This version of the form is not currently in use and is provided for reference only. Download this version of

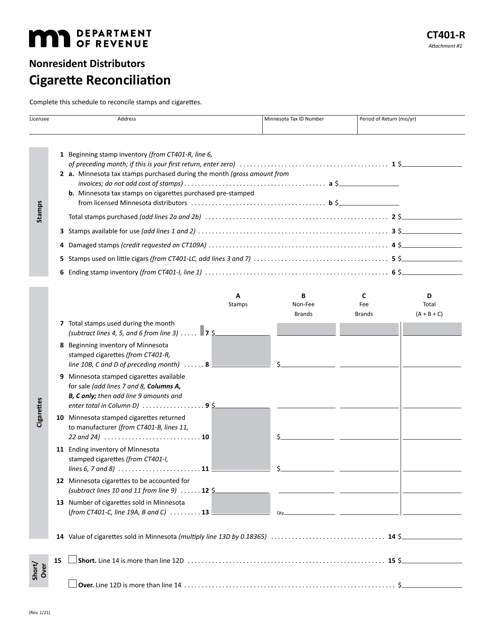

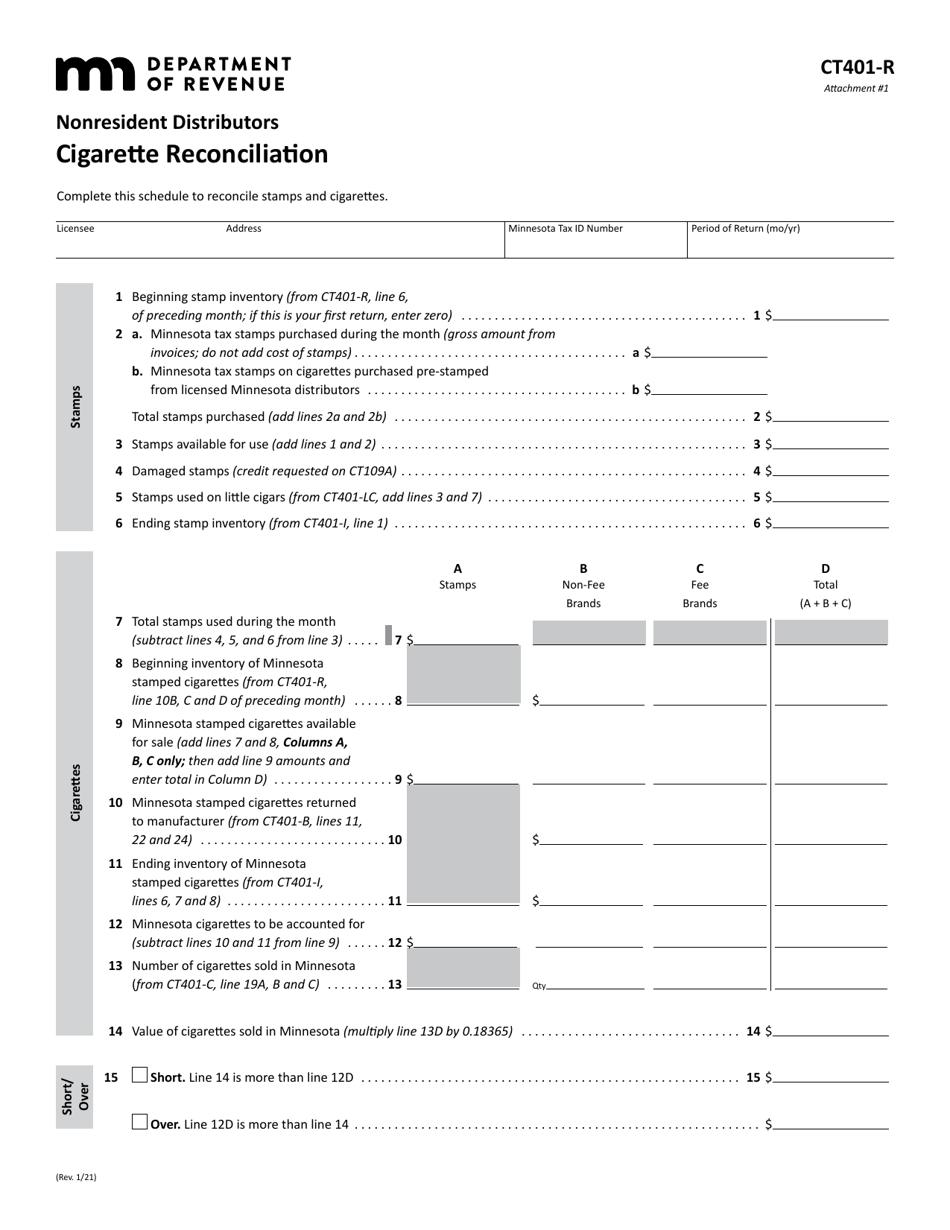

Form CT401-R Attachment 1

for the current year.

Form CT401-R Attachment 1 Cigarette Reconciliation (Nonresident Distributors) - Minnesota

What Is Form CT401-R Attachment 1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT401-R?

A: Form CT401-R is an attachment to the Cigarette Reconciliation form for Nonresident Distributors in the state of Minnesota.

Q: Who is required to file Form CT401-R?

A: Nonresident Distributors of cigarettes in Minnesota are required to file Form CT401-R.

Q: What is the purpose of Form CT401-R?

A: Form CT401-R is used to reconcile the quantity of cigarettes sold in Minnesota by nonresident distributors with the quantity reported by the licensed Minnesota wholesalers.

Q: Are there any penalties for not filing Form CT401-R?

A: Yes, failure to file Form CT401-R or submitting false information can result in penalties, including fines and possible license revocation.

Q: When is the deadline for filing Form CT401-R?

A: The deadline for filing Form CT401-R is generally the 18th day of the month following the reporting period.

Q: Can I file Form CT401-R electronically?

A: Yes, Form CT401-R can be filed electronically through the Minnesota Department of Revenue's e-Services system.

Q: What supporting documents should be included with Form CT401-R?

A: Supporting documents that should be included with Form CT401-R are detailed sales records, invoices, and any other documentation that supports the reported quantities of cigarettes.

Q: Is there a fee for filing Form CT401-R?

A: There is no fee for filing Form CT401-R.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT401-R Attachment 1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.