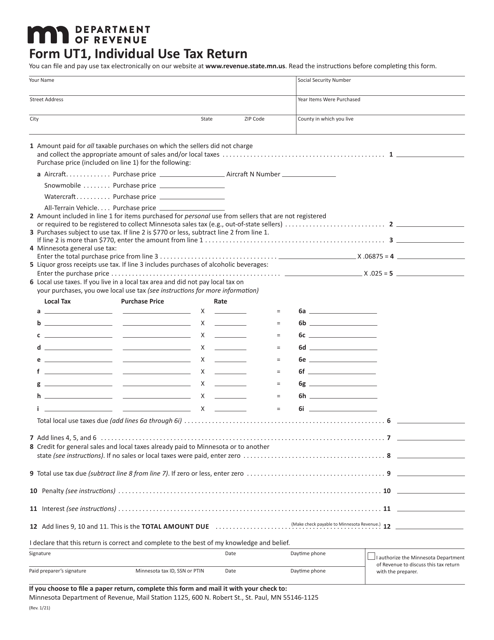

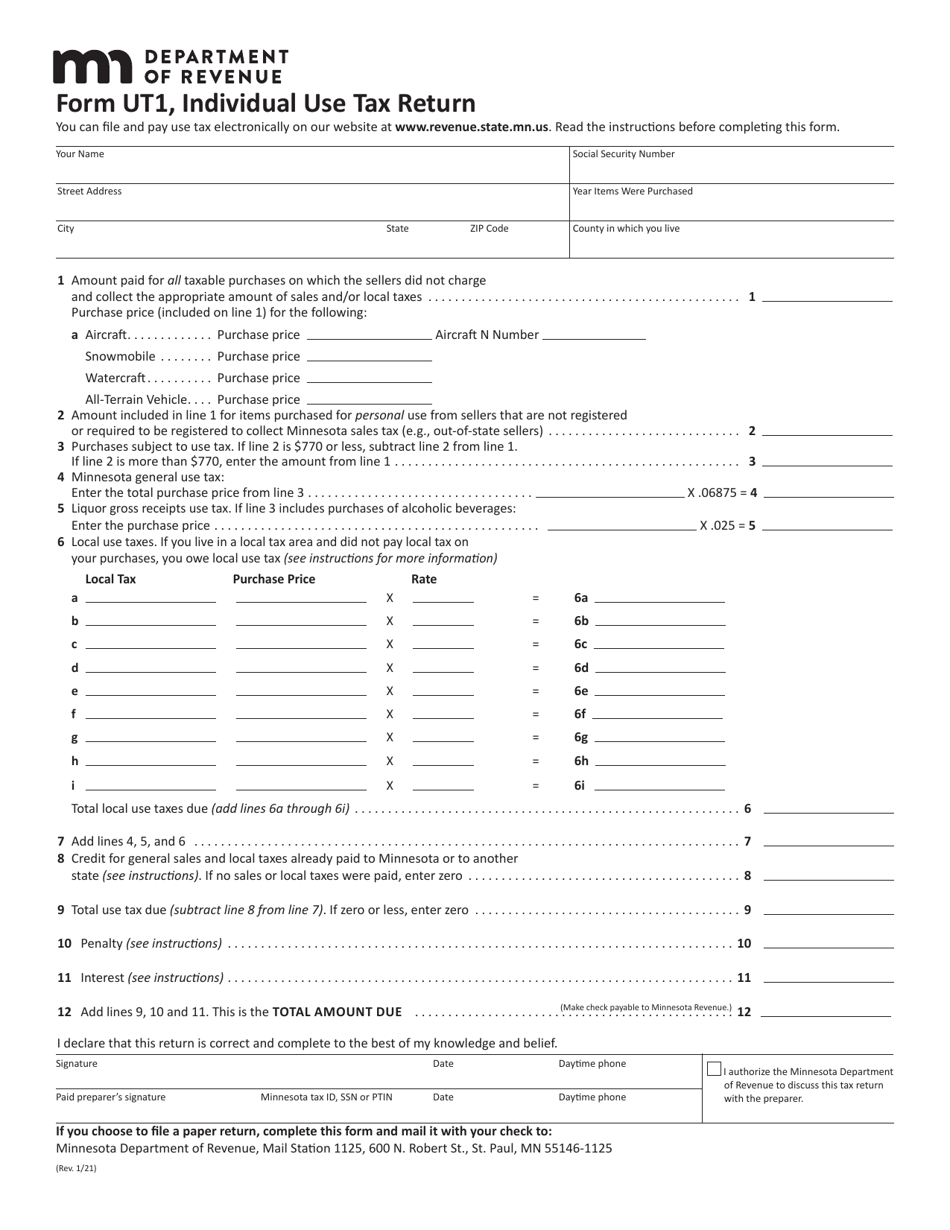

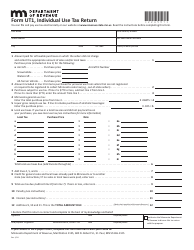

Form UT-1 Individual Use Tax Return - Minnesota

What Is Form UT-1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form UT-1?

A: The Form UT-1 is the Individual Use Tax Return for Minnesota.

Q: Who needs to file Form UT-1?

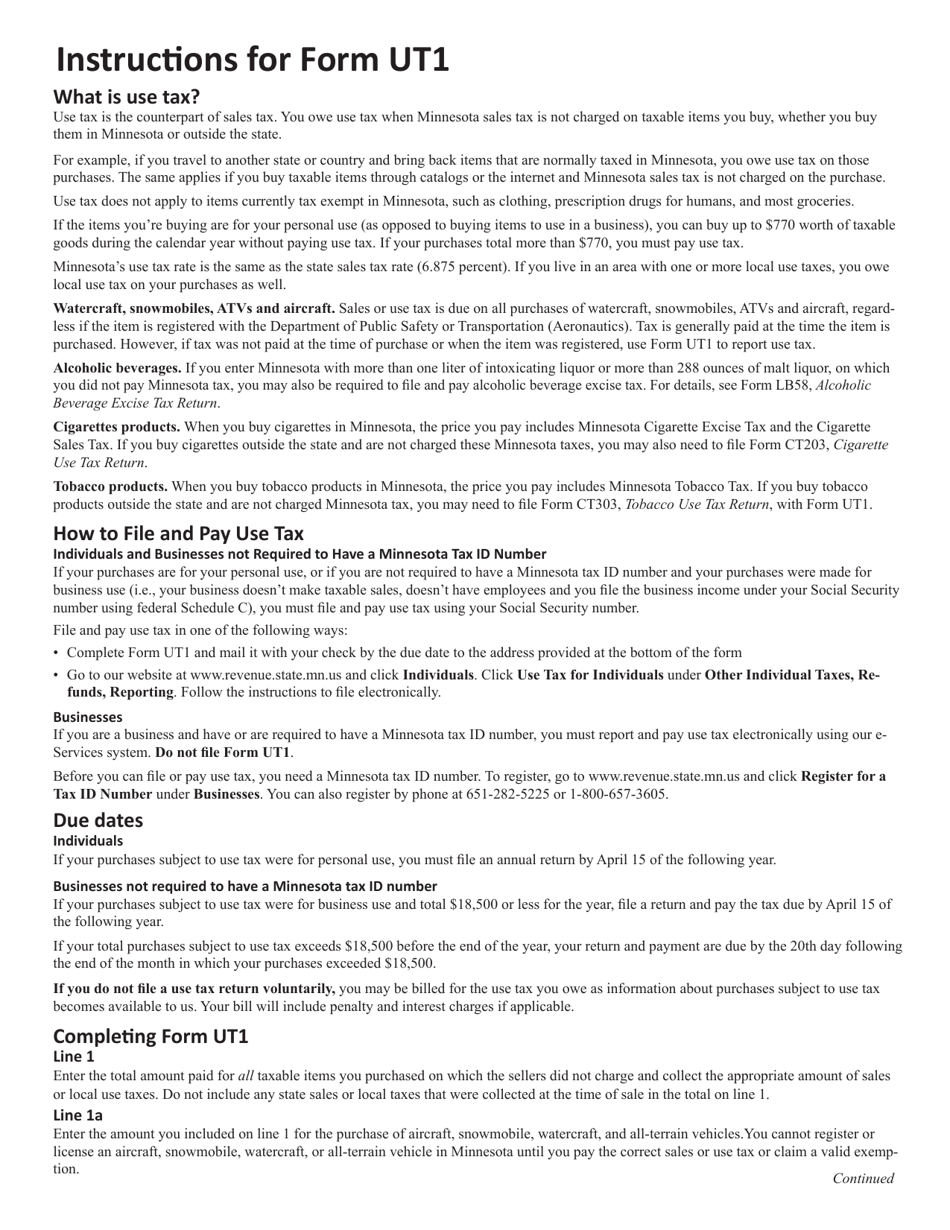

A: Any individual in Minnesota who has made purchases of taxable items for personal use without paying sales tax needs to file Form UT-1.

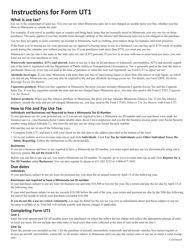

Q: What is use tax?

A: Use tax is a tax on the use, storage, or consumption of tangible personal property that was purchased without paying sales tax.

Q: When is Form UT-1 due?

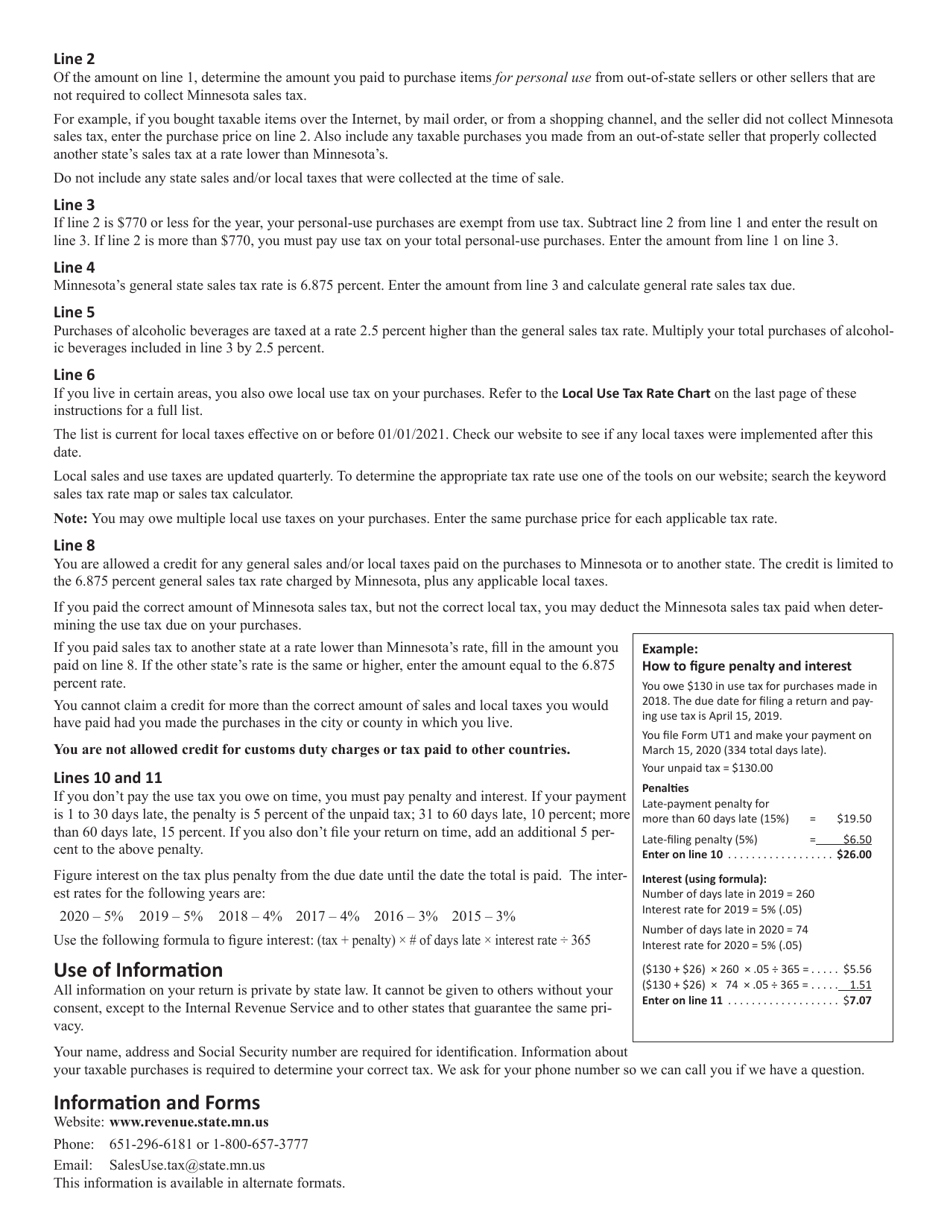

A: Form UT-1 is due on or before April 15th of each year.

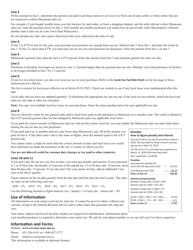

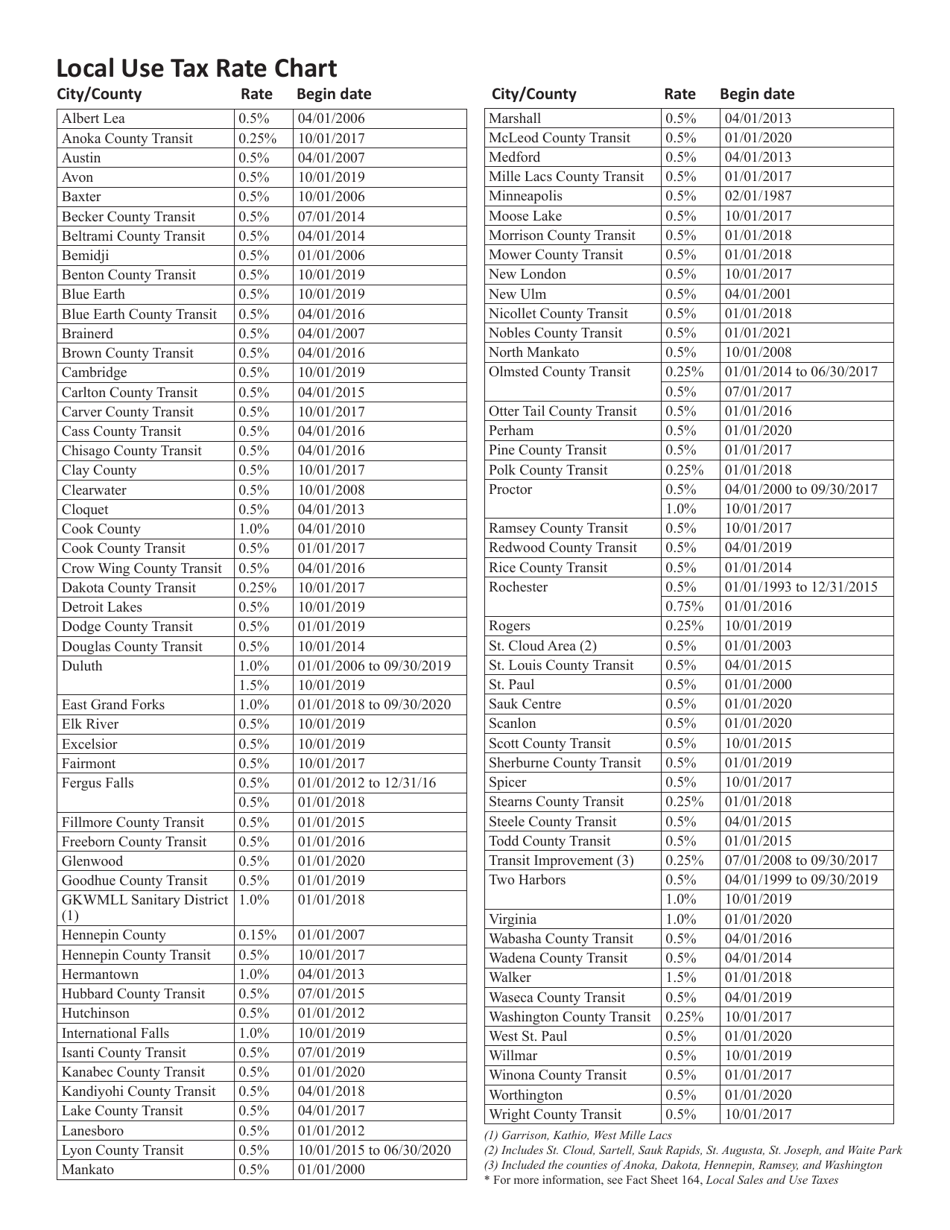

Q: How do I calculate the use tax?

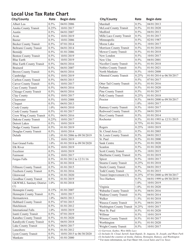

A: To calculate the use tax, you need to determine the purchase price of the taxable items and apply the appropriate tax rate.

Q: Can I claim any exemptions on Form UT-1?

A: Yes, you can claim exemptions for certain items, such as purchases for resale or purchases exempt from sales tax.

Q: What happens if I don't file Form UT-1?

A: If you don't file Form UT-1 or pay the use tax owed, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UT-1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.