This version of the form is not currently in use and is provided for reference only. Download this version of

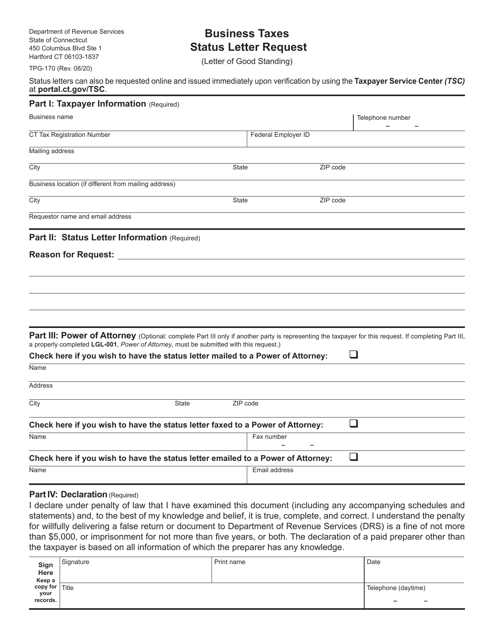

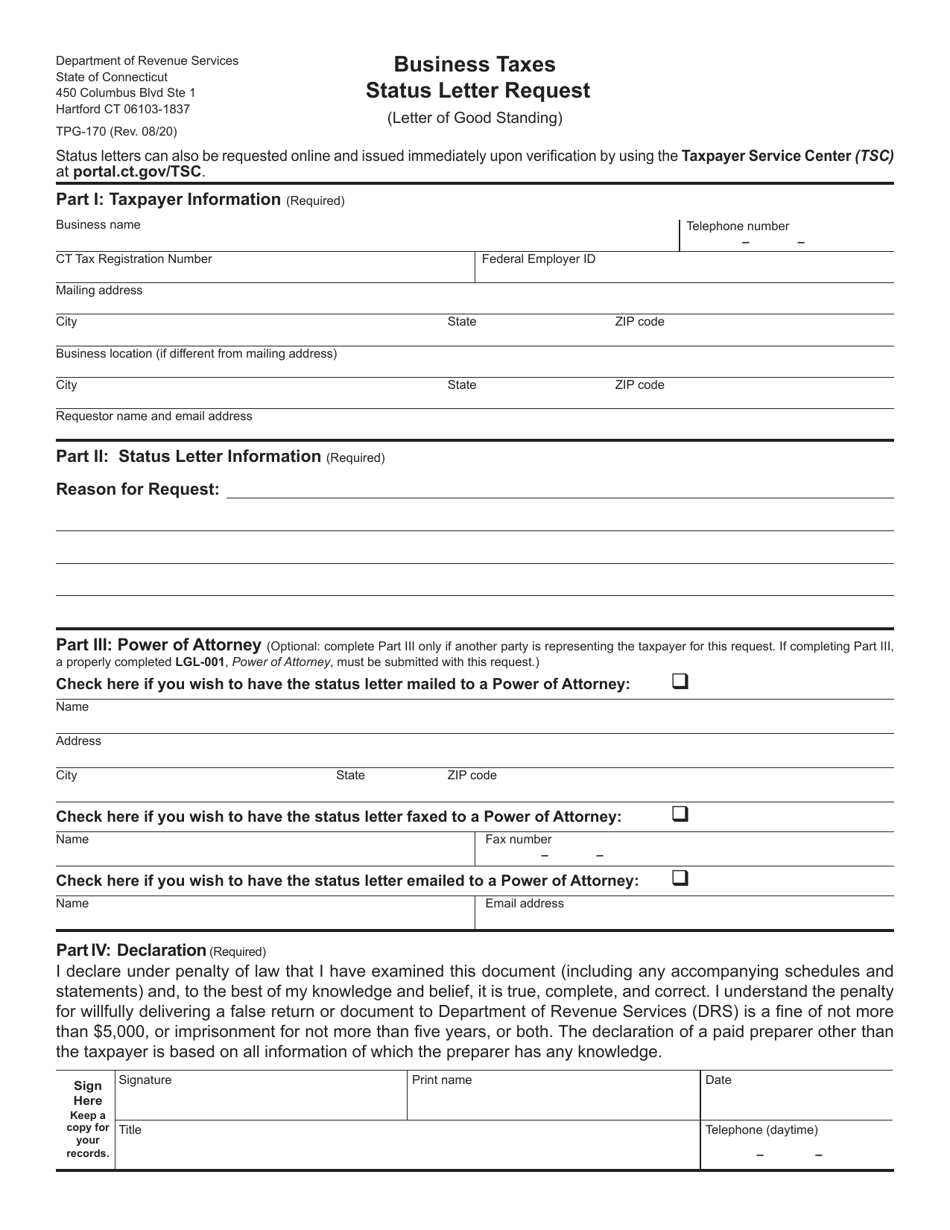

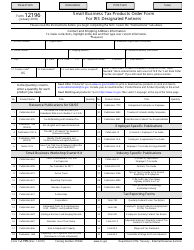

Form TPG-170

for the current year.

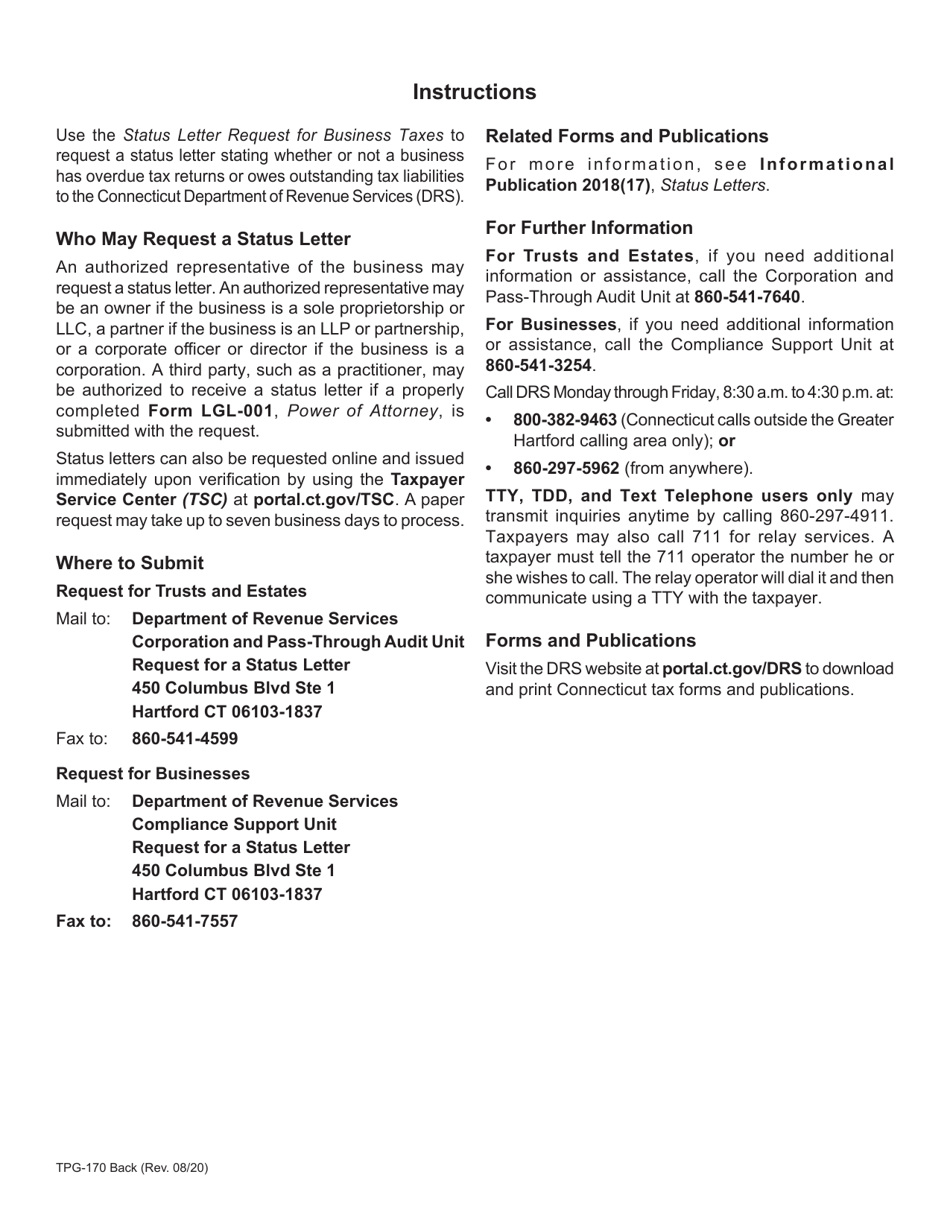

Form TPG-170 Business Taxes Status Letter Request - Connecticut

What Is Form TPG-170?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TPG-170?

A: Form TPG-170 is a business taxes status letter request form used in Connecticut.

Q: What is the purpose of Form TPG-170?

A: The purpose of Form TPG-170 is to request a business taxes status letter in Connecticut.

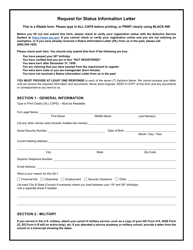

Q: What information is required on Form TPG-170?

A: Form TPG-170 requires information such as the taxpayer's name, federal employer identification number (FEIN), contact information, and a detailed explanation of the reason for the request.

Q: How long does it take to process a business taxes status letter request?

A: The processing time for a business taxes status letter request in Connecticut can vary. It is recommended to allow sufficient time for processing, especially during peak periods.

Q: Can I request a rush processing for a business taxes status letter?

A: Yes, you can request rush processing for a business taxes status letter in Connecticut. Additional fees may apply for expedited processing.

Q: What can I use a business taxes status letter for?

A: A business taxes status letter can be used for various purposes, such as verifying the tax status of a business for licensing, contracting, or financing purposes.

Q: Is Form TPG-170 specific to Connecticut?

A: Yes, Form TPG-170 is specific to Connecticut. Other states may have their own forms or processes for requesting a business taxes status letter.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TPG-170 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.