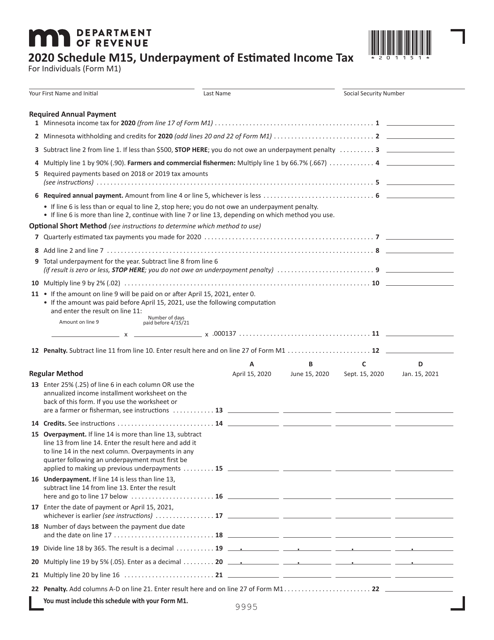

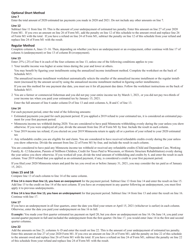

Form M1 Schedule M15 Underpayment of Estimated Income Tax - Minnesota

What Is Form M1 Schedule M15?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.The document is a supplement to Form M1, Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M1 Schedule M15?

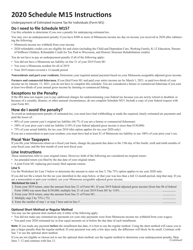

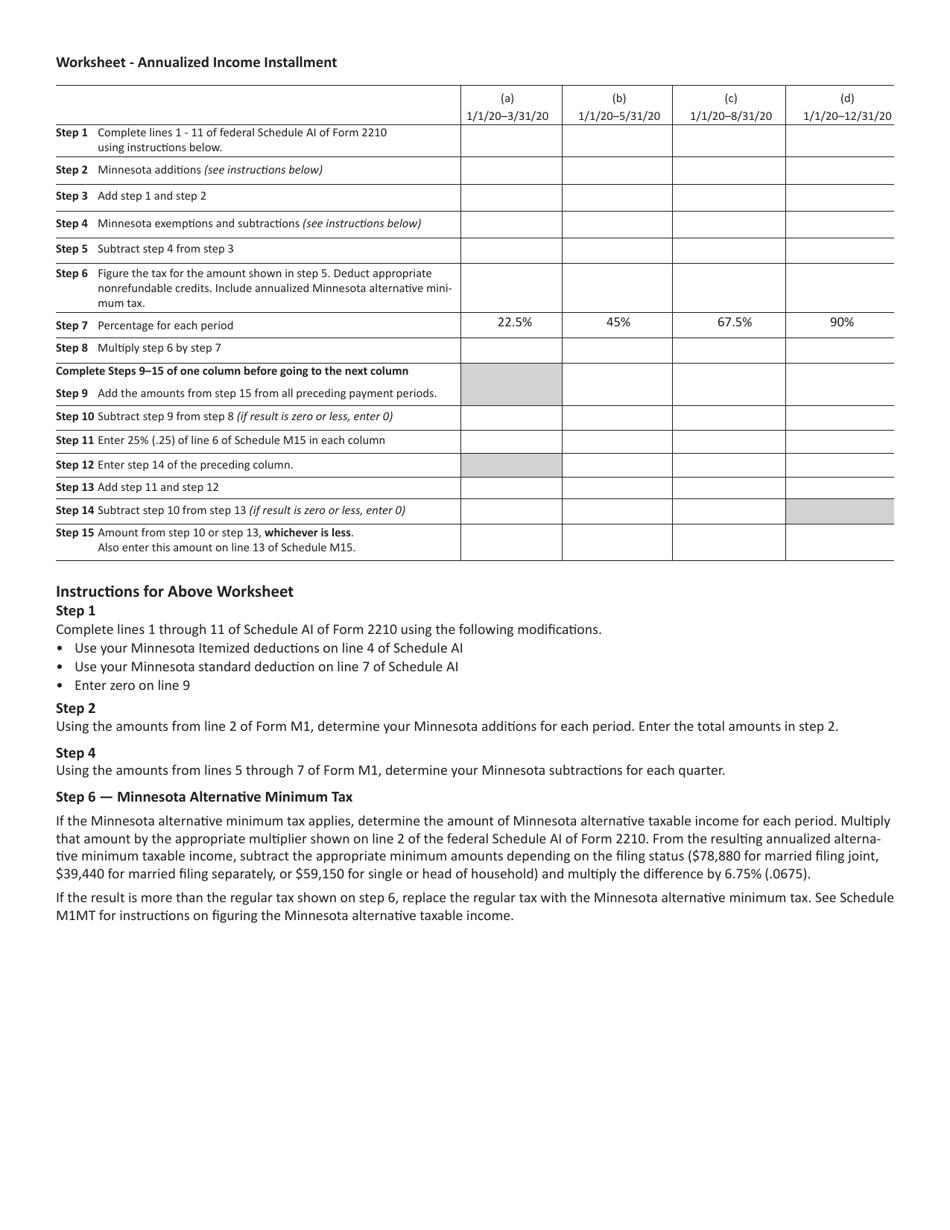

A: Form M1 Schedule M15 is a form used to calculate and report any underpayment of estimated income tax in the state of Minnesota.

Q: Who needs to file Form M1 Schedule M15?

A: Anyone who has underpaid their estimated income tax in Minnesota needs to file Form M1 Schedule M15.

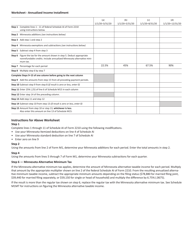

Q: How do I calculate the underpayment of estimated income tax?

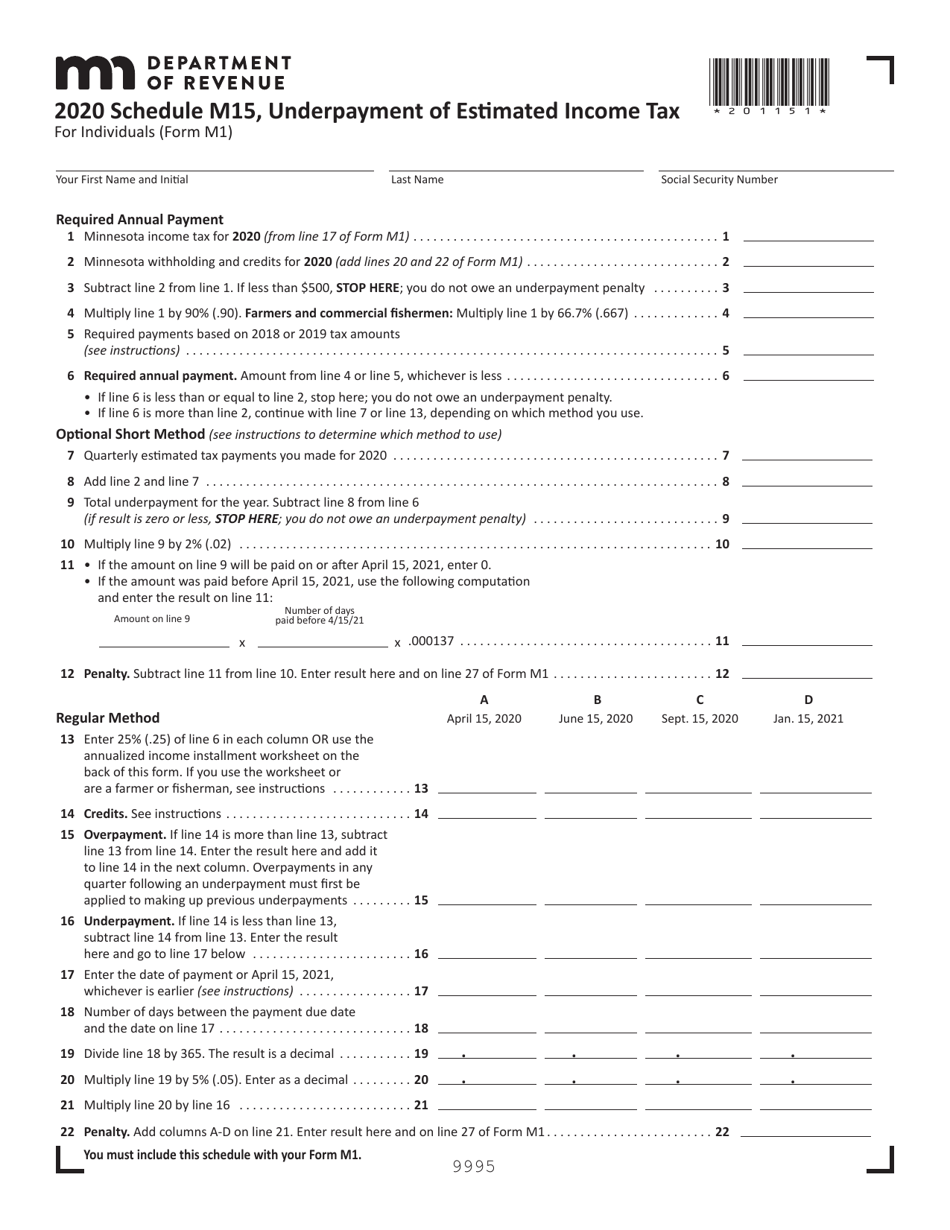

A: To calculate the underpayment of estimated income tax, you must complete the form and follow the instructions provided.

Q: When is the deadline to file Form M1 Schedule M15?

A: The deadline to file Form M1 Schedule M15 is the same as the deadline to file your Minnesota income tax return, which is usually April 15th.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M1 Schedule M15 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.