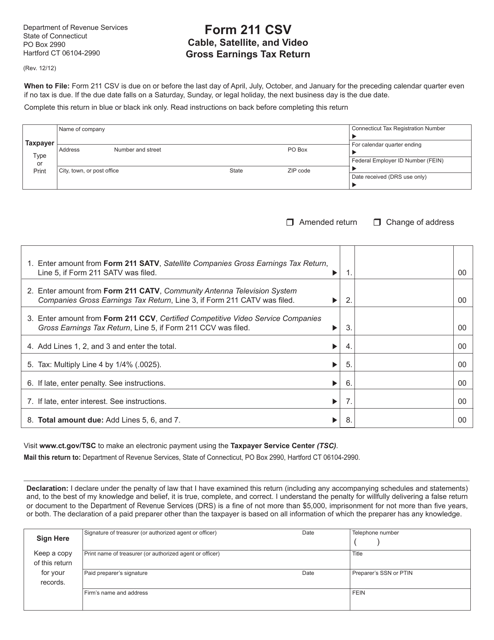

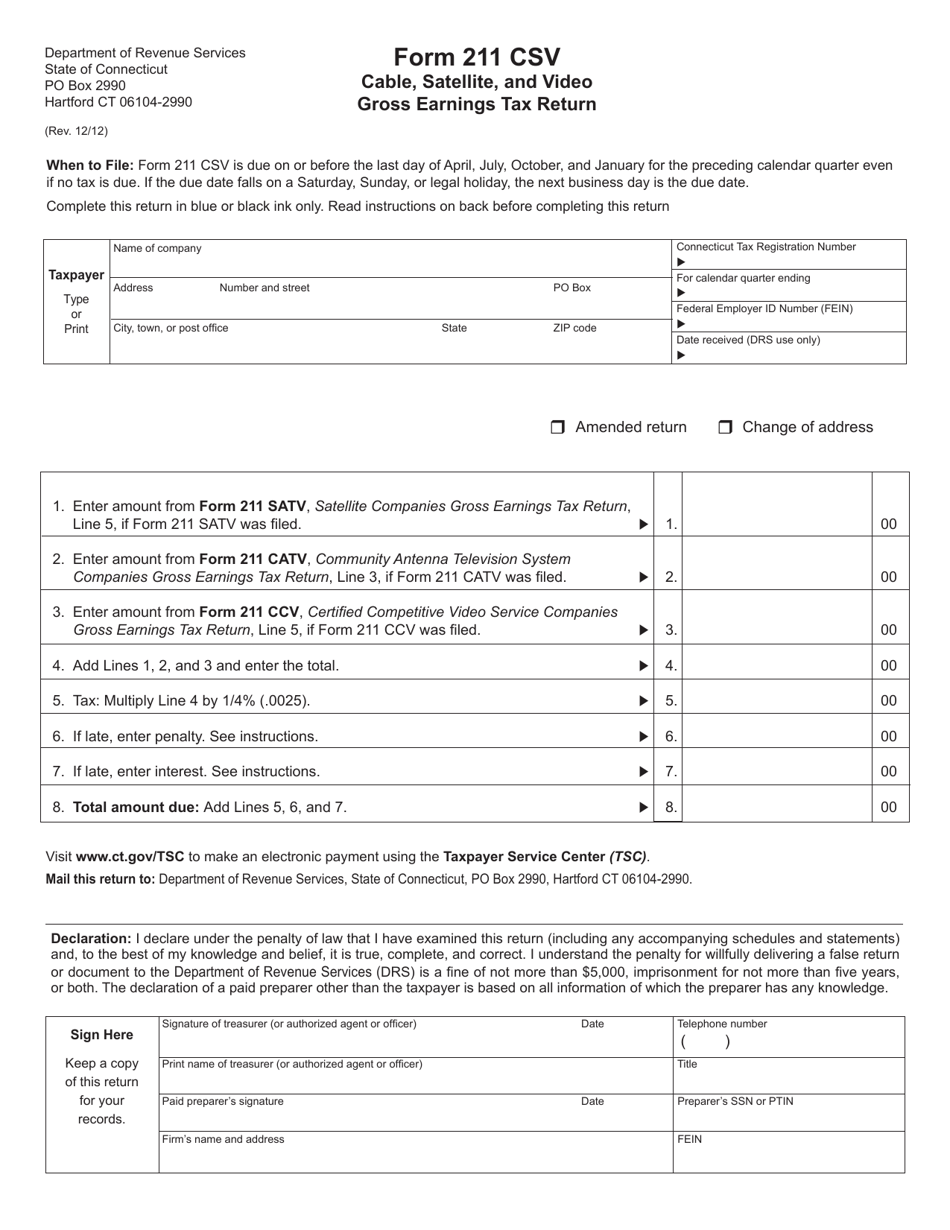

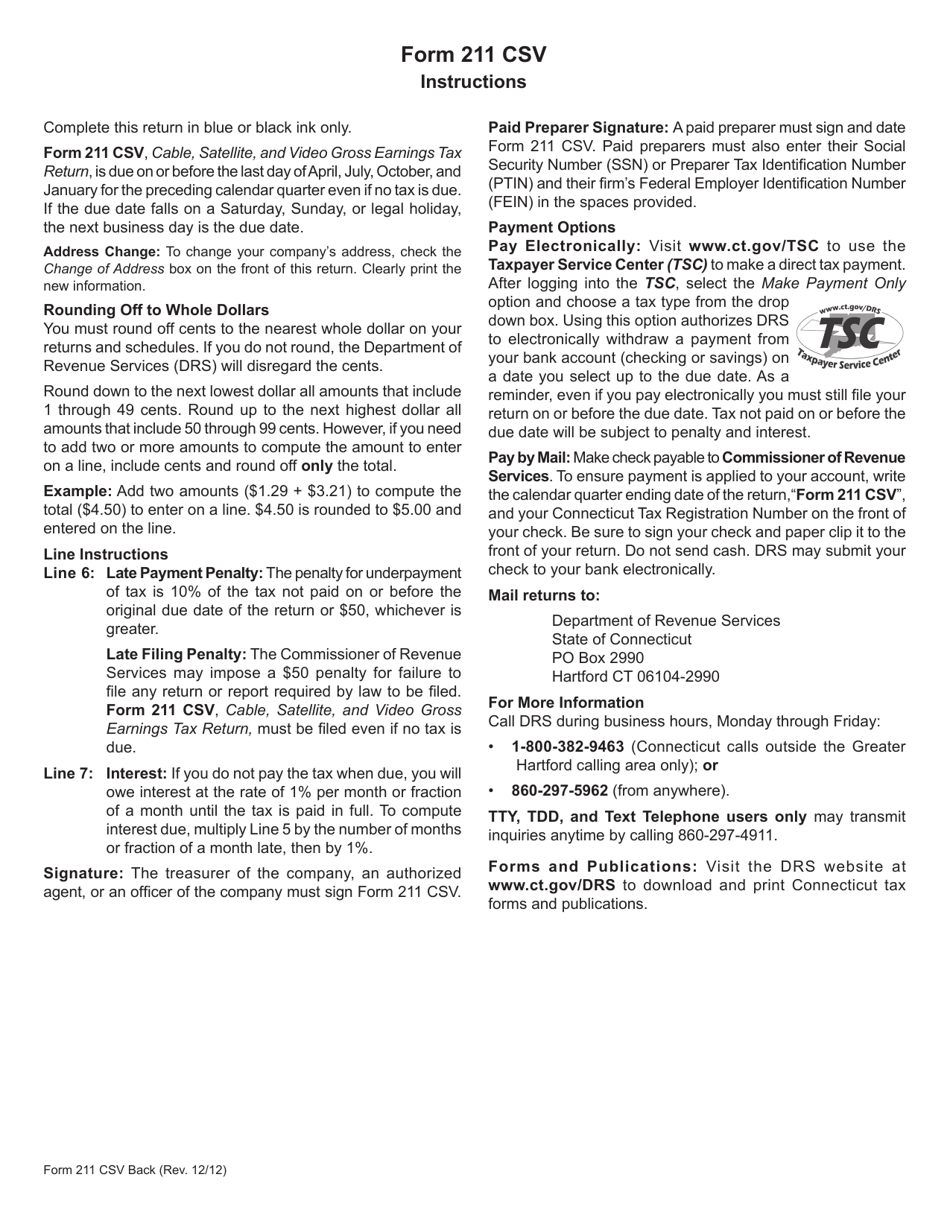

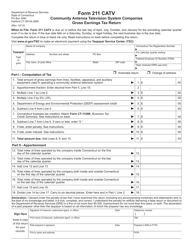

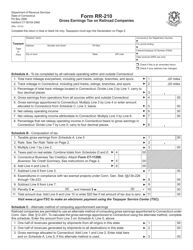

Form 211 CSV Cable, Satellite, and Video Gross Earnings Tax Return - Connecticut

What Is Form 211 CSV?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 211?

A: Form 211 is the Cable, Satellite, and Video Gross Earnings Tax Return in Connecticut.

Q: Who needs to file Form 211?

A: Any business or individual engaged in the cable, satellite, or video industry in Connecticut must file Form 211.

Q: What is the purpose of Form 211?

A: The purpose of Form 211 is to report the gross earnings from cable, satellite, and video services in Connecticut.

Q: When is Form 211 due?

A: Form 211 is due on or before the last day of the month following the close of each quarterly period.

Q: What information is required on Form 211?

A: Form 211 requires information about the gross earnings from cable, satellite, and video services, as well as other related details such as the number of subscribers.

Q: Are there any penalties for late filing of Form 211?

A: Yes, there are penalties for late filing of Form 211, including interest charges and potential penalties for failure to file or pay taxes.

Q: Do I need to include payment with Form 211?

A: Yes, payment for the taxes due must be included with Form 211.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 211 CSV by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.