This version of the form is not currently in use and is provided for reference only. Download this version of

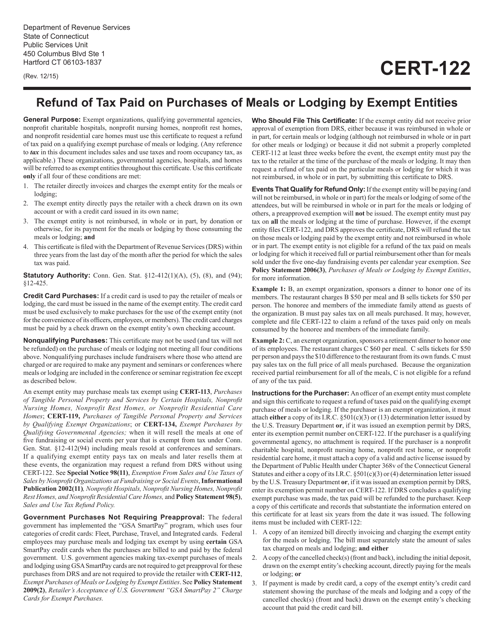

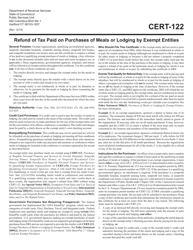

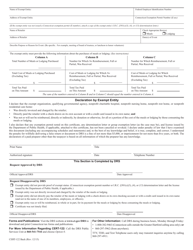

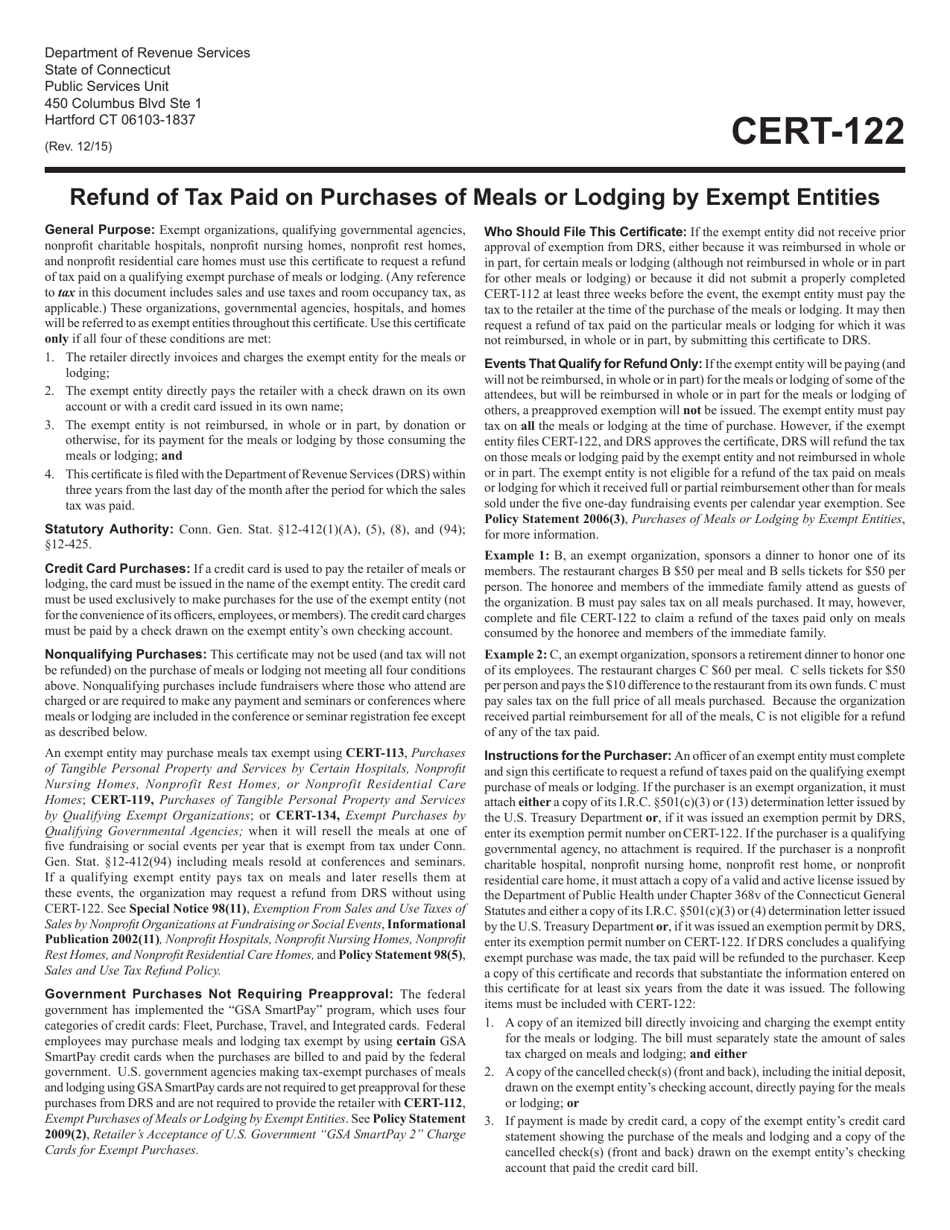

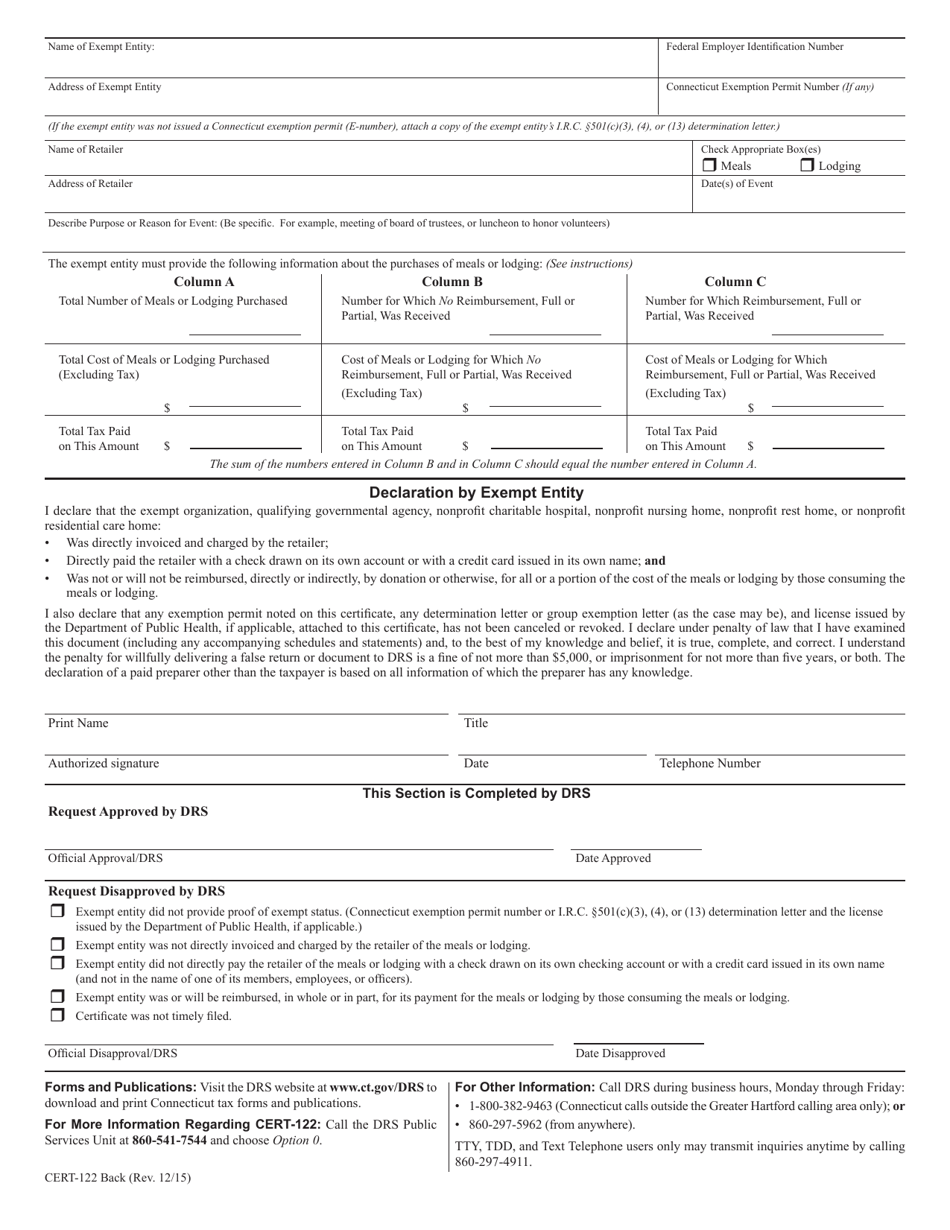

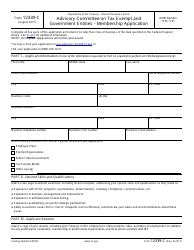

Form CERT-122

for the current year.

Form CERT-122 Refund of Tax Paid on Purchases of Meals or Lodging by Exempt Entities - Connecticut

What Is Form CERT-122?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CERT-122?

A: Form CERT-122 is a form used by exempt entities in Connecticut to apply for a refund of tax paid on purchases of meals or lodging.

Q: Who can use Form CERT-122?

A: Exempt entities in Connecticut can use Form CERT-122 to apply for a refund of tax paid on purchases of meals or lodging.

Q: What type of purchases does Form CERT-122 cover?

A: Form CERT-122 covers purchases of meals or lodging made by exempt entities.

Q: What is the purpose of using Form CERT-122?

A: The purpose of using Form CERT-122 is to request a refund of tax paid on purchases of meals or lodging by exempt entities.

Q: Is there a deadline for filing Form CERT-122?

A: Yes, there is a deadline for filing Form CERT-122. It must be filed within the time limits specified by the Connecticut Department of Revenue Services.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CERT-122 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.