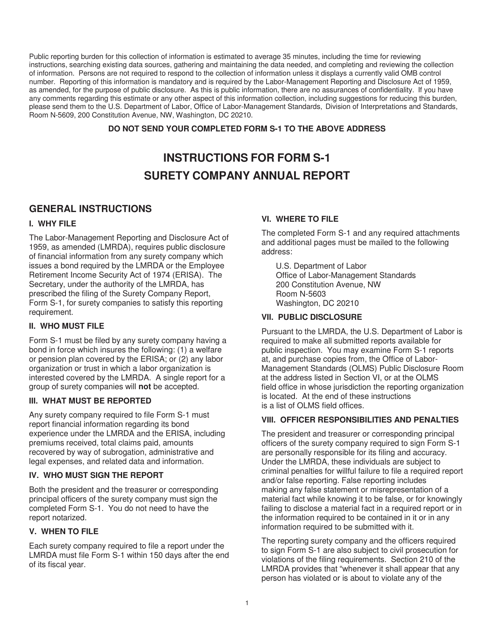

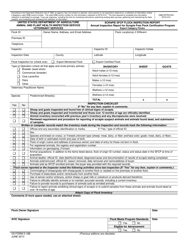

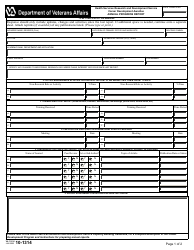

Instructions for Form S-1 Surety Company Annual Report

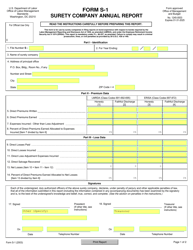

This document contains official instructions for Form S-1 , Surety Company Annual Report - a form released and collected by the U.S. Department of Labor - Office of Labor-Management Standards. An up-to-date fillable Form S-1 is available for download through this link.

FAQ

Q: What is Form S-1?

A: Form S-1 is a document that surety companies use to file their annual reports.

Q: Who is required to file Form S-1?

A: Surety companies are required to file Form S-1.

Q: What information does Form S-1 contain?

A: Form S-1 contains information about the surety company's financial condition, operations, and regulatory compliance.

Q: When is the deadline for filing Form S-1?

A: The deadline for filing Form S-1 is usually specified by the regulatory authority.

Q: Are there any penalties for not filing Form S-1?

A: Yes, there may be penalties for not filing Form S-1, including fines and potential suspension of the surety company's license.

Q: Can Form S-1 be filed electronically?

A: Yes, Form S-1 can usually be filed electronically.

Q: Is Form S-1 the only annual report required for surety companies?

A: No, there may be other annual reports or filings required depending on the jurisdiction and specific regulations.

Q: Who should I contact if I have questions about filing Form S-1?

A: You should contact the regulatory authority overseeing surety companies for guidance and assistance.

Q: Are there any exemptions from filing Form S-1?

A: There may be exemptions or alternative reporting requirements available for certain types of surety companies, depending on the jurisdiction.

Q: Can I request an extension for filing Form S-1?

A: Extension requests for filing Form S-1 are usually considered on a case-by-case basis by the regulatory authority.

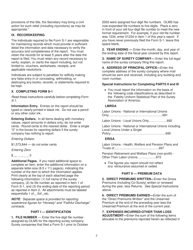

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of Labor - Office of Labor-Management Standards.