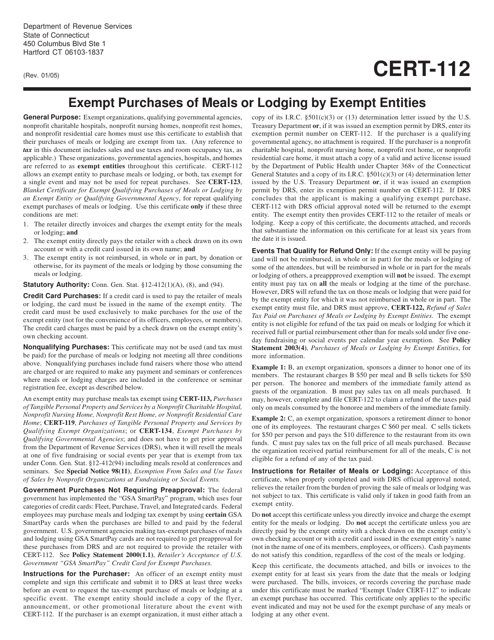

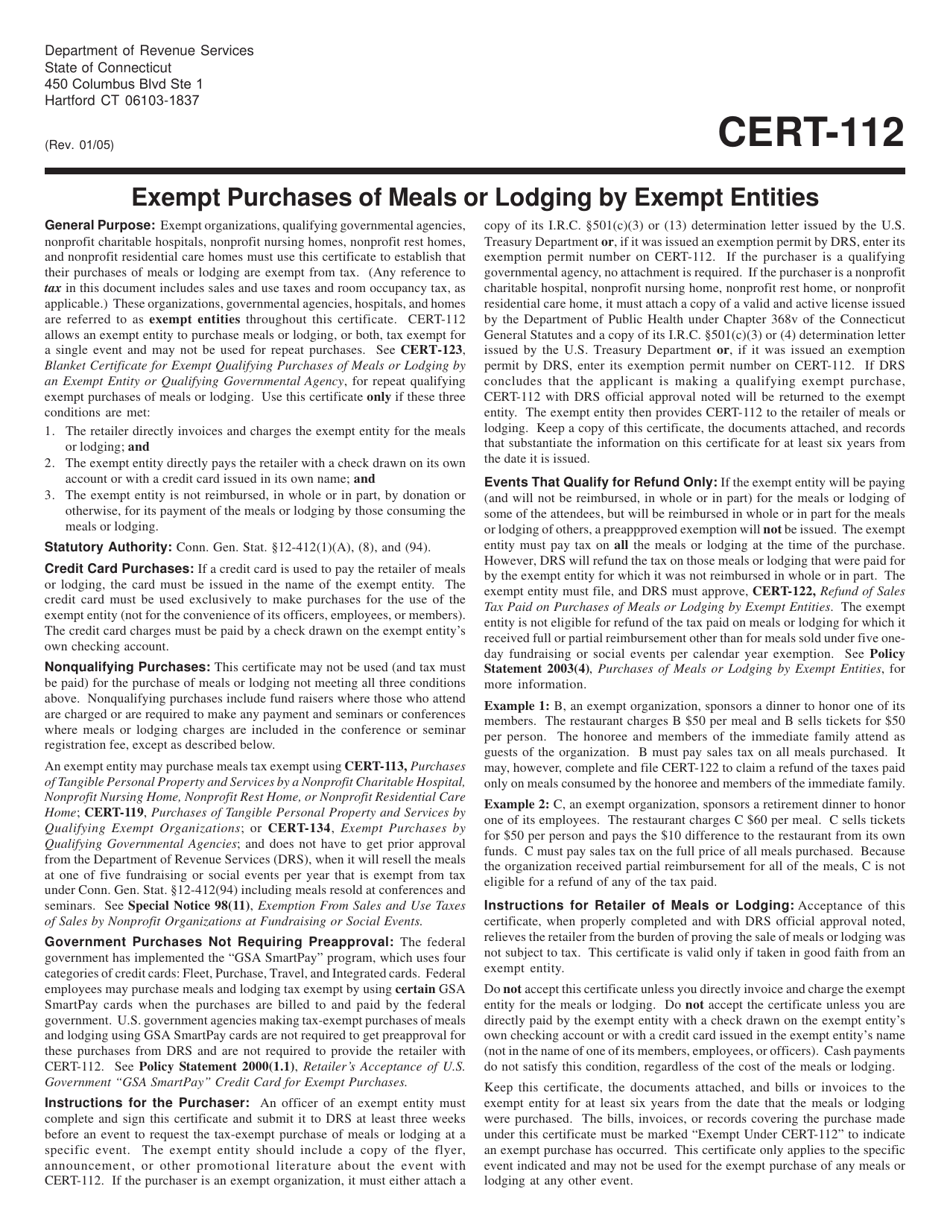

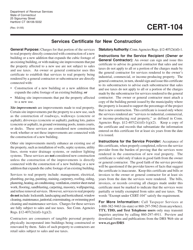

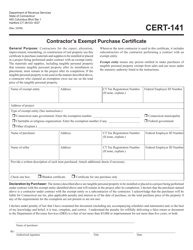

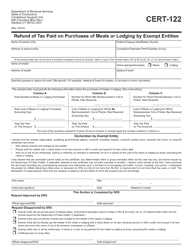

Form CERT-112 Certificate for Exempt Purchases of Meals or Lodging by Exempt Entities - Connecticut

What Is Form CERT-112?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CERT-112?

A: Form CERT-112 is the Certificate for Exempt Purchases of Meals or Lodging by Exempt Entities in Connecticut.

Q: Who can use Form CERT-112?

A: Exempt entities in Connecticut can use Form CERT-112 to claim exemption from certain taxes for purchases of meals or lodging.

Q: What is the purpose of Form CERT-112?

A: The purpose of Form CERT-112 is to provide documentation for exempt entities to claim exemption from certain taxes on purchases of meals or lodging in Connecticut.

Q: When should I use Form CERT-112?

A: You should use Form CERT-112 when making purchases of meals or lodging in Connecticut if you qualify as an exempt entity.

Q: What taxes can be exempted with Form CERT-112?

A: Form CERT-112 can be used to claim exemption from certain taxes, such as sales tax, on purchases of meals or lodging by exempt entities in Connecticut.

Q: Are there any restrictions on using Form CERT-112?

A: Yes, Form CERT-112 can only be used by exempt entities in Connecticut and for qualifying purchases of meals or lodging.

Q: Do I need to submit Form CERT-112 for every purchase?

A: No, Form CERT-112 is a one-time certificate that can be used for multiple purchases of meals or lodging in Connecticut until it expires or is revoked.

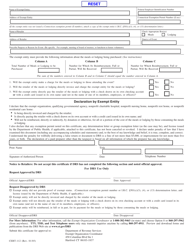

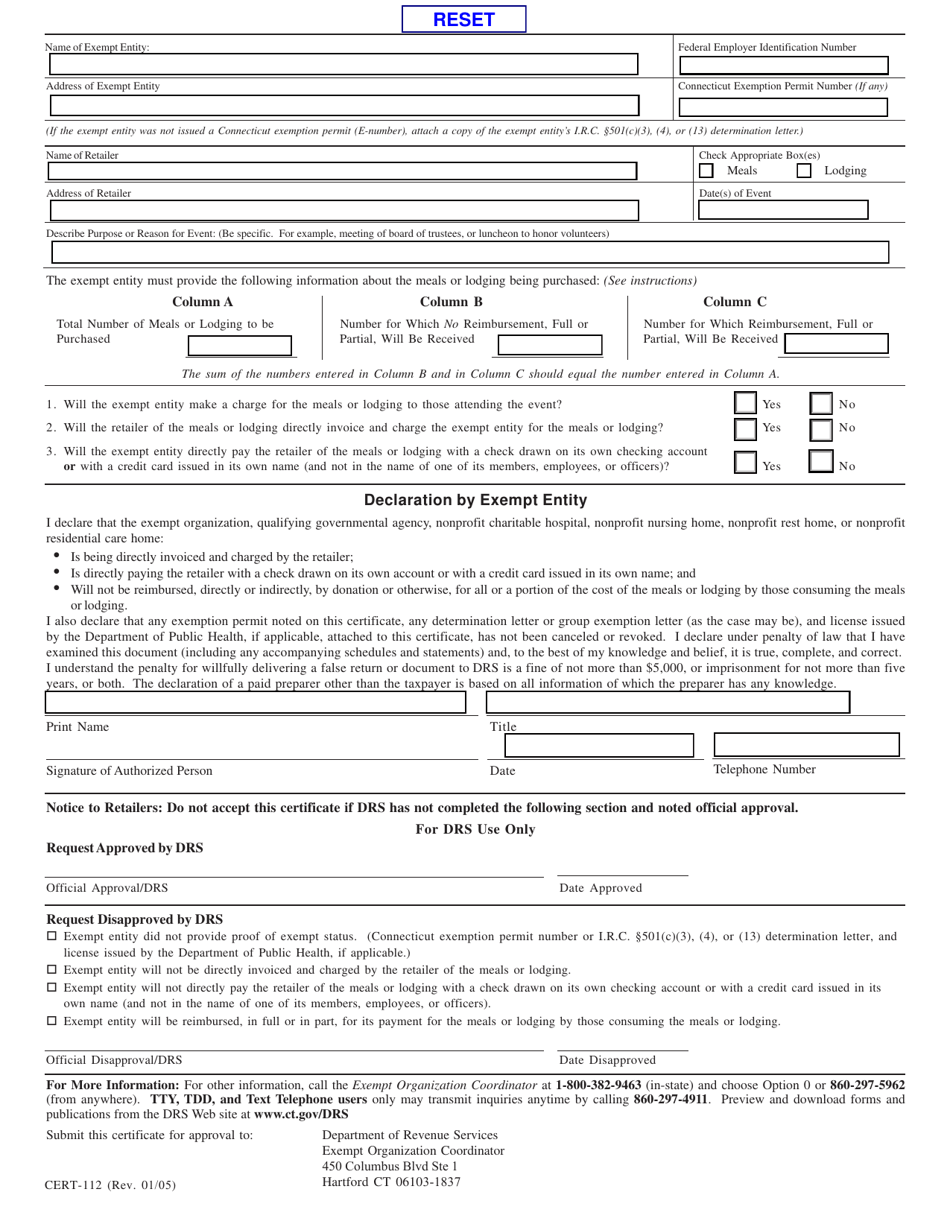

Q: What information is required on Form CERT-112?

A: Form CERT-112 requires information such as the name and address of the exempt entity, the type of exemption claimed, and the signature of an authorized representative.

Q: How long is Form CERT-112 valid for?

A: Form CERT-112 is valid until it is revoked or the exempt entity's status changes. It may need to be renewed periodically.

Q: Can I use Form CERT-112 for purchases in other states?

A: No, Form CERT-112 is specific to exempt purchases of meals or lodging in Connecticut and cannot be used for purchases in other states.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CERT-112 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.