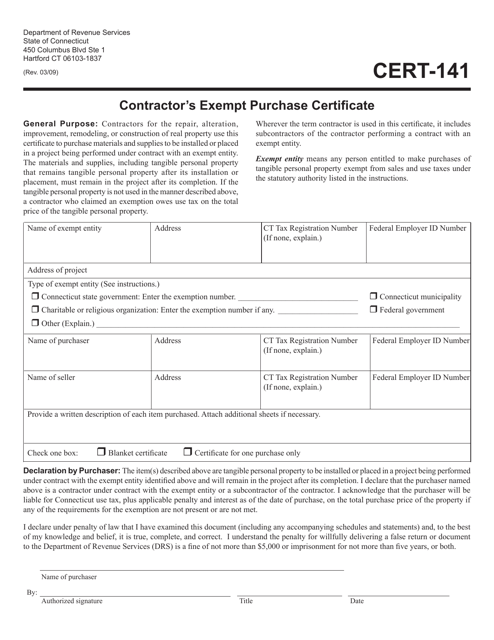

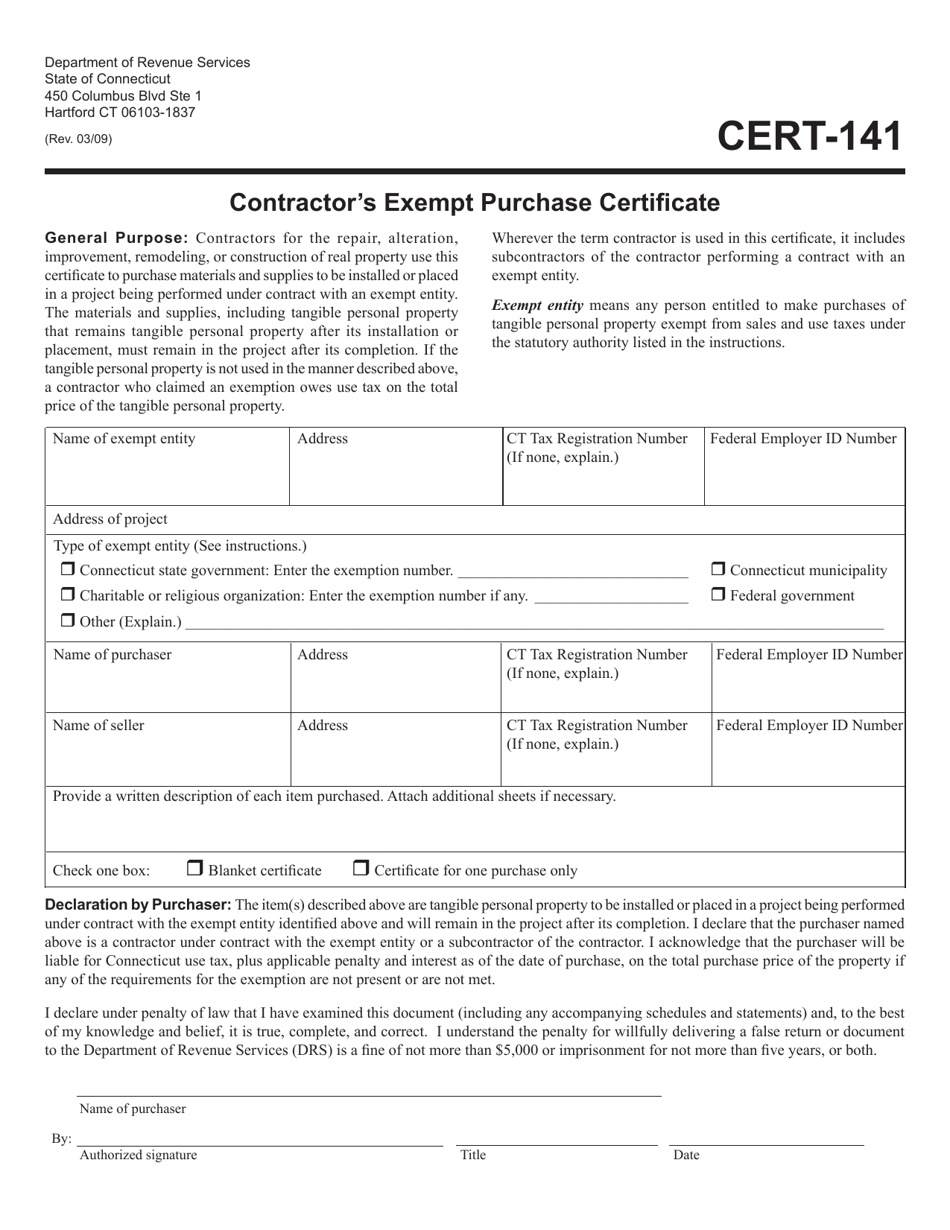

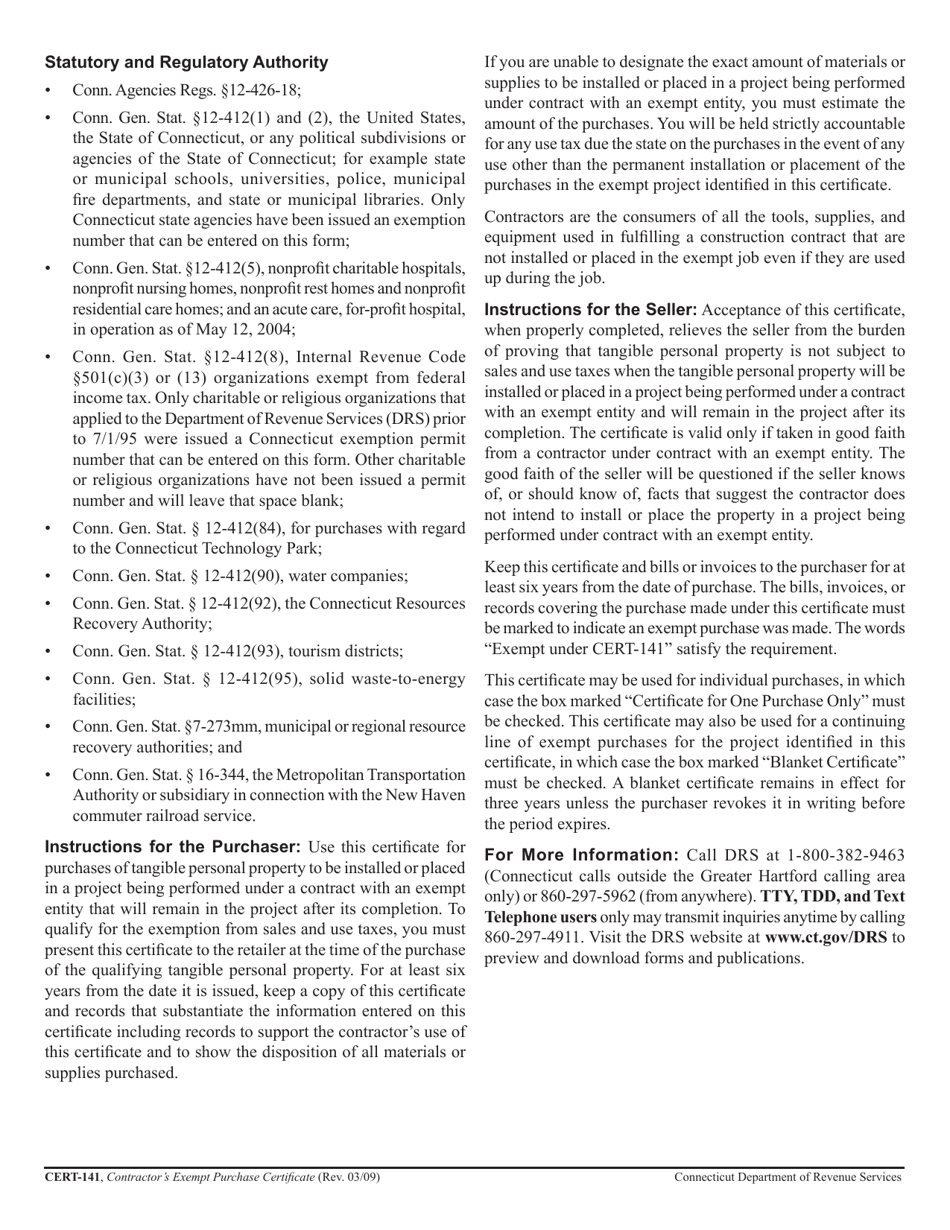

Form CERT-141 Contractors Exempt Purchase Certificate - Connecticut

What Is Form CERT-141?

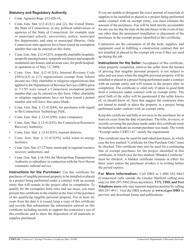

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CERT-141 Contractors Exempt Purchase Certificate?

A: The CERT-141 Contractors Exempt Purchase Certificate is a form used in Connecticut for contractors to claim exemption from sales tax on purchases related to construction projects.

Q: Who can use the CERT-141 Contractors Exempt Purchase Certificate?

A: Contractors in Connecticut can use the CERT-141 form to claim exemption from sales tax on qualifying purchases for construction projects.

Q: What purchases are exempt with the CERT-141 certificate?

A: The CERT-141 certificate can be used to claim exemption from sales tax on materials and supplies used in construction projects.

Q: Is the CERT-141 certificate valid for all purchases?

A: No, the CERT-141 certificate can only be used to claim exemption from sales tax on qualifying purchases related to construction projects.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CERT-141 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.