This version of the form is not currently in use and is provided for reference only. Download this version of

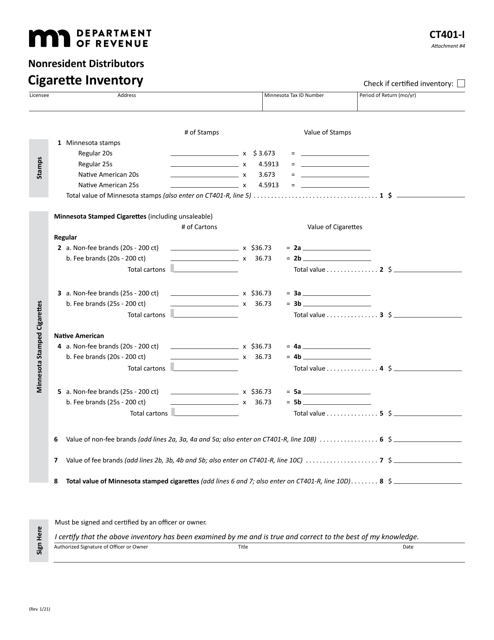

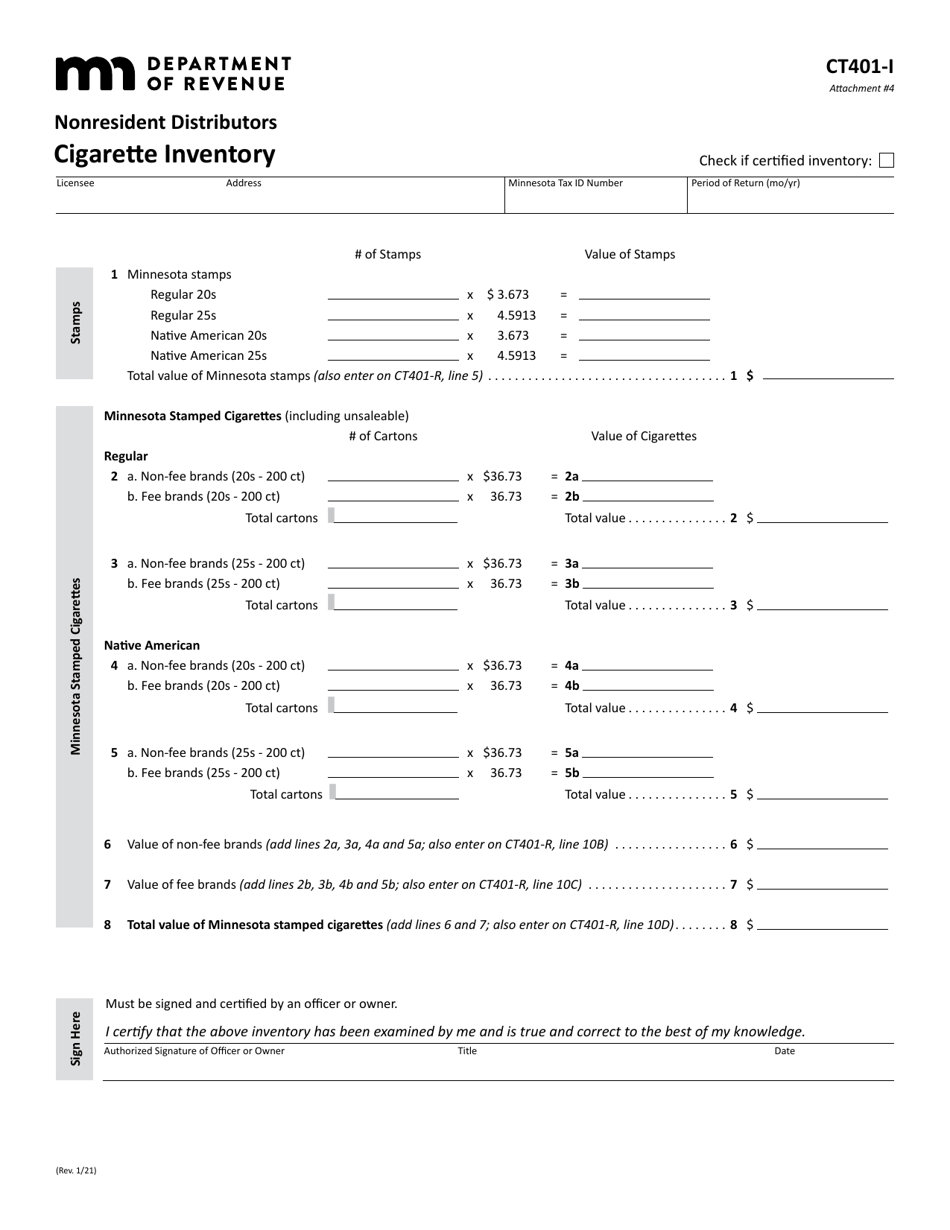

Form CT401-I Attachment 4

for the current year.

Form CT401-I Attachment 4 Cigarette Inventory (Nonresident Distributors) - Minnesota

What Is Form CT401-I Attachment 4?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT401-I?

A: Form CT401-I is an attachment to the Cigarette Inventory (Nonresident Distributors) form for Minnesota.

Q: Who needs to fill out Form CT401-I?

A: Nonresident distributors of cigarettes in Minnesota need to fill out Form CT401-I.

Q: What is the purpose of Form CT401-I?

A: The purpose of Form CT401-I is to report the inventory of cigarettes held by nonresident distributors in Minnesota.

Q: When is Form CT401-I due?

A: Form CT401-I is due on a monthly basis, by the 18th day of the month following the end of the reporting period.

Q: Is Form CT401-I required for resident distributors?

A: No, Form CT401-I is only required for nonresident distributors.

Q: What information is required on Form CT401-I?

A: Form CT401-I requires nonresident distributors to provide details of the quantity and cost of cigarettes held in inventory in Minnesota.

Q: Are there any penalties for late or incorrect filing of Form CT401-I?

A: Yes, there may be penalties for late or incorrect filing of Form CT401-I, as determined by the Minnesota Department of Revenue.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT401-I Attachment 4 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.