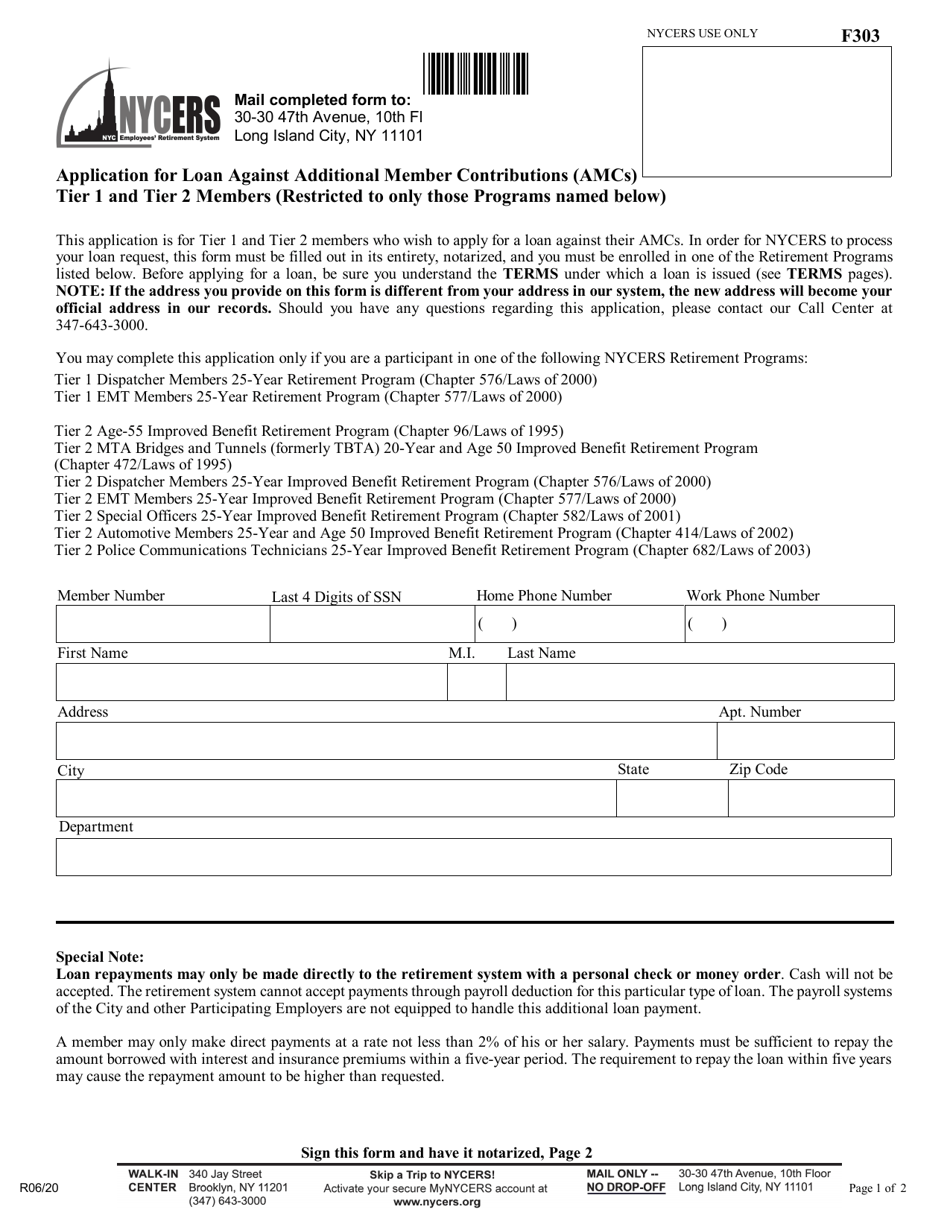

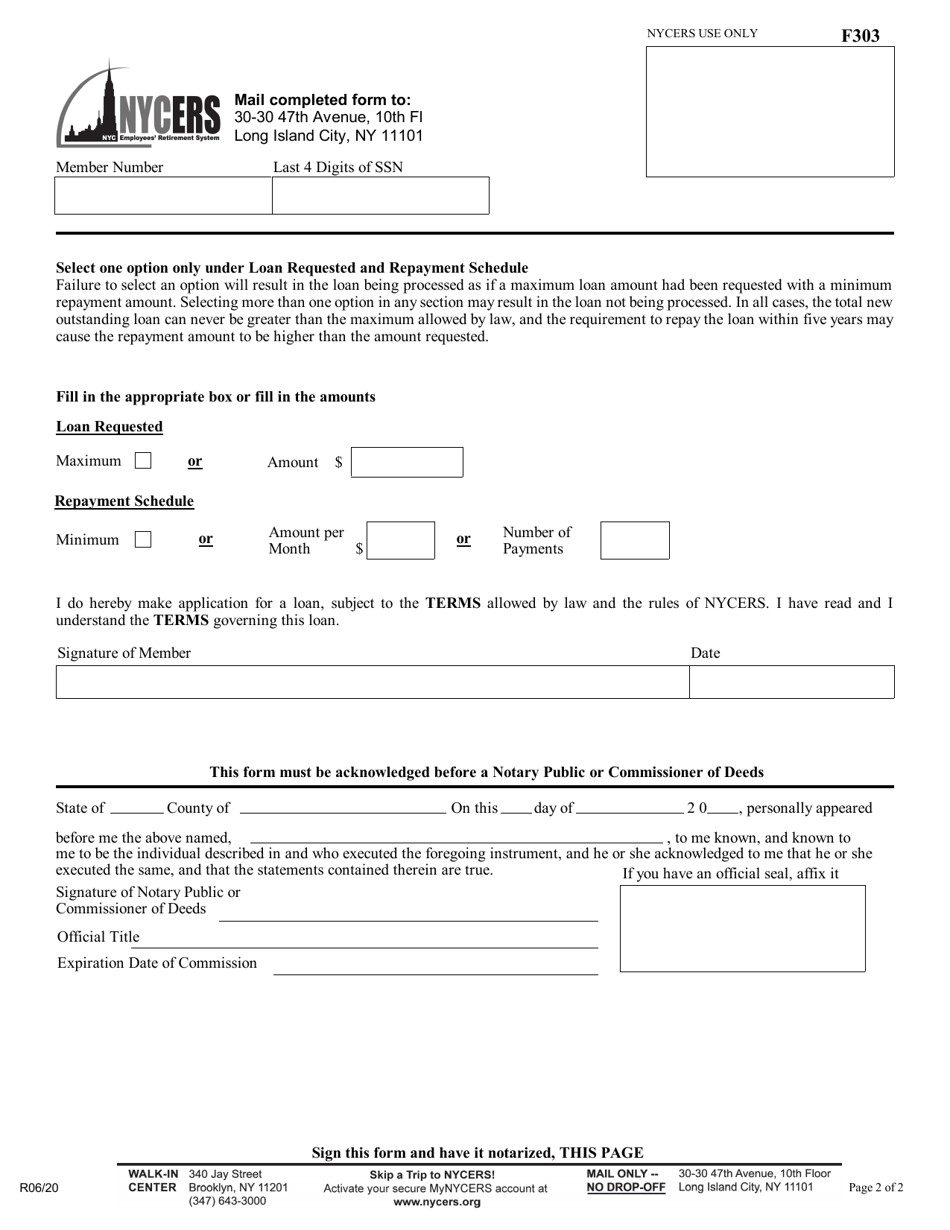

A: Form F303 is an application for a loan against additional member contributions (AMCs) for tier 1 and tier 2 members in New York City.

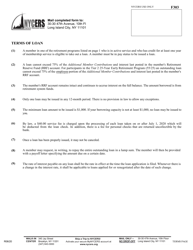

Q: What is a loan against additional member contributions?

A: A loan against additional member contributions is a type of loan that allows tier 1 and tier 2 members in New York City to borrow money against their additional member contributions.

Q: Who can use Form F303?

A: Form F303 can be used by tier 1 and tier 2 members in New York City who want to apply for a loan against their additional member contributions.

Q: What are tier 1 and tier 2 members?

A: Tier 1 and tier 2 members are different categories of members in the New York City retirement system. Tier 1 members are those who joined the system before July 1, 1973, while tier 2 members joined between July 1, 1973, and December 31, 2009.

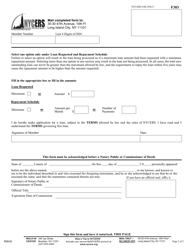

Q: How can I apply for a loan against my additional member contributions?

A: You can apply for a loan against your additional member contributions by completing and submitting Form F303 to the appropriate authorities in New York City.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New York City Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F303 by clicking the link below or browse more documents and templates provided by the New York City Employees' Retirement System.