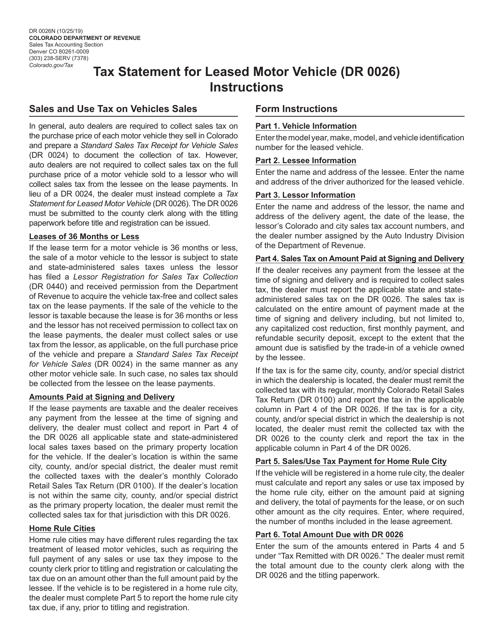

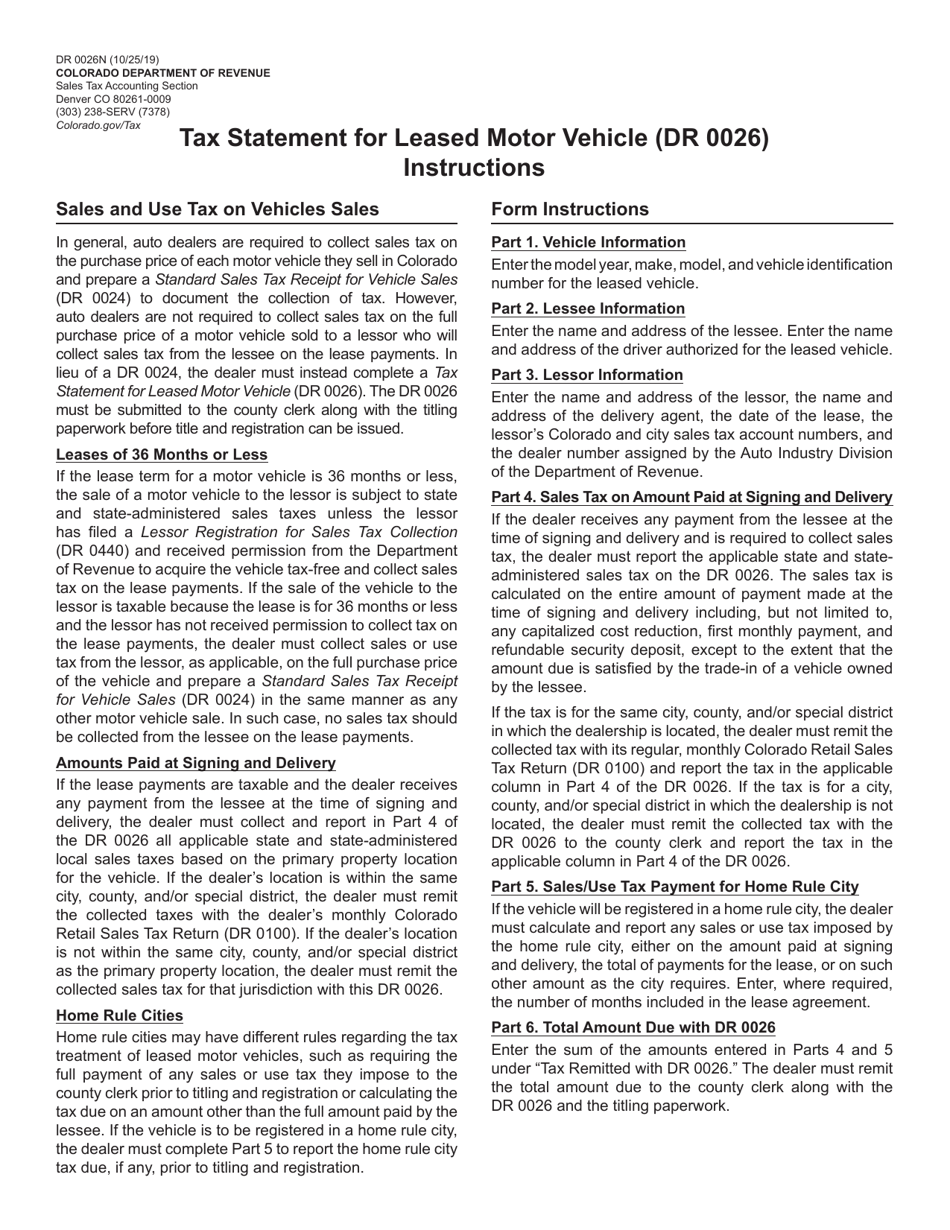

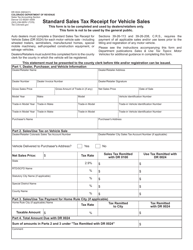

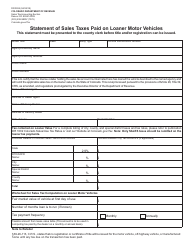

Instructions for Form DR0026 Tax Statement for Leased Motor Vehicle - Colorado

This document contains official instructions for Form DR0026 , Tax Statement for Leased Motor Vehicle - a form released and collected by the Colorado Department of Revenue. An up-to-date fillable Form DR0026 is available for download through this link.

FAQ

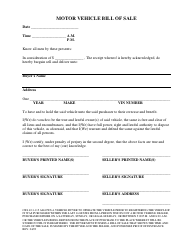

Q: What is Form DR0026?

A: Form DR0026 is a tax statement for leased motor vehicles in Colorado.

Q: Who needs to file Form DR0026?

A: The lessor of a leased motor vehicle needs to file Form DR0026.

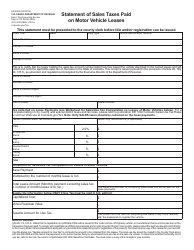

Q: What information is required on Form DR0026?

A: Form DR0026 requires information about the lessor and lessee of the leased motor vehicle, as well as details about the lease agreement.

Q: When is Form DR0026 due?

A: Form DR0026 is due on or before January 31st of the year following the tax year.

Q: Are there any penalties for not filing Form DR0026?

A: Yes, there are penalties for not filing Form DR0026 or for filing it late. It's important to file the form on time to avoid these penalties.

Q: Is Form DR0026 only for leased motor vehicles?

A: Yes, Form DR0026 is specifically for leased motor vehicles in Colorado.

Q: Do I need to include any supporting documents with Form DR0026?

A: No, you do not need to include any supporting documents with Form DR0026. However, it's important to retain them for your records in case of an audit.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Colorado Department of Revenue.