This version of the form is not currently in use and is provided for reference only. Download this version of

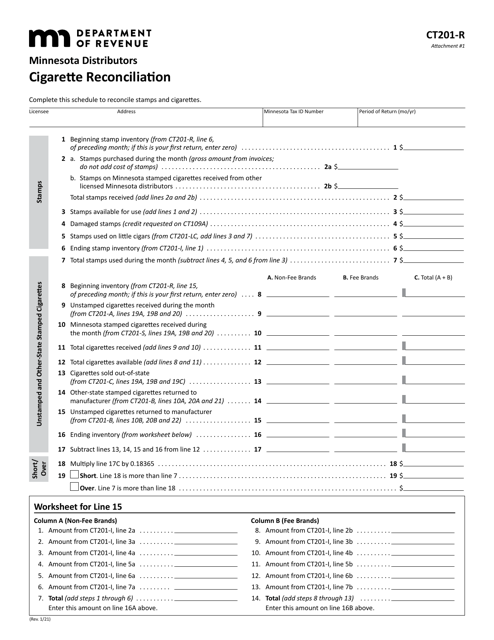

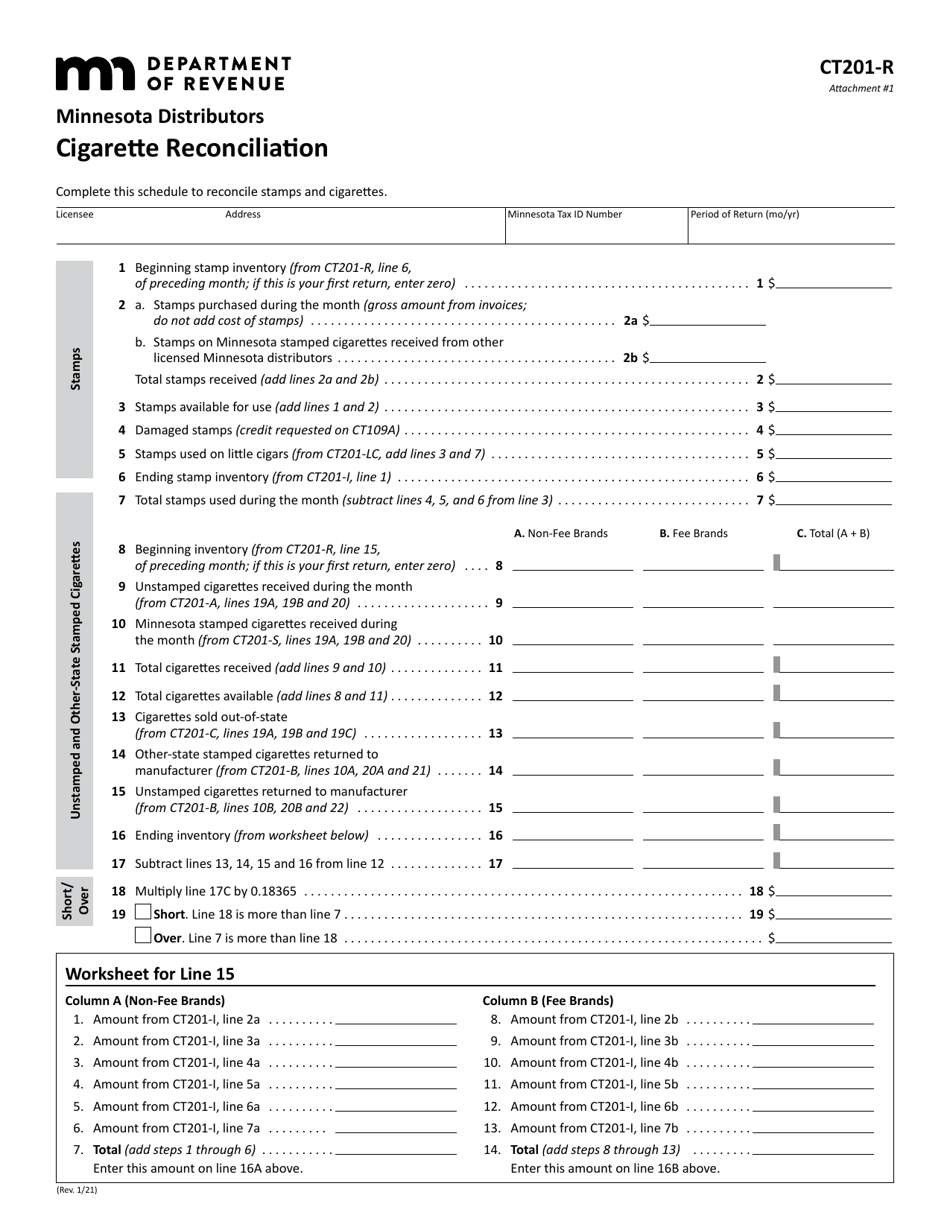

Form CT201-R Attachment 1

for the current year.

Form CT201-R Attachment 1 Cigarette Reconciliation (Minnesota Distributors) - Minnesota

What Is Form CT201-R Attachment 1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT201-R?

A: Form CT201-R is a form used for cigarette reconciliation in Minnesota for distributors.

Q: What is the purpose of Attachment 1?

A: Attachment 1 is used for providing cigarette reconciliation information specifically for Minnesota distributors.

Q: Who is required to file Form CT201-R Attachment 1?

A: Minnesota distributors of cigarettes are required to file Form CT201-R Attachment 1.

Q: What information is required in the Cigarette Reconciliation?

A: The Cigarette Reconciliation requires information such as beginning inventory, receipts, sales, and ending inventory of cigarettes.

Q: What is the deadline for filing Form CT201-R Attachment 1?

A: Form CT201-R Attachment 1 must be filed by the due date specified by the Minnesota Department of Revenue.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT201-R Attachment 1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.