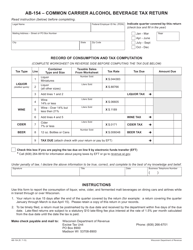

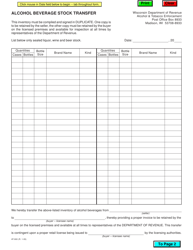

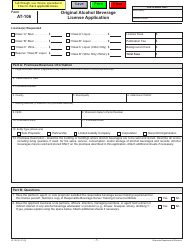

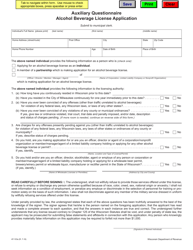

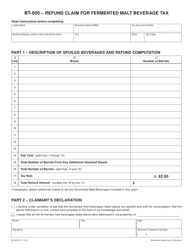

Form AB-131 Wisconsin Liquor Tax Multiple Schedule - Wisconsin

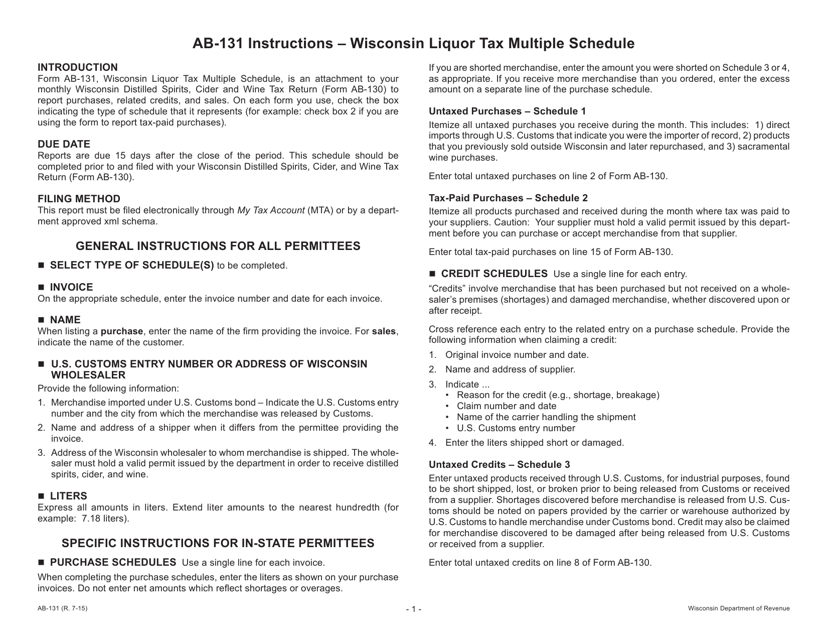

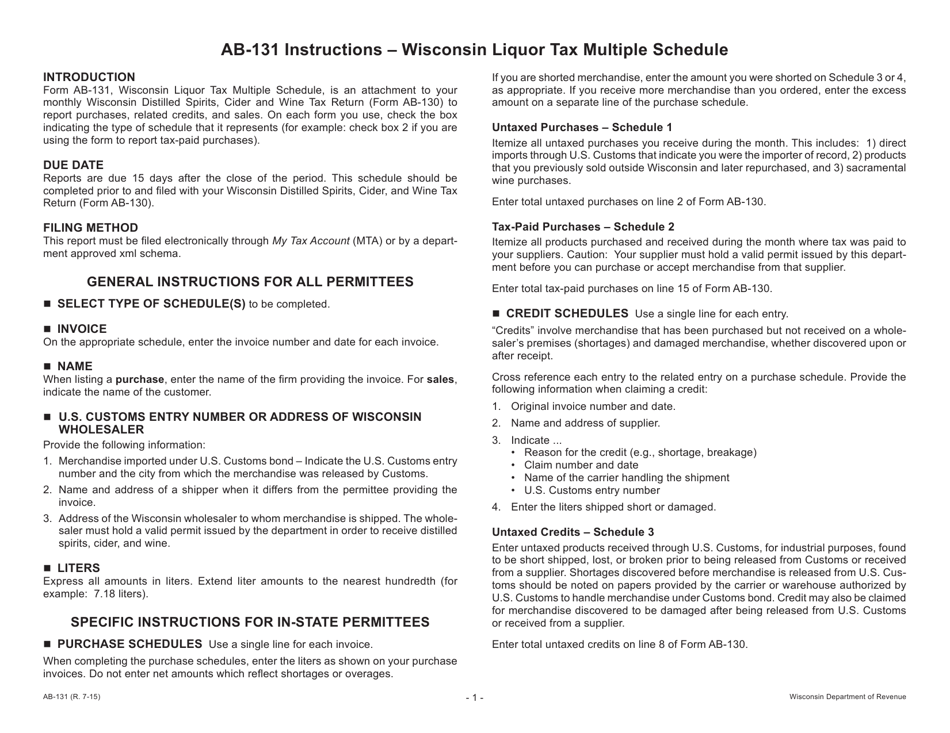

What Is Form AB-131?

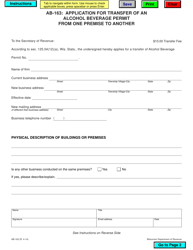

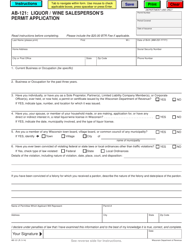

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-131?

A: Form AB-131 is a Wisconsin Liquor Tax Multiple Schedule form.

Q: What is the purpose of Form AB-131?

A: The purpose of Form AB-131 is to report Wisconsin liquor tax.

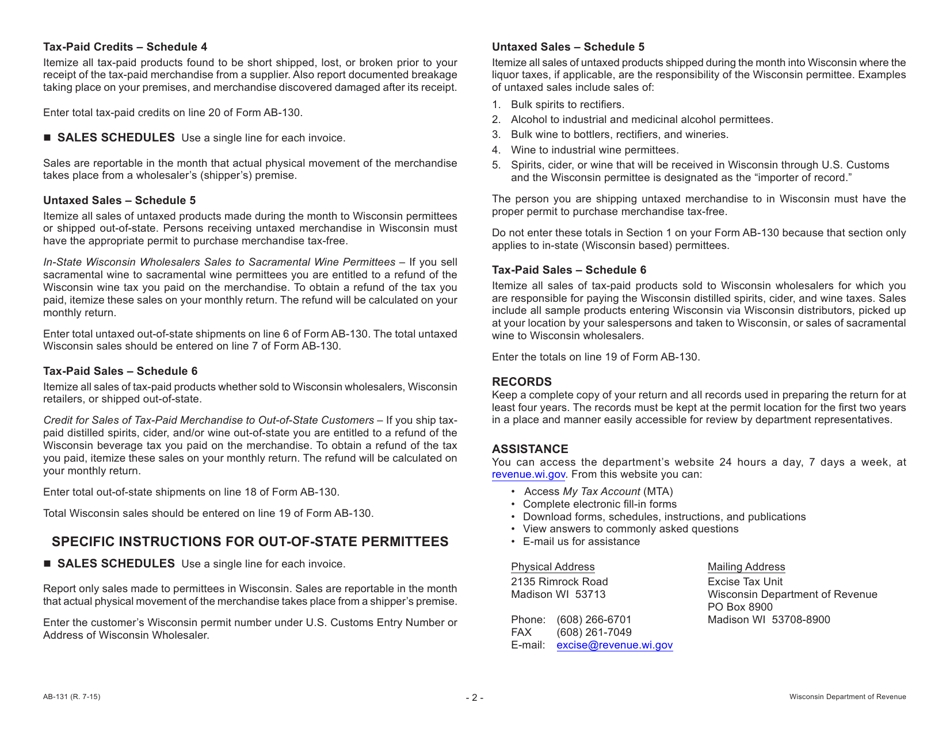

Q: Who needs to file Form AB-131?

A: Businesses and individuals engaged in the sale or distribution of liquor in Wisconsin need to file Form AB-131.

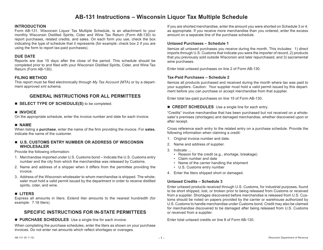

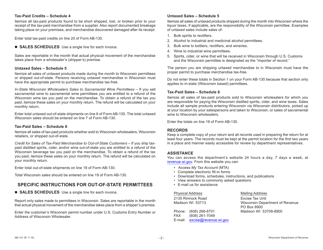

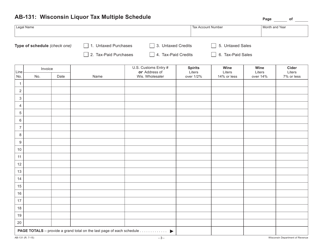

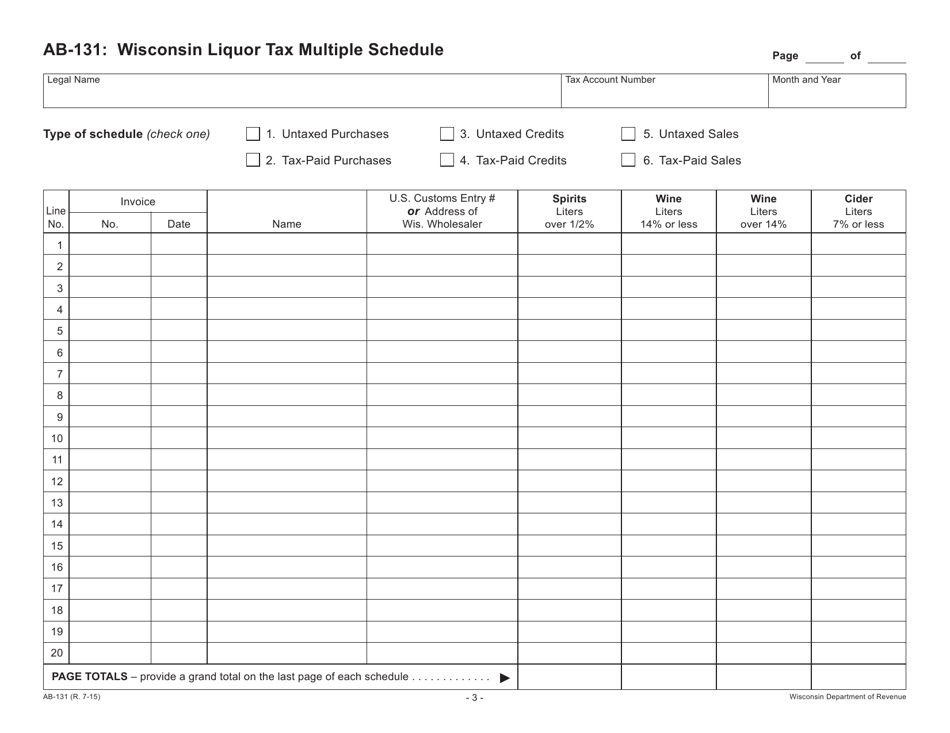

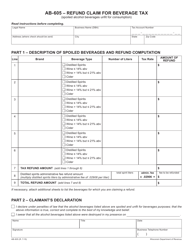

Q: What is included in Form AB-131?

A: Form AB-131 includes multiple schedules for reporting different types of liquor sales.

Q: When is Form AB-131 due?

A: Form AB-131 is due on the 20th day of the month following the end of the reporting period.

Q: What are the penalties for not filing Form AB-131?

A: Penalties for not filing Form AB-131 include late filing penalties and interest on unpaid taxes.

Q: Are there any exemptions or deductions available for liquor tax?

A: Yes, there are certain exemptions and deductions available for liquor tax. Check the instructions for Form AB-131 for more information.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AB-131 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.